Coverage Under Motor Insurance Policy

Understanding Motor Insurance Coverage

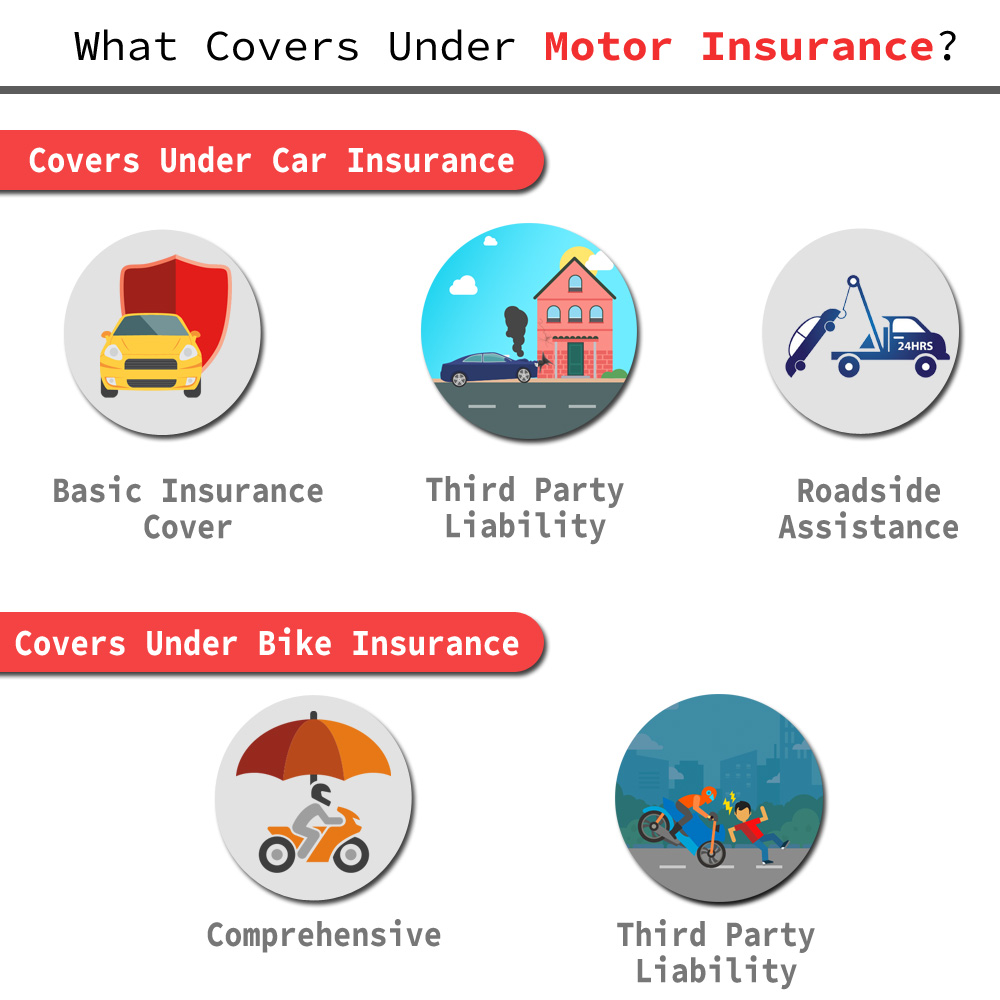

Motor insurance is a must-have for any car owner. It provides financial protection against damages to your car and other people’s property as well as against bodily injuries to you and other people. Motor insurance also provides liability protection against any legal claims made against you as a result of an accident. Motor insurance policy coverage is determined by the type of policy you choose. There are three main types of motor insurance policies – third party, third party fire and theft, and comprehensive.

Third Party Insurance

Third party motor insurance is the most basic form of motor insurance. It provides coverage for any damage or injury caused to a third party. This includes any damage or injury to other people’s property as well as any medical expenses incurred as a result of the accident. Third party motor insurance does not provide coverage for any damage or injury to your own car or to yourself.

Third Party Fire and Theft Insurance

Third party fire and theft insurance is the second level of motor insurance coverage. This type of insurance provides coverage for any damage or injury to a third party, as well as any damage to your car as a result of fire or theft. However, it does not provide coverage for any damage or injury to yourself.

Comprehensive Insurance

Comprehensive motor insurance is the highest level of motor insurance coverage. It provides coverage for any damage or injury to a third party, as well as any damage to your car as a result of fire, theft, or any other accident. It also provides coverage for any medical expenses incurred as a result of an accident, as well as any damage or injury to yourself.

Additional Coverage

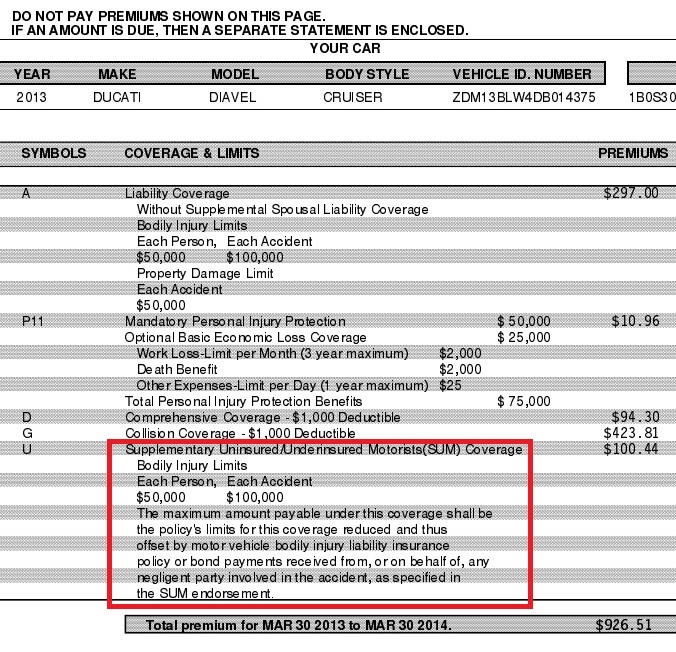

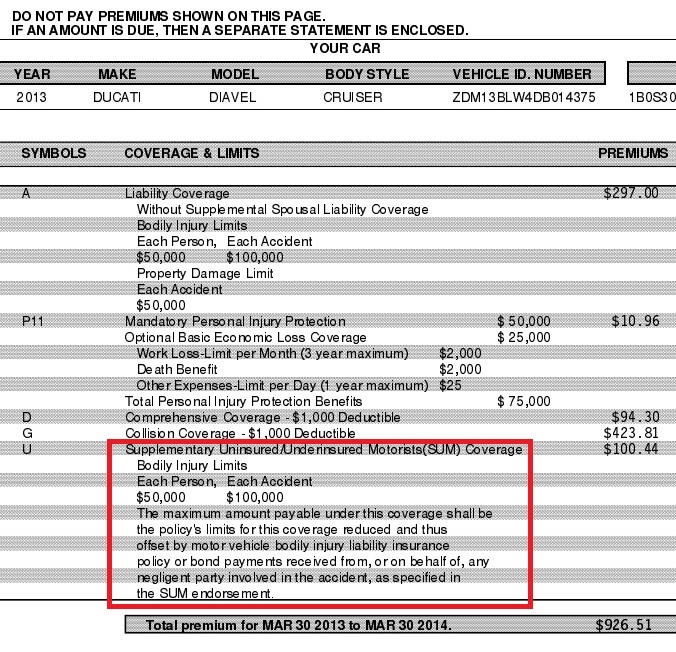

In addition to the three main types of motor insurance coverage, there are several other types of coverage that can be added to your policy. These additional coverage options include no-fault coverage, personal injury protection, uninsured motorist coverage, and rental reimbursement coverage. No-fault coverage provides protection against any medical expenses incurred as a result of an accident regardless of who is at fault. Personal injury protection provides coverage for any medical expenses incurred as a result of an accident, as well as any lost wages due to an injury. Uninsured motorist coverage provides protection against any damages caused by an uninsured driver. Rental reimbursement coverage provides coverage for rental car expenses due to an accident.

Conclusion

Motor insurance provides financial protection against damages to your car and other people’s property as well as against bodily injuries to you and other people. The type of coverage you choose will depend on your individual needs and budget. There are three main types of motor insurance – third party, third party fire and theft, and comprehensive. In addition, there are several other types of coverage that can be added to your policy. It is important to understand what type of coverage you need and the cost associated with each type of coverage before purchasing a policy.

How Much Underinsured Coverage Do I Need? • NY Motorcycle Lawyers 1-800

Motor Insurance | Car Insurance | Two Wheeler Insurance Plans

5 Types of Car Insurance Coverage You Must Know (con imágenes) | Autos

When To Get Automobile Insurance coverage?

Third Party Insurance Cover For Car - worlddesignjobs