One Day Liability Insurance For Event

Friday, June 13, 2025

Edit

One Day Liability Insurance For Event

What is One Day Liability Insurance?

One Day Liability Insurance is a type of insurance policy designed to provide financial protection to those who are hosting or organizing an event of any kind. This type of policy is very useful for planning large events such as weddings, conferences, concerts, or other large gatherings. It provides coverage for any potential liability issues that may arise during the event, such as property damage, medical bills, or legal fees. The policy is typically purchased for a single day, although it is possible to purchase multiple days of coverage.

Who Needs One Day Liability Insurance?

Anyone who is planning an event with more than a few dozen people should consider purchasing One Day Liability Insurance. This type of policy can provide protection for business owners, event organizers, and anyone else associated with the event. It is especially important for those who are potentially liable for any damages or injuries that may occur during the event. It is also important to note that many venues will require event organizers to have this type of insurance in order to use their facilities.

What Is Covered By One Day Liability Insurance?

One Day Liability Insurance typically covers any claims that arise from property damage, bodily injury, or personal injury during the event. This includes any legal fees or medical bills that may be incurred. The policy will also cover any damages that may be caused by the event itself, such as damage to the venue or other property. In some cases, the policy may also cover any loss of income that may be suffered as a result of the event.

What Is Not Covered By One Day Liability Insurance?

One Day Liability Insurance typically does not cover any claims related to alcohol, drugs, or any illegal activities. It also does not cover any intentional acts that may cause damage or injury. In addition, the policy does not typically cover any losses that may arise from the event being cancelled or postponed. It is important to note that the policy will only cover damages or injuries that occurred during the event and not any that may have occurred before or after the event.

How Much Does One Day Liability Insurance Cost?

The cost of One Day Liability Insurance will vary depending on the size and scope of the event. Generally speaking, the larger and more complex the event, the more expensive the policy will be. It is important to note that the cost of the policy will also depend on the type of coverage that is purchased. Some policies may provide a limited amount of coverage, while others may provide comprehensive coverage that covers all potential liability issues.

Where Can I Purchase One Day Liability Insurance?

One Day Liability Insurance can typically be purchased from an insurance agent or online. It is important to shop around and compare the different policies that are available in order to find the best deal. It is also important to read the policy carefully to make sure that it meets all of the requirements of the event and provides the necessary coverage. By doing this, event organizers can ensure that they are properly protected in the event of any potential liability issues.

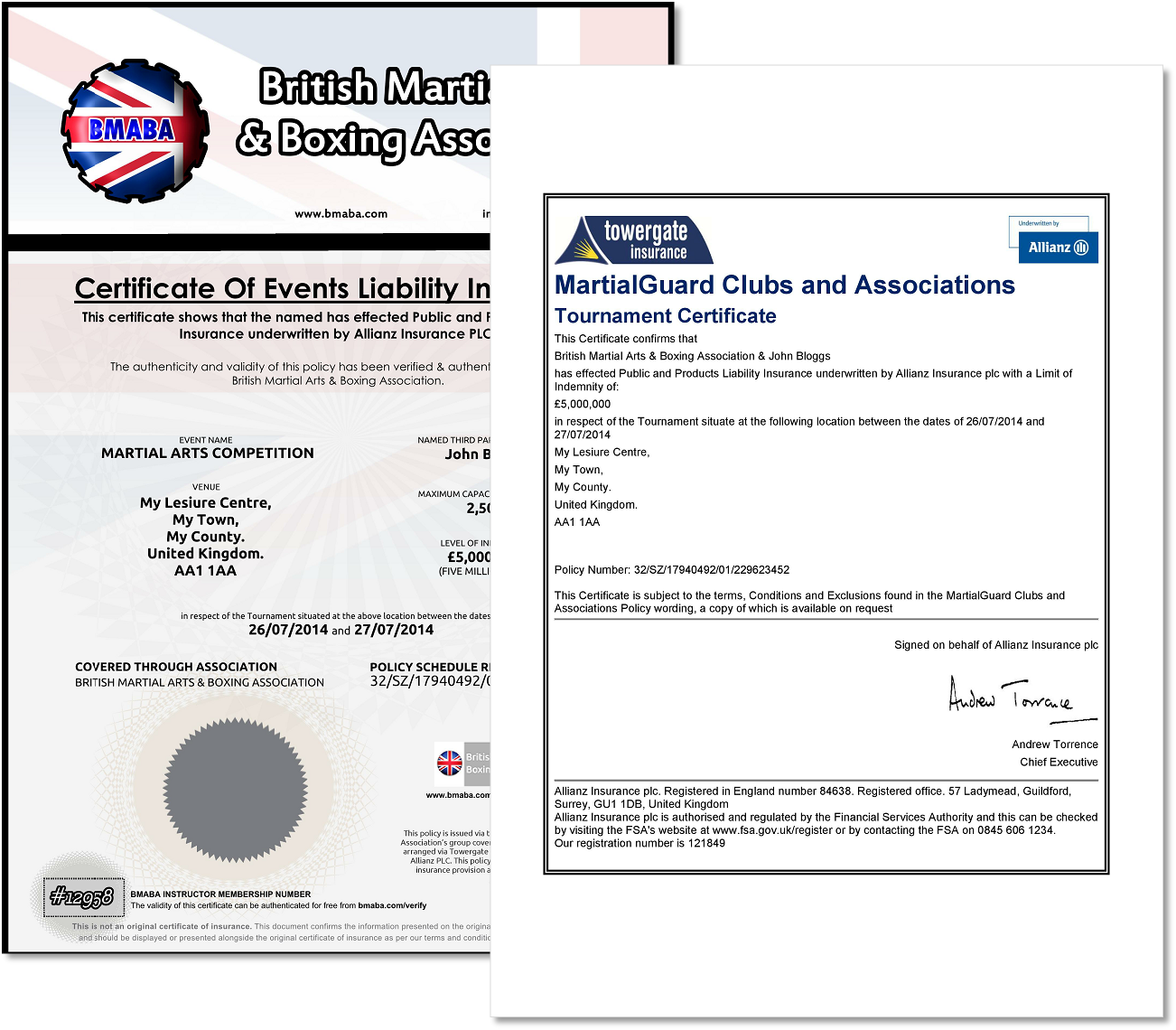

WedSafe Wedding Insurance | 1 Day Event Insurance & Liability Policies

Public Liability Insurance ONE DAY COVER

Liability Insurance: One Day Event Liability Insurance

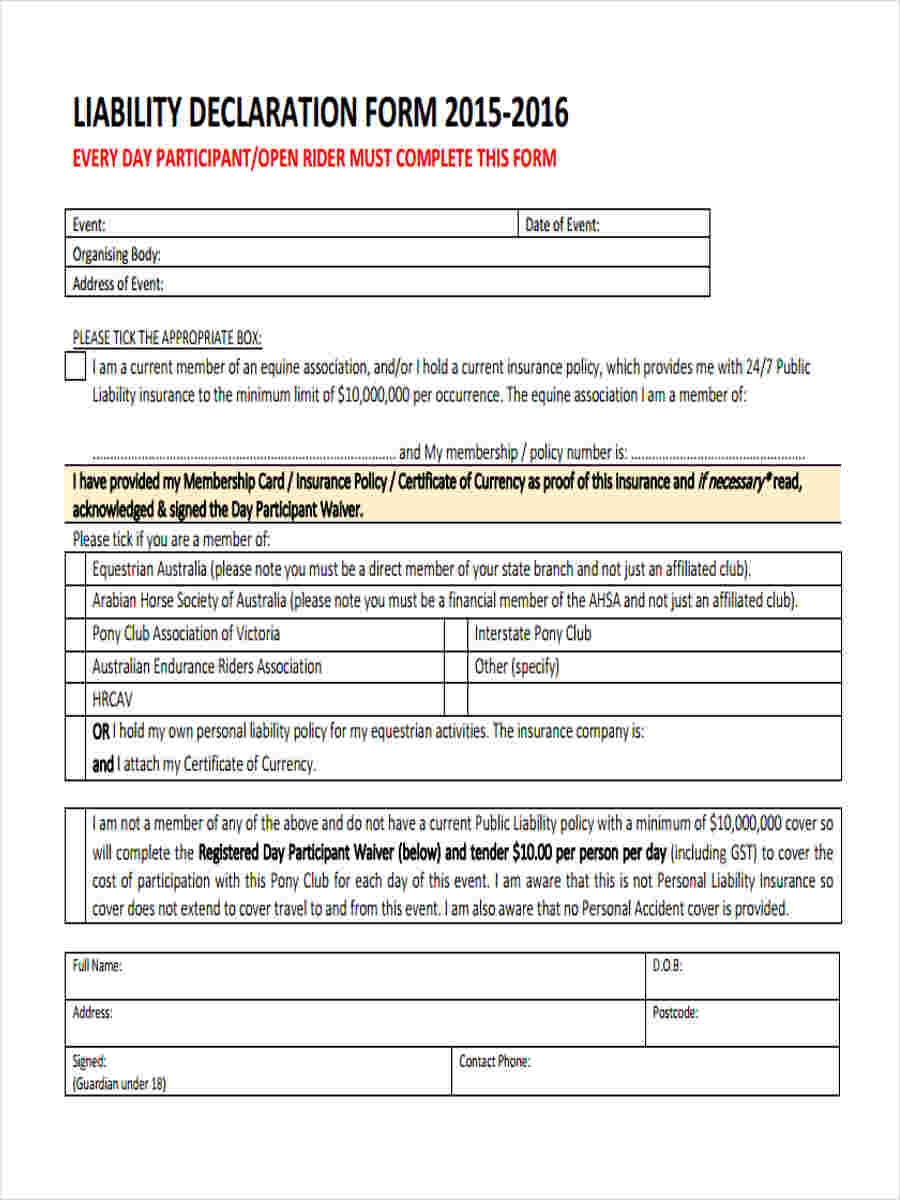

FREE 8+ Public Liability Forms in PDF | Ms Word

Think of a Special Event Liability Insurance When Organising an