Does Admiral Do Gap Insurance

Does Admiral Do Gap Insurance?

If you're considering buying a new car, you'll likely also be thinking about insurance. Whether you're a first-time car buyer or you've had a car for years, understanding gap insurance is important. Gap insurance is a type of auto insurance that covers the difference between what you owe on a car loan and the value of the car, if it's totaled in an accident. While gap insurance is not required by law, it's a good idea to understand it and decide if it's right for you. So, does Admiral do gap insurance?

What Is Gap Insurance?

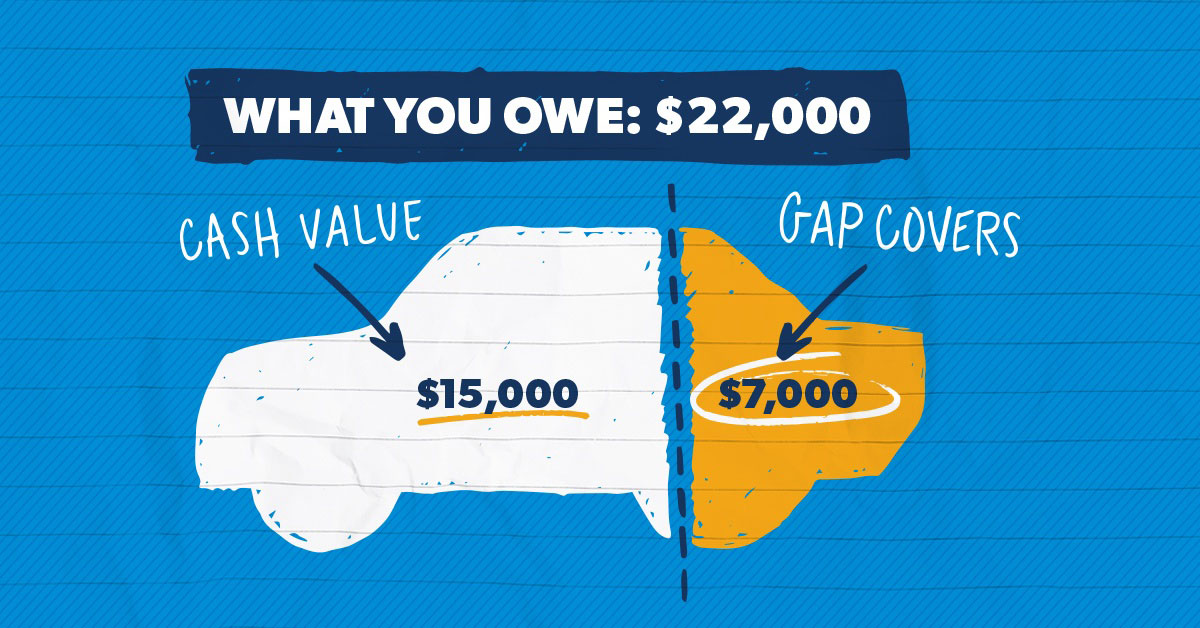

Gap insurance, also known as "loan/lease payoff coverage," is designed to cover the difference between the loan balance and the actual cash value of the car. If your car is totaled in an accident, your collision and comprehensive coverages will only pay out the car's actual cash value, which is usually less than the amount you still owe on the loan. Gap insurance covers the difference between the loan balance and the actual cash value of the car.

For example, if you have a loan balance of $20,000 and your car is totaled, the actual cash value of the car is determined to be $15,000. Gap insurance pays out the difference of $5,000. Without gap insurance, you would be responsible for the remaining $5,000. Gap insurance is a good idea for anyone who has a loan and is worried about being financially responsible for the difference between the loan and the actual cash value of the car.

Does Admiral Do Gap Insurance?

Admiral does offer gap insurance. Gap insurance is an optional coverage, so it is not automatically included in your policy. To find out more about gap insurance, contact your Admiral representative and they can answer any questions you might have. Admiral offers three levels of gap insurance: Basic, Plus, and Premier.

Basic Gap Insurance

Basic gap insurance covers the difference between your loan balance and the actual cash value of the car. It also covers administrative fees, such as the cost of getting a new title and registration, up to a certain amount. With basic gap insurance, the coverage amount is limited to the invoice price of the car.

Plus Gap Insurance

Plus gap insurance covers the same things as basic gap insurance, but it also covers additional costs, such as sales tax, license fees, and extended warranties. Plus gap insurance covers up to 125% of the invoice price of the car.

Premier Gap Insurance

Premier gap insurance covers all of the same things as basic and plus gap insurance, but it also covers up to 150% of the invoice price of the car. This is the most comprehensive gap insurance coverage offered by Admiral.

Should I Get Gap Insurance?

Gap insurance can be a good idea for anyone who has a loan and is worried about being financially responsible for the difference between the loan balance and the actual cash value of the car. If you're considering gap insurance, it's a good idea to talk to your Admiral representative to find out more about the coverage and determine if it's right for you.

Pin on And.....

Admiral picked to lead Navy is retiring; bad judgment cited | The

Commander, Joint Force Maritime Component Commander (JFMCC) > U.S

How Does Gap Insurance Work? | DaveRamsey.com

Gap Insurance Refund After Refinancing : Total Loss Protection Policy