Are Insurance Rates Higher For Electric Cars

Are Insurance Rates Higher For Electric Cars?

Electric Car Insurance Basics

Electric cars are becoming increasingly popular, and for good reason. They are cleaner and more efficient than traditional gasoline-powered vehicles, and they are often cheaper to operate and maintain. However, one area where electric cars may be more expensive is car insurance. Many drivers wonder if electric cars have higher insurance rates than their gasoline-powered counterparts. The answer is not always straightforward, as there are many factors that play into the cost of car insurance.

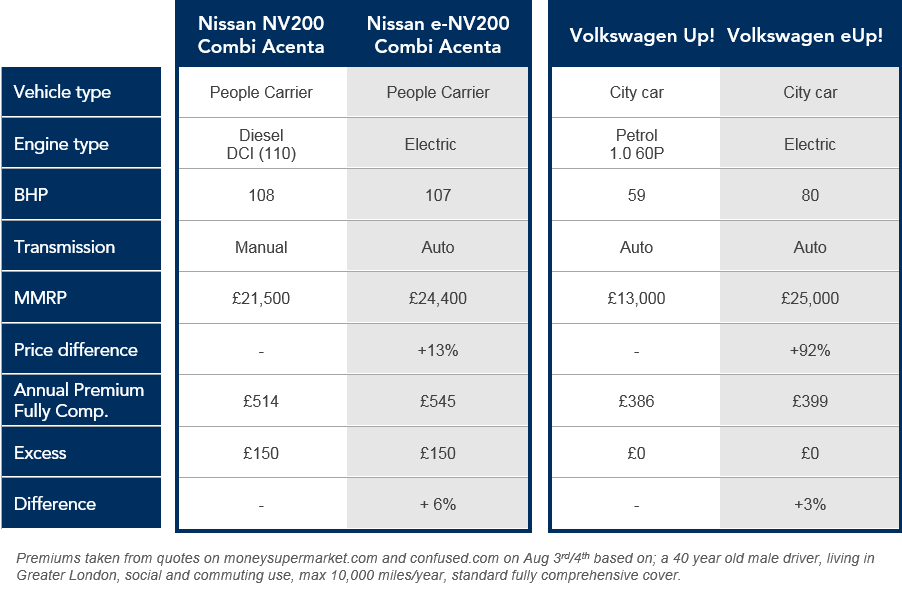

When it comes to insurance rates, the type of car is just one of many factors. Insurance companies look at a variety of factors when determining rates, including the driver’s age, driving record, and the type of coverage they are seeking. In addition, the make, model, and year of the car can also play a role in the cost of insurance. Electric cars are generally more expensive than gasoline-powered cars, and this can lead to higher insurance premiums.

Factors Affecting Electric Car Insurance Rates

The cost of insuring an electric car can vary greatly depending on a variety of factors. For example, the value of the car, the age and condition of the car, and the type of coverage the driver is seeking can all play a role in the cost of coverage. In addition, the make, model, and year of the electric car can also have an impact on the cost of insurance. For example, older electric cars may have higher insurance premiums than newer models.

In addition, the type of battery used in the electric car can also affect the cost of insurance. Electric cars with lithium-ion batteries may be more expensive to insure than those with nickel-metal-hydride batteries. The size and power of the electric motor can also affect the cost of insurance. Large, powerful electric cars may be more expensive to insure than smaller, less powerful models.

Insurance Discounts for Electric Cars

Some insurance companies offer discounts for electric cars. For example, some companies may offer discounts for drivers who install anti-theft devices, have clean driving records, or have multiple cars insured with the same company. Drivers should check with their insurance company to see if they qualify for any discounts.

In addition, some states offer discounts on insurance premiums for electric cars. For example, California offers a 20% discount on auto insurance premiums for electric cars. Some states also offer tax credits for drivers who purchase electric cars. Drivers should check with their state’s department of motor vehicles to see if they qualify for any discounts or tax credits.

Conclusion

Electric cars can be more expensive to insure than traditional gasoline-powered cars, but there are ways to reduce the cost of coverage. Drivers should shop around for the best rates, and look for discounts and tax credits. Insurance companies also take a variety of factors into account when determining rates, so drivers should be sure to provide accurate information to get the most accurate quotes.

Is it easy to insure an electric car? We consider the cost

Average Cost of Electric Car Insurance UK 2020 | NimbleFins

How Having an Electric Car Affects Your Auto Insurance Rates - ValuePenguin

Electric Cars cost $400 more to be Insured on Average compared to a

Insurance Comparison Uk - How Car Specs