Liberty Mutual Auto Insurance Lienholder Verification

Liberty Mutual Auto Insurance: Lienholder Verification

When you purchase a car, you usually are required to take out auto insurance to protect yourself and other drivers. Liberty Mutual Auto Insurance is one of the most popular auto insurance companies, offering a variety of coverage options for their customers. However, if you have a loan or lien on your vehicle, the lender may require you to have the lienholder listed on your policy.

If you have a lienholder listed on your policy, Liberty Mutual is required to verify the information to make sure it is correct and up-to-date. This verification process is done in order to ensure that the lienholder is properly protected in the event of an accident. Liberty Mutual will verify the lienholder’s name, address, and other contact information.

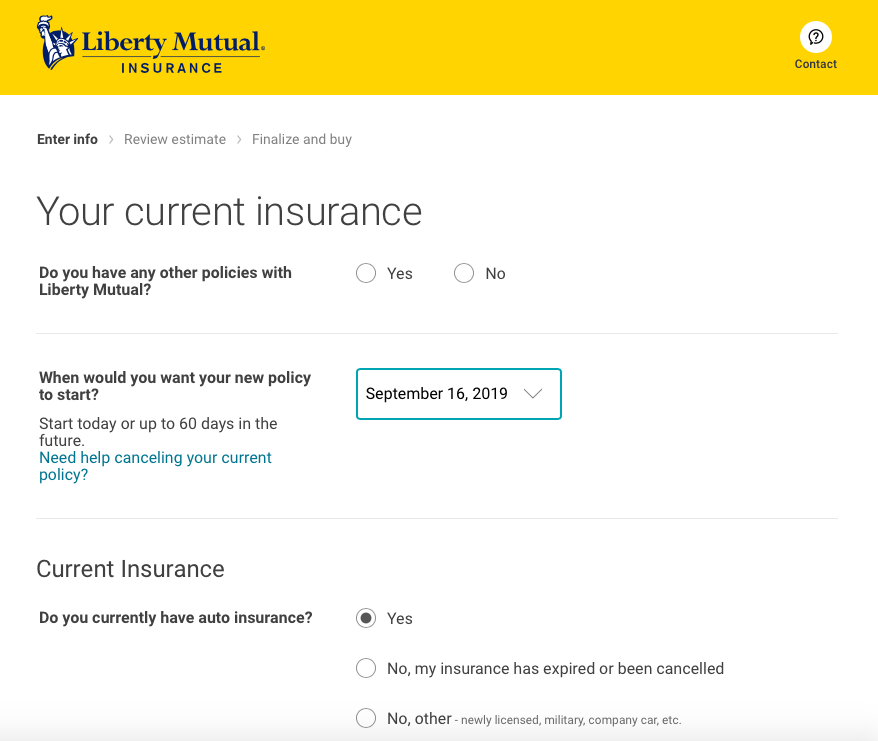

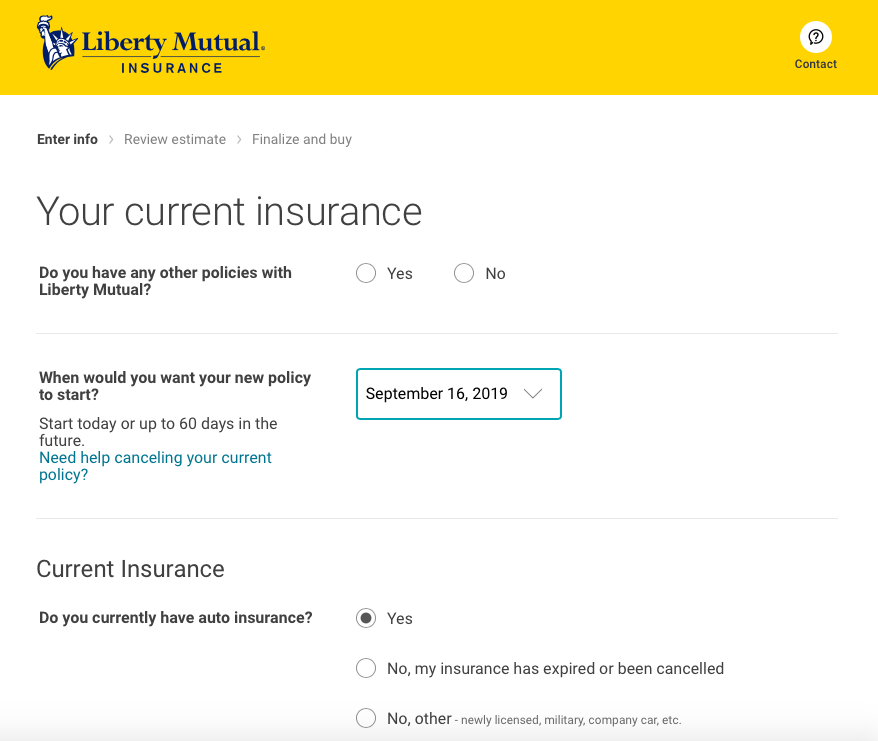

If you are purchasing a new policy or making changes to an existing policy, you will need to provide Liberty Mutual with the lienholder’s information. You can do this by providing the lienholder’s name, address, and phone number. Liberty Mutual will then contact the lienholder to verify the information and ensure that it is correct.

What Happens if the Lienholder Information is Incorrect?

If the lienholder information is not correct, Liberty Mutual will not be able to verify the information and may deny the policy. This is because the lienholder’s information must be correct in order for them to be properly protected in the event of an accident. If the lienholder information is incorrect, Liberty Mutual will notify you of the issue and you will need to provide the correct information.

How Long Does the Verification Process Take?

The verification process typically takes a few days, but it can take up to a week or two depending on the circumstances. If you need to provide additional information to Liberty Mutual, the process may take longer. Liberty Mutual will notify you when the lienholder has been verified and your policy is ready to be issued.

Conclusion

Liberty Mutual Auto Insurance is one of the most popular auto insurance companies and offers a variety of coverage options for their customers. However, if you have a loan or lien on your vehicle, the lender may require you to have the lienholder listed on your policy. Liberty Mutual is required to verify the lienholder information to ensure that it is correct and up-to-date. The verification process takes a few days, but can take up to a week or two depending on the circumstances. If you need to provide additional information to Liberty Mutual, the process may take longer. Liberty Mutual will notify you when the lienholder has been verified and your policy is ready to be issued.

Liberty Mutual Auto Insurance Review for 2020 | AutoInsuranceEZ.com

Liberty Mutual Auto Insurance Login - www.libertymutual.com Login

Liberty Mutual Auto/Car Insurance Login | Make a Payment

Liberty Mutual - Jessica Liu Insurance Services

The Rating Of Liberty Mutual Auto Insurance In Customer - Pemco