Car Insurance For A Month

Car Insurance For A Month: Everything You Need To Know

Introduction

Driving a car is a great way to get around, but it comes with a lot of responsibility. Car owners must be sure to have the right car insurance coverage in order to drive safely and legally. Many people choose to get car insurance for a month, instead of signing up for a longer policy. This can be a great way to save money and get the coverage you need without committing to a long-term policy. In this article, we’ll cover everything you need to know about getting car insurance for a month.

What Is Car Insurance For A Month?

Car insurance for a month is exactly what it sounds like – a car insurance policy that lasts for one month. This type of policy is often referred to as a “short-term” policy. It is a good option for people who don’t drive often, or who want the flexibility of being able to switch providers every month. With a short-term policy, you’ll be able to get the coverage you need without having to commit to a long-term policy.

What Does A Short-Term Car Insurance Policy Cover?

A short-term car insurance policy typically covers the same types of coverage as a regular car insurance policy. This includes liability coverage, collision coverage, and comprehensive coverage. Liability coverage will cover any medical expenses or property damage that you may cause in an accident. Collision coverage will cover any repairs to your vehicle, while comprehensive coverage will cover any damages caused by events other than collisions, such as theft or natural disasters.

What Are The Benefits Of A Short-Term Car Insurance Policy?

There are several benefits to getting a short-term car insurance policy. First, it’s much cheaper than a regular policy. Since you’re only paying for a month at a time, you won’t have to commit to a long-term policy and pay for the entire duration upfront. This makes it a great option for people who don’t drive often or who want the flexibility of being able to switch providers every month. Additionally, short-term policies are often more customizable than regular policies. You can choose the type of coverage you need and the amount of coverage you need, so you’re only paying for what you need.

How Much Does A Short-Term Car Insurance Policy Cost?

The cost of a short-term car insurance policy depends on several factors, such as the type of coverage and the amount of coverage you choose. Generally, short-term policies are cheaper than regular policies. However, you should still shop around to find the best deal. Compare quotes from multiple providers to make sure you’re getting the best rate for your coverage.

Conclusion

Car insurance for a month is a great option for people who don’t drive often or who want the flexibility of being able to switch providers every month. It’s much cheaper than a regular policy and more customizable, so you’re only paying for the coverage you need. Be sure to shop around to find the best deal and compare quotes from multiple providers to make sure you’re getting the best rate for your coverage.

Month to Month Car Insurance | Just at Rodney D Young

Pre Paid Month To Month Car Insurance by month2month007 - Issuu

Auto Insurance Month To Month / Cheap Month To Month Car Insurance

Insurance On The Spot Phone Number - blog.pricespin.net

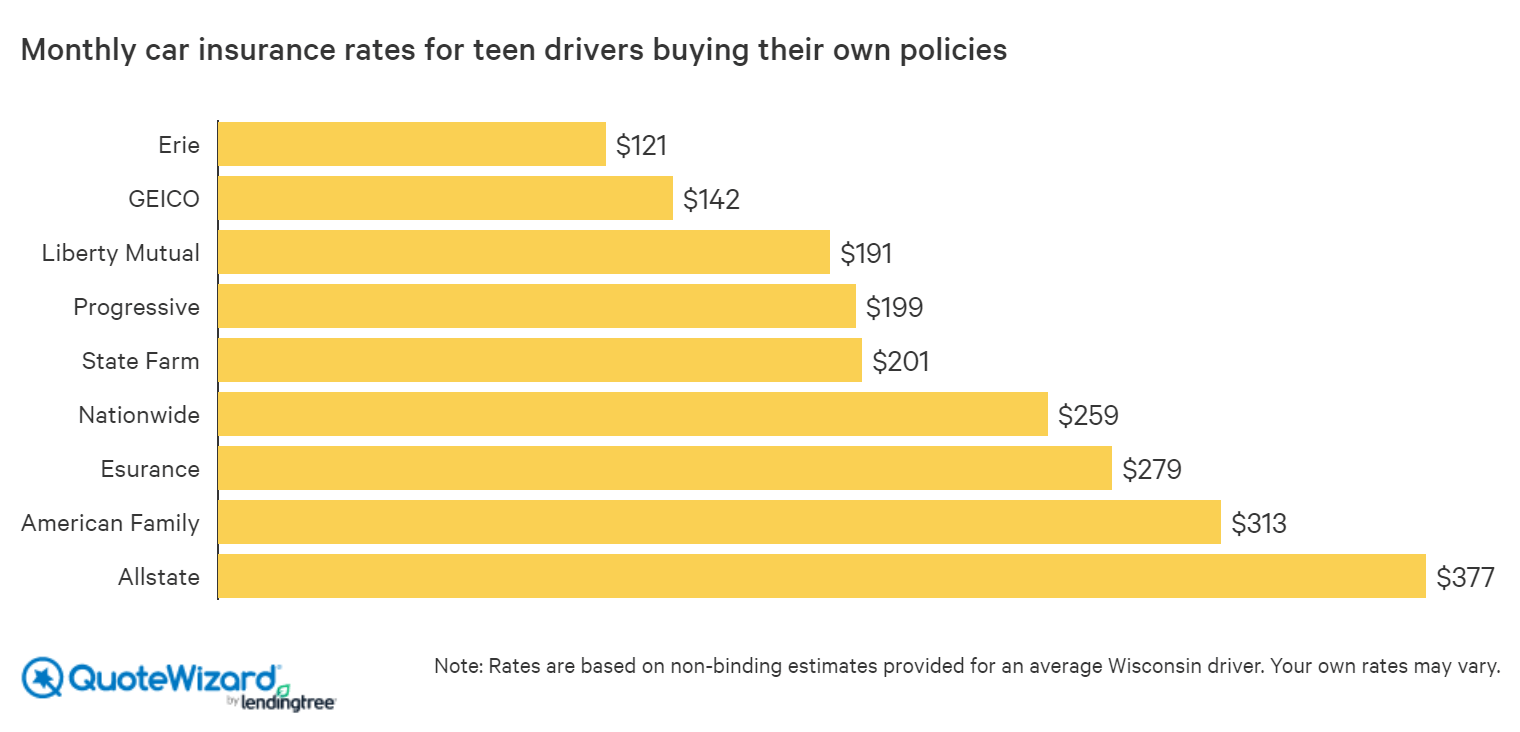

Best Car Insurance for Teens | QuoteWizard