Uninsured Motorist Coverage Vs Collision

Comparing Uninsured Motorist Coverage and Collision Coverage

What is Uninsured Motorist Coverage?

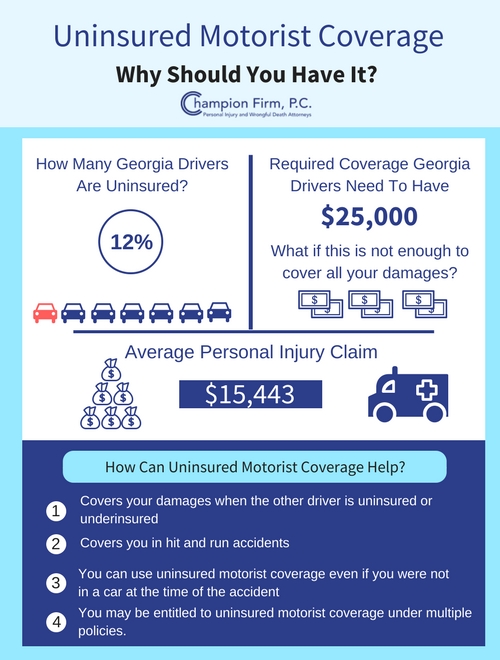

Uninsured Motorist Coverage (UM) is an insurance policy that provides protection for drivers who are injured in an accident involving an at-fault driver who does not have insurance coverage. UM coverage is similar to liability insurance, but is specifically designed to cover the costs associated with an accident involving an uninsured driver. It is usually an optional coverage that can be added to a policy and is required by law in some states. UM coverage can also provide coverage for an individual’s vehicle damage, as well as medical bills if the at-fault driver is uninsured.

What is Collision Coverage?

Collision coverage is another type of car insurance coverage that pays for damages to your own car in the event of an accident. It covers damage to your car regardless of who is at fault. Collision coverage typically covers the repair or replacement of your car, as well as any other related costs. It is generally required by lenders when financing a vehicle, and can be added to your policy for an additional fee.

Uninsured Motorist Coverage vs. Collision Coverage

Uninsured Motorist Coverage and Collision Coverage are both important types of insurance coverage for drivers. Uninsured Motorist Coverage provides protection for drivers who are injured in accidents involving an at-fault driver who does not have insurance coverage. Collision Coverage pays for damages to your own car in the event of an accident, regardless of who is at fault. It is important to understand the differences between the two types of coverage and to consider both when purchasing car insurance.

Uninsured Motorist Coverage

Uninsured Motorist Coverage provides protection for drivers who are injured in accidents involving an at-fault driver who does not have insurance coverage. UM coverage is similar to liability insurance, but is specifically designed to cover the costs associated with an accident involving an uninsured driver. It is usually an optional coverage that can be added to a policy and is required by law in some states. UM coverage can also provide coverage for an individual’s vehicle damage, as well as medical bills if the at-fault driver is uninsured.

Collision Coverage

Collision coverage is another type of car insurance coverage that pays for damages to your own car in the event of an accident. It covers damage to your car regardless of who is at fault. Collision coverage typically covers the repair or replacement of your car, as well as any other related costs. It is generally required by lenders when financing a vehicle, and can be added to your policy for an additional fee.

Which One Should You Choose?

It is important to understand the differences between Uninsured Motorist Coverage and Collision Coverage and to consider both when purchasing car insurance. It is generally recommended that drivers purchase both types of coverage to ensure they are protected in the event of an accident. Uninsured Motorist Coverage provides protection for drivers who are injured in an accident involving an at-fault driver who does not have insurance coverage, while Collision Coverage pays for damages to your own car in the event of an accident. Ultimately, the decision to purchase both types of coverage depends on your individual needs and budget.

How to Save Money on Auto Insurance - Define Financial

Collision Vs Uninsured Motorist Property Damage California | Webmotor.org

What is the difference between basic and full coverage? | Star Nsurance

artopusdesign: Uninsured Motorist Coverage Colorado

Uninsured and Underinsured Motorist Coverage – Why do I need it?