Do Lease Cars Need Gap Insurance

Do Lease Cars Need Gap Insurance?

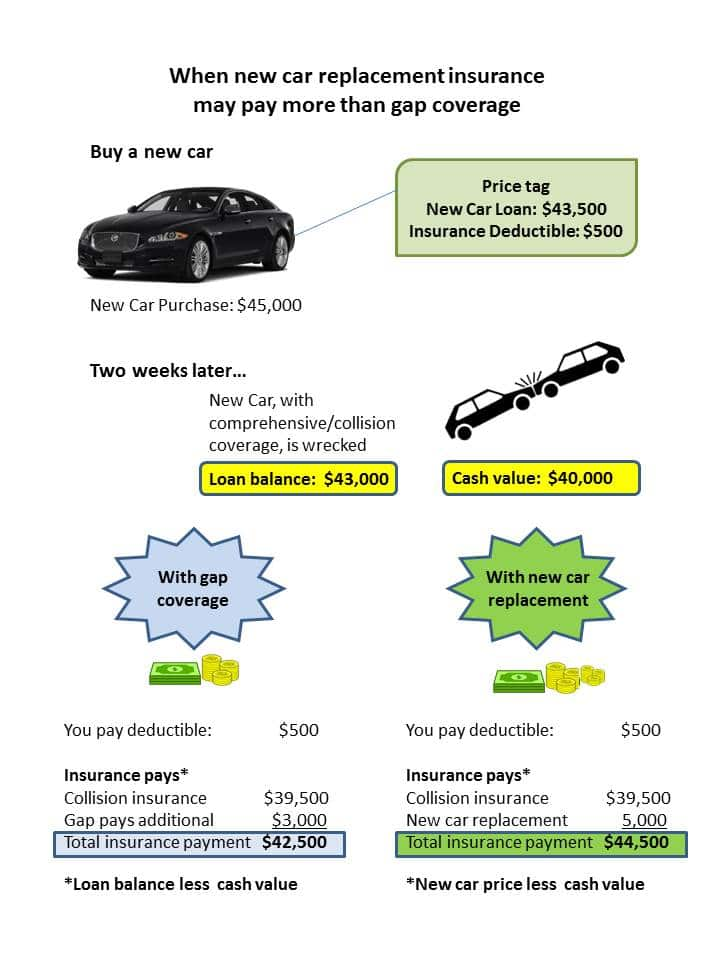

Buying a car can be a daunting process, with a lot of decisions to make. One of those decisions is whether or not to get Gap insurance. Gap insurance is an insurance policy that covers the difference between what you owe on your car loan and what your car is worth at the time of a total loss. It can be a valuable policy to have if you are leasing a car, as it can help to protect you from financial hardship in the event of an accident.

What is Gap Insurance?

Gap insurance is an insurance policy that covers the difference between what you owe on your car loan and what your car is worth at the time of a total loss. This means that if your car is totaled in an accident, your insurance will only pay out the current market value of the car, which can often be far less than the amount you owe on the loan. Gap insurance will cover the difference between the two, so you don’t have to pay out of pocket for the remainder.

Do Lease Cars Need Gap Insurance?

Lease cars definitely need Gap insurance. The reason for this is that the amount you owe on a lease is typically higher than what your car is worth at the time of a total loss. This is because you’re not just paying for the car itself, but also for the depreciation of the car over the course of the lease. Without Gap insurance, you would be responsible for the difference between what the car is worth and what you owe, which could be thousands of dollars.

When Should You Get Gap Insurance?

Ideally, you should get Gap insurance as soon as you sign your lease. This is because you will be responsible for the difference between what the car is worth and what you owe, regardless of when the accident occurs. Some insurance companies offer Gap insurance as part of their policies, so you may be able to get it when you purchase your auto insurance. If not, you can usually purchase it separately from the insurance company or from the dealership.

What Does Gap Insurance Cover?

Gap insurance typically covers the difference between what you owe on your car loan and what your car is worth at the time of a total loss. It also covers certain out-of-pocket expenses, such as sales tax, registration fees, and other costs associated with purchasing the car. In some cases, Gap insurance may also cover the cost of a rental car while your car is being repaired or replaced.

Conclusion

Lease cars need Gap insurance to protect you from financial hardship in the event of an accident. Gap insurance will cover the difference between what you owe on the loan and what your car is worth at the time of a total loss. It is important to get Gap insurance as soon as you sign your lease, as you will be responsible for the difference regardless of when the accident occurs. Gap insurance typically covers the difference between the two, as well as certain out-of-pocket expenses associated with purchasing the car.

Leasing vs. financing a car (and how it affects your insurance

Why do You Need Gap Insurance? | Car lease, Insurance, Gap

Gap Insurance for your New or Leased Cars

Do You Need GAP Insurance On A Lease Car? | Moneyshake

Buying A Car Gap Insurance ~ designologer