How Much Is New Driver Insurance

How Much Is New Driver Insurance?

What Is New Driver Insurance?

New driver insurance is a type of insurance specifically designed for those who have recently obtained their driver’s license. It is a form of car insurance that covers the costs associated with an accident or damage to the vehicle should an incident occur. This type of insurance is typically more expensive than traditional car insurance as it is designed to protect new drivers who may not have the experience or knowledge to prevent or avoid potential risks.

Why Do I Need New Driver Insurance?

New drivers are generally more prone to accidents due to inexperience and lack of knowledge about the rules of the road. This means that getting into an accident is more likely for a new driver than it is for an experienced driver. Getting specific new driver insurance is a great way to protect yourself from potential risks and also from the financial burden of an accident. Additionally, some states may require new drivers to carry specific insurance in order to legally drive.

How Much Does New Driver Insurance Cost?

The cost of new driver insurance will vary depending on the insurance company, the type of coverage chosen, and the state in which you live. Generally, new driver insurance can range from a few hundred dollars to a few thousand dollars, depending on the factors mentioned above. It is important to shop around and compare rates to ensure that you are getting the best deal.

What Factors Affect the Cost of New Driver Insurance?

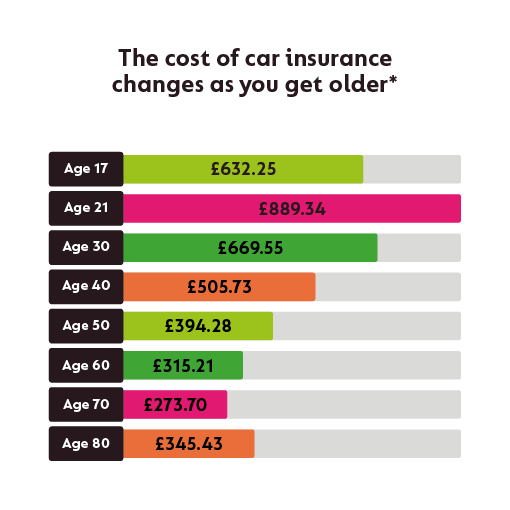

There are a variety of factors that can affect the cost of new driver insurance. These factors include the type of vehicle being insured, the driver’s age and driving history, the state in which the driver lives, and the type of coverage chosen. Some insurance companies may also offer discounts for certain drivers, such as those who have taken a driver’s education course or those who have good grades.

How Can I Save Money on New Driver Insurance?

There are a few different ways that you can save money on new driver insurance. First, it is important to shop around and compare rates between different insurance companies. Additionally, you may be able to get a discount by taking a driver’s education course or by having good grades. You should also consider raising your deductible in order to lower your monthly payments. Finally, bundling your insurance policies with the same company can often lead to discounts.

Conclusion

New driver insurance can be a great way to protect yourself and your vehicle in the event of an accident. The cost of new driver insurance will vary depending on a variety of factors, but there are a few ways that you can save money. It is important to shop around and compare rates in order to get the best deal. Additionally, taking a driver’s education course or raising your deductible may help to lower your monthly payments.

New Driver Insurance Cost Varies Widely Depending on Your Situation

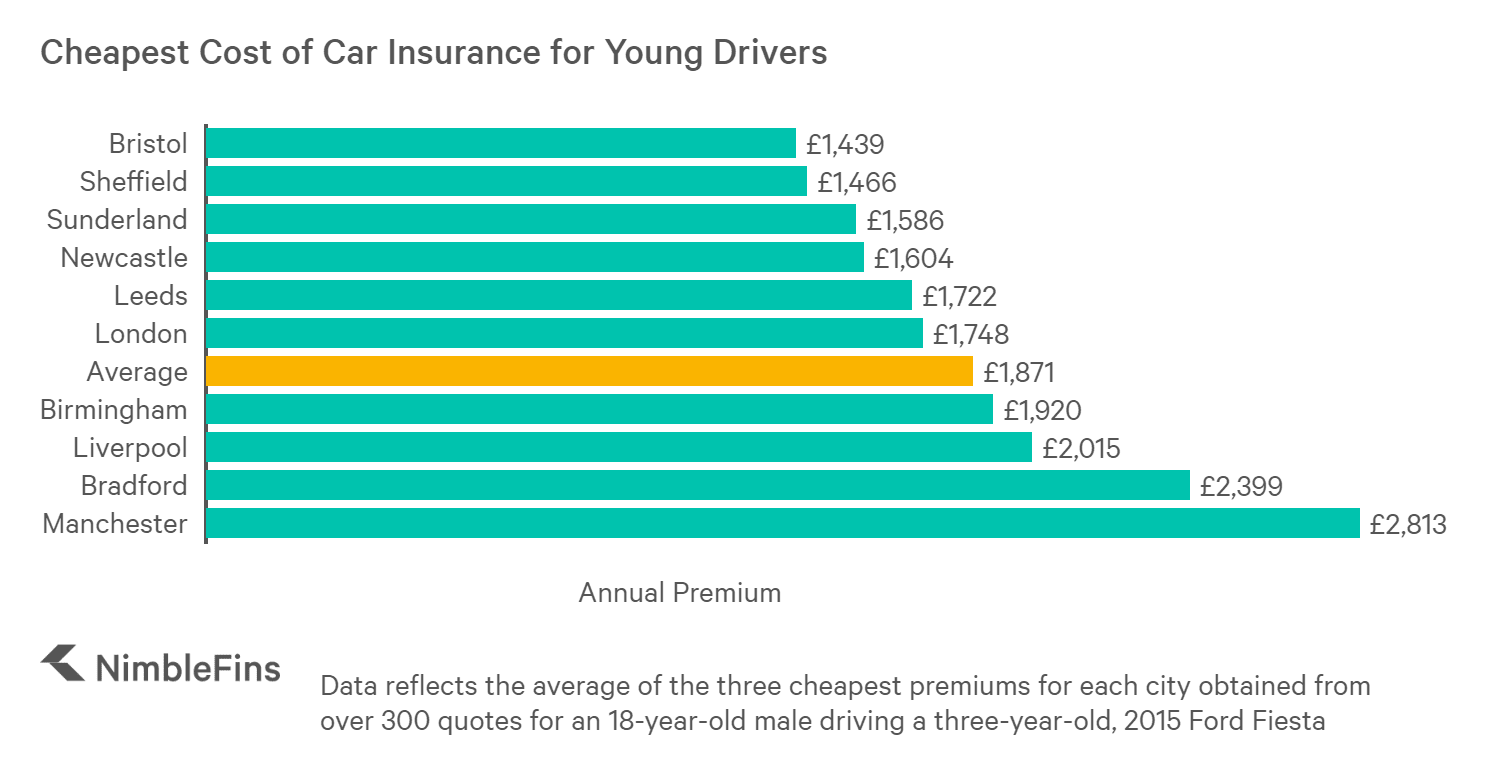

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

Car Insurance For New Drivers Over 21 - A Life of Luxury - Personal

How To Save On Car Insurance: Smart Ways To Lower Your Rate - PointsPanda

What do Americans Pay for Car Insurance in 2019?