Business Car Insurance For Fast Food Delivery

Fast Food Delivery Drivers: Get the Right Business Car Insurance

Fast food delivery is a booming industry, and the demand for drivers shows no sign of slowing down. Whether you’re a part-time driver or full-time, you’re going to need the right car insurance. With the right coverage, you can drive with confidence knowing that you’re protected in the event of an accident or breakdown. The following article will explain the basics of business car insurance and why it’s important for fast food delivery drivers.

What is Business Car Insurance?

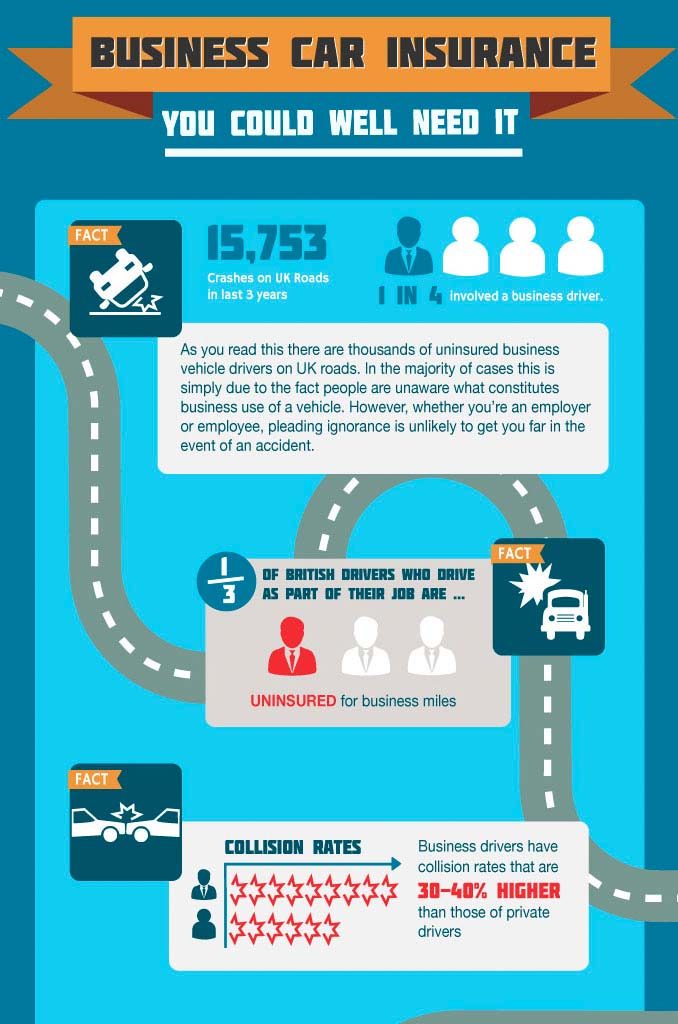

Business car insurance is a type of car insurance that covers vehicles used for business purposes. This includes delivery drivers, sales representatives, and anyone else who drives for work. Business car insurance is similar to personal car insurance, but with a few key differences. For one, it covers a wider range of vehicles and drivers, including employees, business partners, and drivers who are using the company car for business purposes. It also offers higher liability limits, which means the company is better protected in the event of an accident.

Why Do Fast Food Delivery Drivers Need Business Car Insurance?

Fast food delivery drivers need business car insurance for a few reasons. For one, it provides higher liability limits than personal car insurance. This means that if you’re involved in an accident, the company’s liability is better protected. Additionally, business car insurance covers a wider range of vehicles and drivers, which is important for companies that use a fleet of vehicles. Finally, business car insurance is often cheaper than personal car insurance, which can help companies save money.

What Does Business Car Insurance Cover?

Business car insurance typically covers a wide range of vehicles and drivers. This includes company cars, rental cars, and employee-owned vehicles. It also covers liability, property damage, and medical expenses. Additionally, some policies may cover towing, rental car reimbursement, and roadside assistance. Business car insurance can also cover uninsured and underinsured motorist coverage, which can help protect you if you’re hit by an uninsured or underinsured driver.

How Much Does Business Car Insurance Cost?

The cost of business car insurance varies depending on a number of factors, including the type of coverage, the number of vehicles, and the driver’s driving record. Generally, business car insurance is more expensive than personal car insurance due to the higher liability limits. However, some companies may be eligible for discounts if they have a large fleet of vehicles or if the drivers have a clean driving record.

Conclusion

Fast food delivery drivers need the right car insurance to stay safe on the roads. Business car insurance is an important type of insurance that provides higher liability limits and covers a wider range of vehicles and drivers. It also offers additional coverage, such as towing and rental car reimbursement. The cost of business car insurance varies, but companies may be eligible for discounts if they have a large fleet of vehicles or if the drivers have a clean driving record.

Business car insurance - do you need it? - Company Bug

What is Business Car Insurance? | Business Insurance

Food Delivery Insurance

Food Delivery Insurance Certificate Uk

Temporary Business Car Insurance | Company Car Insurance | Dayinsure