Car Insurance Liability Vs Full Coverage

Car Insurance Liability Vs Full Coverage

What is Car Insurance Liability?

Car insurance liability is the most basic type of car insurance coverage that is legally required in nearly all states. It is designed to provide financial protection to the driver in the event they are involved in an at-fault accident. Liability insurance covers the cost of any property damage or bodily injury that are caused by the driver. It can also cover the cost of legal defense in the event of a lawsuit being brought against the driver.

Liability insurance is usually broken down into two different parts: bodily injury liability and property damage liability. Bodily injury liability covers the cost of any medical treatment for the other driver or passengers involved in the accident. Property damage liability covers the cost of any damage to the other driver’s vehicle or other property.

What is Full Coverage Car Insurance?

Full coverage car insurance is a comprehensive car insurance policy that includes both liability and collision coverage. Collision coverage is designed to pay for any damage caused to your vehicle in an accident. It does not cover any medical costs or legal fees that may arise from the accident. Additionally, full coverage car insurance may also include comprehensive coverage, which pays for any damage to your vehicle due to theft, vandalism, or natural disasters such as floods or fires.

How Do You Choose Between Liability and Full Coverage?

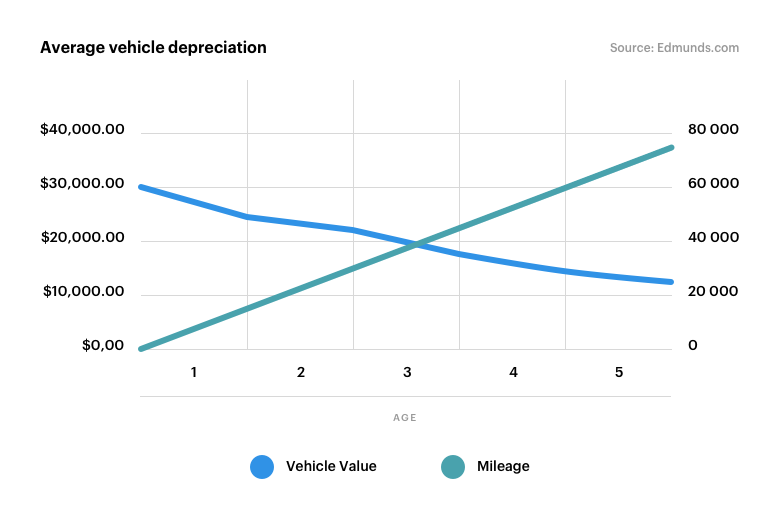

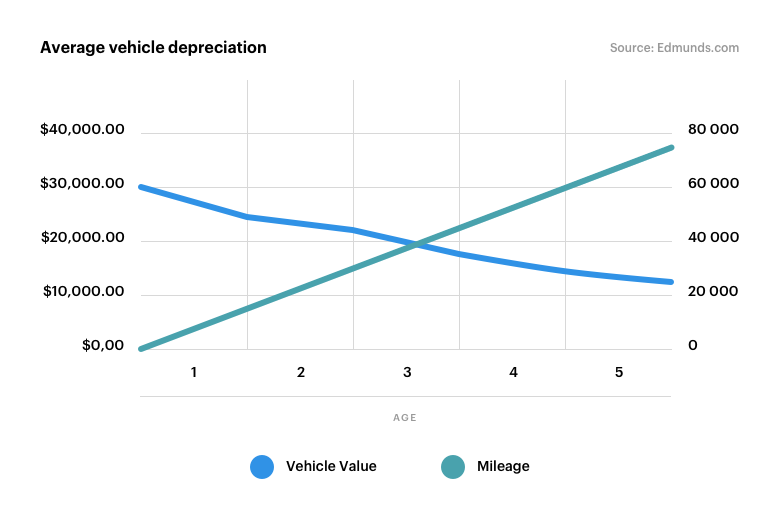

The decision between car insurance liability and full coverage is largely based on the type of car you drive and the amount of risk you are willing to take. For instance, if you are driving a newer car that is worth more than you could afford to replace, you may want to opt for full coverage in order to protect your investment. On the other hand, if you are driving an older car that is not worth much, you may be able to get away with just liability insurance.

Another factor to consider is your driving record. If you have a history of at-fault accidents or tickets, you may want to opt for full coverage in order to protect yourself from any financial responsibility in the event of another accident. Conversely, if you have a clean driving record, you may be able to get away with just liability.

What Does Full Coverage Car Insurance Cost?

The cost of full coverage car insurance will vary depending on the type of car you drive, the amount of coverage you choose, and your driving record. Generally, full coverage car insurance is more expensive than liability only insurance. However, it is important to remember that the cost of full coverage car insurance may be worth it in the long run if you are involved in an accident and are found to be at fault. Full coverage car insurance can help protect you from any financial responsibility.

Conclusion

Choosing between car insurance liability and full coverage can be a difficult decision. However, it is important to weigh your options and consider what type of coverage is best for you. If you are driving a newer car that is worth more than you could afford to replace, you may want to opt for full coverage in order to protect your investment. On the other hand, if you are driving an older car that is not worth much, you may be able to get away with just liability insurance.

Liability vs Full Coverage: What You Need To Know - Cover

Liability vs. Full Coverage: Which Auto Insurance Do You Need? - Clark

Liability Car Insurance vs. Full-Coverage Car Insurance | The Zebra

Page for individual images - QuoteInspector.com

Choose Deductibles for Car Insurance Coverages [Cheap Quotes]

![Car Insurance Liability Vs Full Coverage Choose Deductibles for Car Insurance Coverages [Cheap Quotes]](https://www.carinsurancecomparison.com/Images/f8478c63-basic-types-of-insurance-01-1-medium.jpg)