Hdfc Ergo Motor Insurance Claim Process

HDFC ERGO Motor Insurance Claim Process

Overview of Motor Insurance Claim Process

HDFC Ergo Motor Insurance offers you unmatched coverage for your vehicle. In the unfortunate event of any claim, HDFC ERGO Motor Insurance will provide you with a seamless claim experience. This article will explain the process of filing and settling a motor insurance claim with HDFC ERGO.

Steps to Filing a Motor Insurance Claim with HDFC ERGO

The process of filing a motor insurance claim with HDFC ERGO is simple and hassle-free. All you need to do is follow the steps outlined below:

- Notify the insurer immediately: In the case of an accident, the first step is to notify the insurance company. You can do this by calling the insurer's 24x7 helpline number or by sending an email to the customer care team.

- Fill the claim form: Once your claim is registered, you will be provided with a claim form, which needs to be filled in with all the required details.

- Submit supporting documents: Along with the claim form, you will need to submit all the supporting documents, such as repair bills, copy of FIR, copy of the driving license, etc.

- Surveyor to assess the damage: Once the documents are submitted, a surveyor appointed by the insurance company will visit the site to assess the damage. The surveyor will prepare a report, which will be sent to the insurance company for further processing.

- Claim processing and settlement: After the surveyor’s report is received, the insurance company will process the claim and settle the amount.

Documents Required to File a Motor Insurance Claim

To file a motor insurance claim with HDFC ERGO, you need to submit the following documents:

- Duly filled claim form

- Copy of the FIR

- Copy of the driving license

- Copy of the vehicle's registration certificate

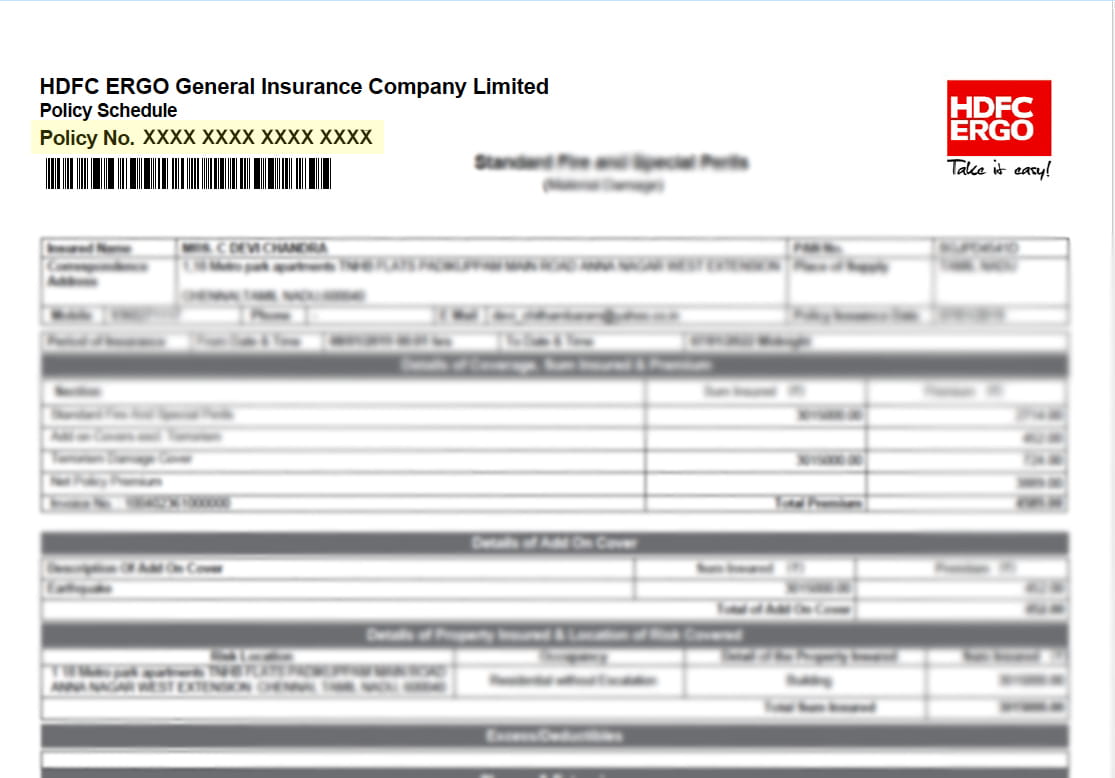

- Copy of the insurance policy document

- Repair bills

- Estimates of repair costs

Tips to Make Sure Your Motor Insurance Claim is Settled Quickly

To ensure that your motor insurance claim is settled quickly, here are a few tips to keep in mind:

- Always notify the insurer immediately in the case of an accident.

- Fill the claim form accurately and submit all the required documents.

- Keep all the original bills and documents handy.

- Cooperate with the surveyor and provide all the information needed.

- Make sure all the documents are in order before submitting them.

- Be patient and cooperative throughout the process.

Conclusion

Filing a motor insurance claim with HDFC ERGO is a simple process. All you need to do is follow the steps outlined above, fill the claim form accurately, submit all the required documents, and cooperate with the surveyor. With HDFC ERGO, you can be assured of a hassle-free claim experience.

[PDF] HDFC ERGO Insurance Claim Form PDF Download in English – InstaPDF

![Hdfc Ergo Motor Insurance Claim Process [PDF] HDFC ERGO Insurance Claim Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/motorclaimform-pdf-244.jpg)

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Ergo Motor Insurance Claim Process [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Hdfc Ergo Car Insurance Certificate Download : HDFC ERGO Insurance App

Car Insurance Hdfc Ergo

Watch How To Track Your Insurance Claims On HDFC ERGO IPO - YouTube