General Liability Insurance Coverage For Small Business

Wednesday, January 8, 2025

Edit

General Liability Insurance Coverage For Small Business

What is General Liability Insurance?

General Liability Insurance is an important coverage for small businesses to protect the owners and their employees from any financial loss due to a third-party claim. It covers the legal expenses and damages related to the injury or property damage of another party. It also protects against any claims of negligence related to the products or services provided by the business.

General Liability Insurance is also known as Commercial General Liability Insurance (CGL) and is a necessary coverage for any small business. It is important to understand the coverage so that small business owners can protect themselves from any potential financial losses.

What Does General Liability Insurance Cover?

General Liability Insurance covers a wide range of potential claims. It covers claims of bodily injury, property damage, personal injury, and advertising injury. It also covers legal defense costs associated with any of these claims.

The coverage also includes the costs associated with any medical treatment for an injured person. It also covers the cost to repair any property damaged in the incident. This coverage also includes any settlement and/or judgment costs associated with the claim.

What Types of Businesses Need General Liability Insurance?

General Liability Insurance is an important coverage for any small business. It is a must-have for any business that provides products or services to customers. This includes retail, manufacturing, and service businesses.

It is also important for businesses that have customers or clients on their premises. This includes offices, stores, and warehouses. Any business that has customers or clients visiting the premises is at risk of a third-party claim.

What Is the Cost of General Liability Insurance?

The cost of General Liability Insurance varies depending on the type of business and the amount of coverage that is needed. Generally, the cost of the coverage is based on the size of the business, the type of products or services offered, and the number of employees.

The best way to determine the cost of coverage is to speak with a local insurance agent who can provide a quote for the coverage. This will allow business owners to compare the costs and make an informed decision about the coverage they need.

What Are the Benefits of General Liability Insurance?

The primary benefit of General Liability Insurance is the peace of mind it provides for small business owners. This coverage helps to protect the business from any financial losses due to a third-party claim. It also covers any legal costs associated with defending the claim.

This coverage also provides financial protection for the business’s employees. If an employee is injured on the job, the coverage can help to pay for any medical treatment they may need.

Conclusion

General Liability Insurance is an important coverage for any small business. It provides financial protection for the business in the event of a third-party claim. It also helps to protect the business’s employees from any potential financial losses due to an injury or property damage. The cost of the coverage varies depending on the size and type of business, but it is an important coverage for any small business to have.

general liability insurance for small business ontario

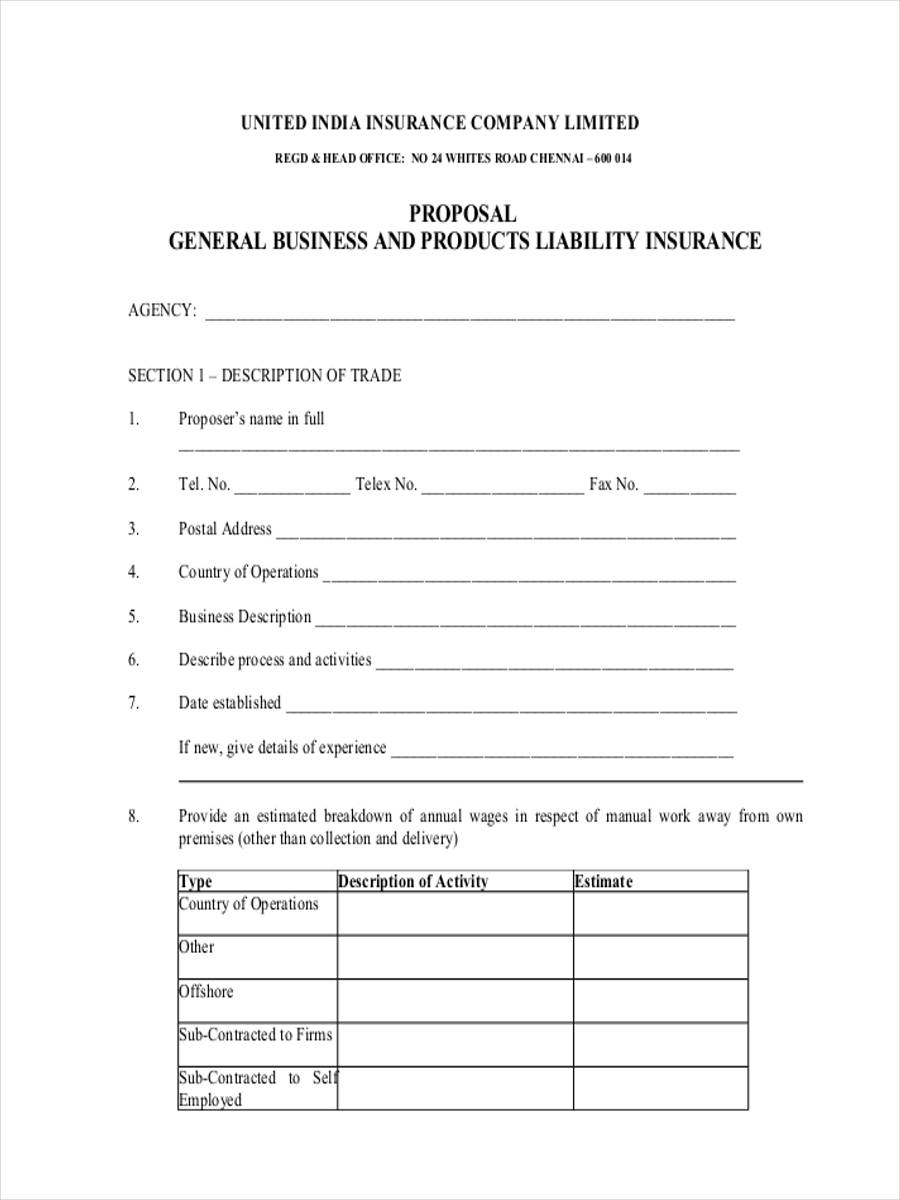

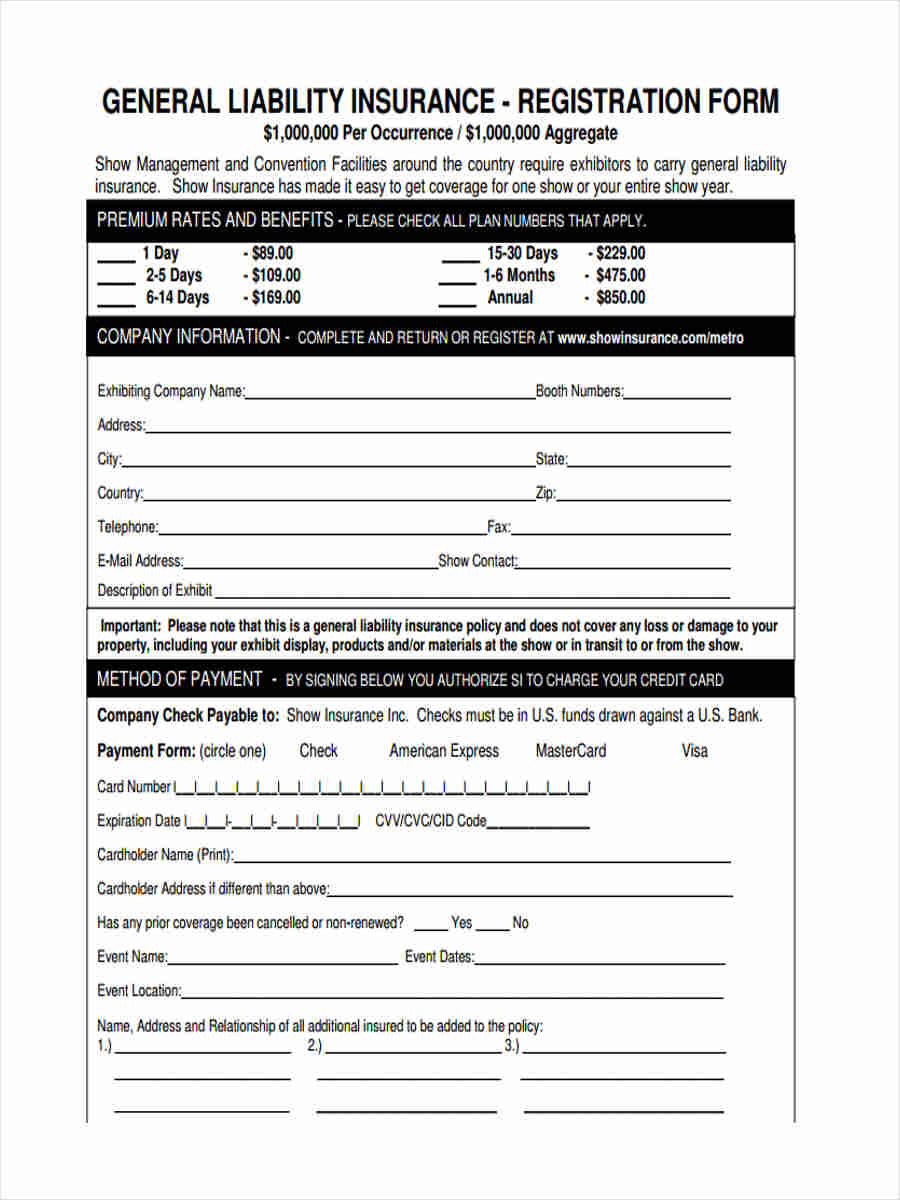

FREE 7+ Liability Insurance Forms in MS Word | PDF

Corporate Liability Insurance – Haibae Insurance Class

How to Protect Your Business From Unpredictable Events With General

FREE 5+ Business Liability Forms in PDF