Full Coverage For Auto Insurance

Full Coverage For Auto Insurance: What You Need To Know

What Is Full Coverage Auto Insurance?

Full coverage car insurance is the combination of liability, collision and comprehensive coverage for your vehicle. Liability coverage is required in most states, and it pays for damages to another person or property if you are at fault in an accident. Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault. Comprehensive coverage pays for damage to your vehicle caused by external factors such as theft, fire, flooding, or vandalism.

Do I Need Full Coverage Auto Insurance?

Whether you need full coverage auto insurance depends on a few factors. If you are financing a vehicle, your lender may require you to have full coverage. If you own your vehicle outright and do not plan to finance it, you may not need full coverage. You should consider the value of your vehicle and the cost of repairs to determine whether full coverage is necessary.

What Does Full Coverage Auto Insurance Cover?

Full coverage auto insurance typically covers the cost of repairs to your vehicle in the event of an accident, regardless of who is at fault. It also covers the cost of repairs to another person’s vehicle if you are at fault. In some cases, full coverage auto insurance may cover the cost of a rental car if your vehicle is damaged in an accident. It may also provide coverage for towing and labor costs, and some policies may even provide coverage for uninsured motorists if they are at fault in an accident.

What Does Full Coverage Auto Insurance Not Cover?

Full coverage auto insurance typically does not cover the cost of routine maintenance or repairs to your vehicle. It also does not cover the cost of medical expenses or lost wages if you are injured in an accident. Additionally, full coverage auto insurance does not cover damage to your vehicle caused by weather, flooding, fire, or vandalism.

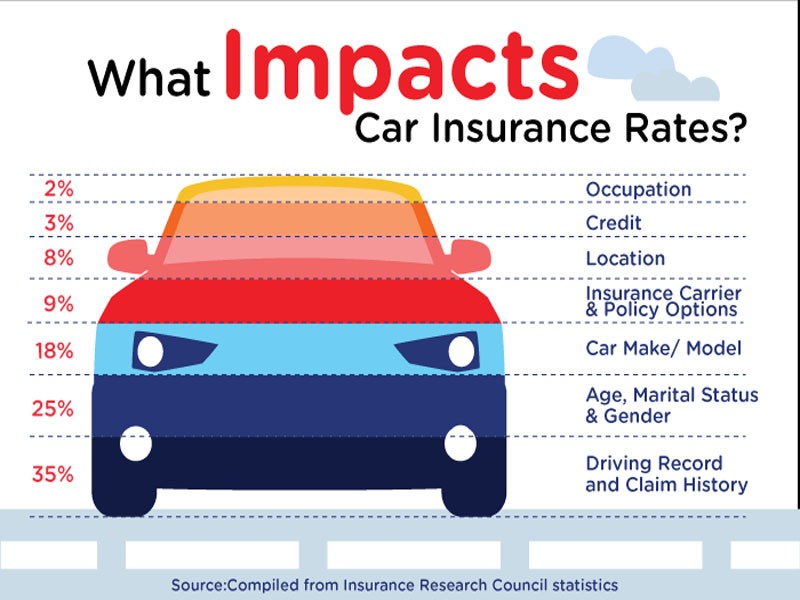

How Can I Save Money On Full Coverage Auto Insurance?

There are several ways to save money on full coverage auto insurance. Increasing your deductible is one of the simplest ways to reduce your premium. Additionally, you can take advantage of discounts offered by insurance companies such as discounts for good drivers, discounts for having multiple policies, and discounts for insuring multiple vehicles. You can also ask your insurance agent about discounts for certain safety features on your vehicle. Finally, you can shop around and compare rates from different insurance companies.

Conclusion

Full coverage auto insurance is a combination of liability, collision, and comprehensive coverage for your vehicle. Whether you need full coverage auto insurance depends on your individual situation. Understanding what full coverage auto insurance covers and does not cover can help you make an informed decision. There are several ways to save money on full coverage auto insurance, and shopping around can help you find the best rate.

+11 What Is Considered Full Coverage Auto Insurance In Florida 2022 - SPB

Full coverage car insurance in california by Promax Insurance Agency

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

What is Full Coverage Car Insurance? - eTrustedAdvisor

What Does Full Coverage Auto Insurance Include?