Does It Cost More To Insure An Electric Car

Does It Cost More To Insure An Electric Car?

The cost of driving an electric car is becoming increasingly popular for drivers who want to save money and reduce their carbon footprint. But does it also cost more to insure an electric car?

The answer to that question is, it depends. In some cases, electric cars could be cheaper to insure than their petrol or diesel equivalents, while in others, they could be more expensive. Here, we look at some of the factors which could affect your electric car insurance premiums.

Vehicle Value

The value of your electric car is likely to be a key factor in determining your insurance premiums. For example, if your car is worth more than a standard petrol or diesel car, it may be more expensive to insure. This is because electric cars, especially high-end models, are more expensive to repair or replace, so insurers may charge more to cover them.

Driving Record

Your driving record is also likely to be taken into account when calculating your electric car insurance premiums. If you have a good driving record, you may be rewarded with cheaper premiums than those with a less-than-perfect record. This is because insurers view drivers with a good record as lower risk and less likely to make a claim.

Location

Where you live can also have an impact on your electric car insurance premiums. For example, if you live in an area with higher levels of crime or theft, your premiums may be higher than those living in a safer area. This is because your insurer will want to cover the risk of your vehicle being stolen or damaged.

Type of Coverage

The type of coverage you choose can also affect the cost of your electric car insurance. If you choose comprehensive coverage, you’ll be covered for more than just third party damage, and this could mean higher premiums. However, it’s important to remember that comprehensive insurance can provide you with greater protection, so it may be worth the additional cost.

Conclusion

In conclusion, the cost of insuring an electric car can vary depending on a number of factors. The value of the car, your driving record and the type of coverage you choose are all likely to be taken into account by insurers when calculating your premiums. However, in some cases, electric cars could be cheaper to insure than their petrol or diesel equivalents.

Does it cost more to insure an electric car?

Does it cost more to insure an electric car? - Lovebylife

Buying an Electric Car? For Savings, Time Could Be of the Essence

Is an electric car more expensive to insure than a gas car

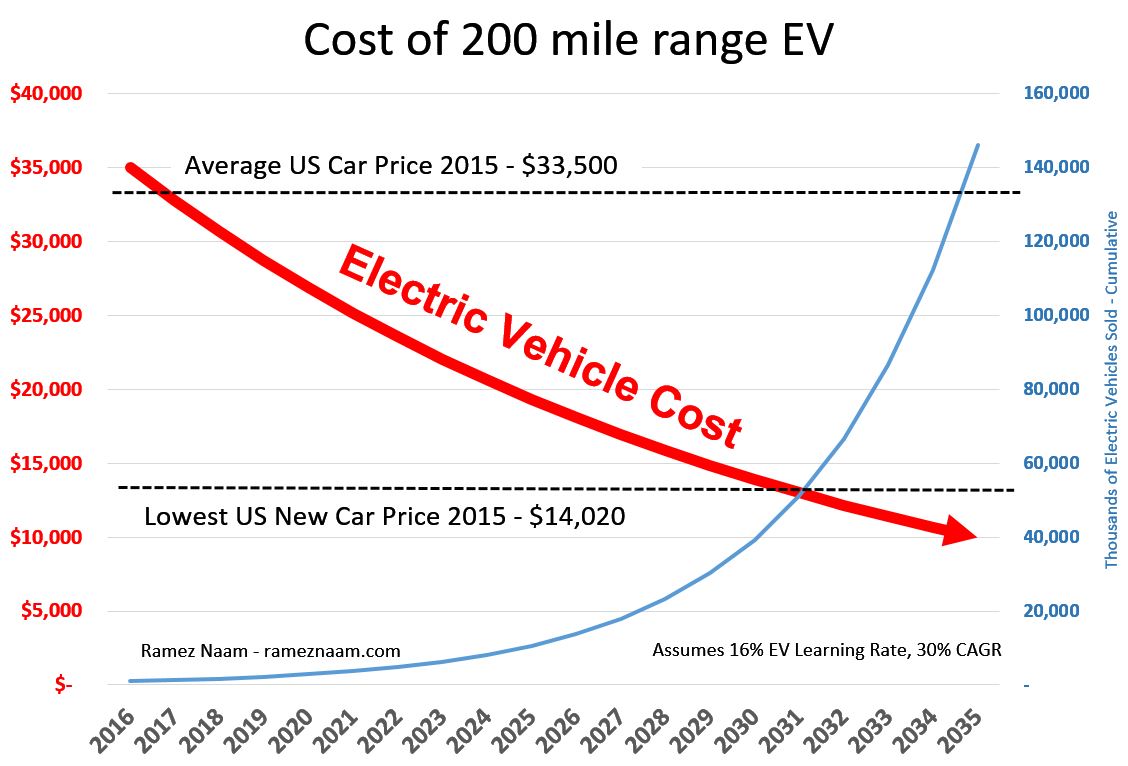

By 2030 Electric Vehicles with a 200 mile range will be lower cost than