Car Insurance Age Groups Uk

Car Insurance Age Groups in the UK

Why Does Age Matter?

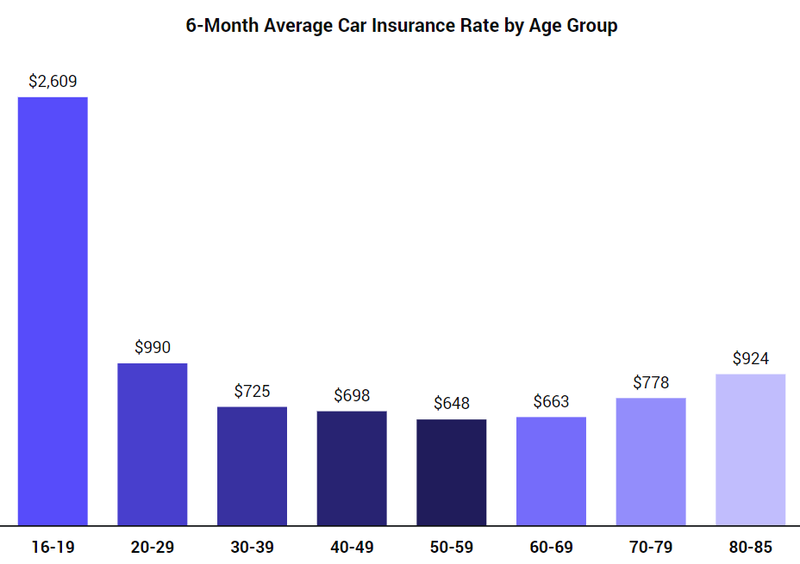

Age plays a big role in the amount of money you pay for car insurance in the UK. Insurance companies use age as an indicator of how experienced you are as a driver and how likely you are to make a claim. Generally, the younger you are, the higher your car insurance premiums will be due to having less experience on the roads.

Age Groups for Car Insurance

Car insurance companies in the UK generally break up their customers into three or four age groups for the purpose of pricing. The age groups typically start at 17 and go up in five-year increments: 17-22, 23-27, 28-39, and 40+. This means that if you are 24 years old, you will be in the 23-27 age group.

What Are the Age Ranges?

The age ranges for car insurance in the UK are as follows: 17-22, 23-27, 28-39, and 40+. Typically, the 17-22 age range is the most expensive, with premiums increasing as the age range goes up. The 40+ age range is usually the cheapest, as drivers in this age group are more experienced and less likely to make a claim.

What Are the Benefits of Being in an Older Age Group?

The primary benefit of being in an older age group for car insurance is the lower premiums. As drivers in the older age groups are more experienced and less likely to make a claim, insurance companies are willing to offer them lower premiums. This can be a significant saving, depending on the age and experience of the driver.

Are There Any Disadvantages?

The main disadvantage of being in an older age group is the increased likelihood of being penalised for having a poor driving record. As insurance companies view older drivers as more experienced, they will be more likely to penalise them for any accidents or convictions they may have. This could lead to higher premiums or even refusal of cover.

How Can I Get the Best Deal?

The best way to get the best deal on car insurance in the UK is to shop around and compare quotes from different providers. Each provider will have their own criteria for setting premiums, so it is important to compare them carefully. Additionally, it is important to make sure that you disclose any accidents or convictions to the insurer, as failure to do so could result in your policy being invalidated.

UK's Best Car Insurance Providers | mustard.co.uk

ALL You Need to Know About the Average Car Insurance Cost

Average Cost of Car Insurance in the UK | NimbleFins

Average Car Insurance Rates by Age and Gender Per Month | by Instant

Average Car Insurance Cost For 18 Year Old Male Uk - New Cars Review