Average Cost Of Tesla Model Y Insurance

Average Cost Of Tesla Model Y Insurance

Overview

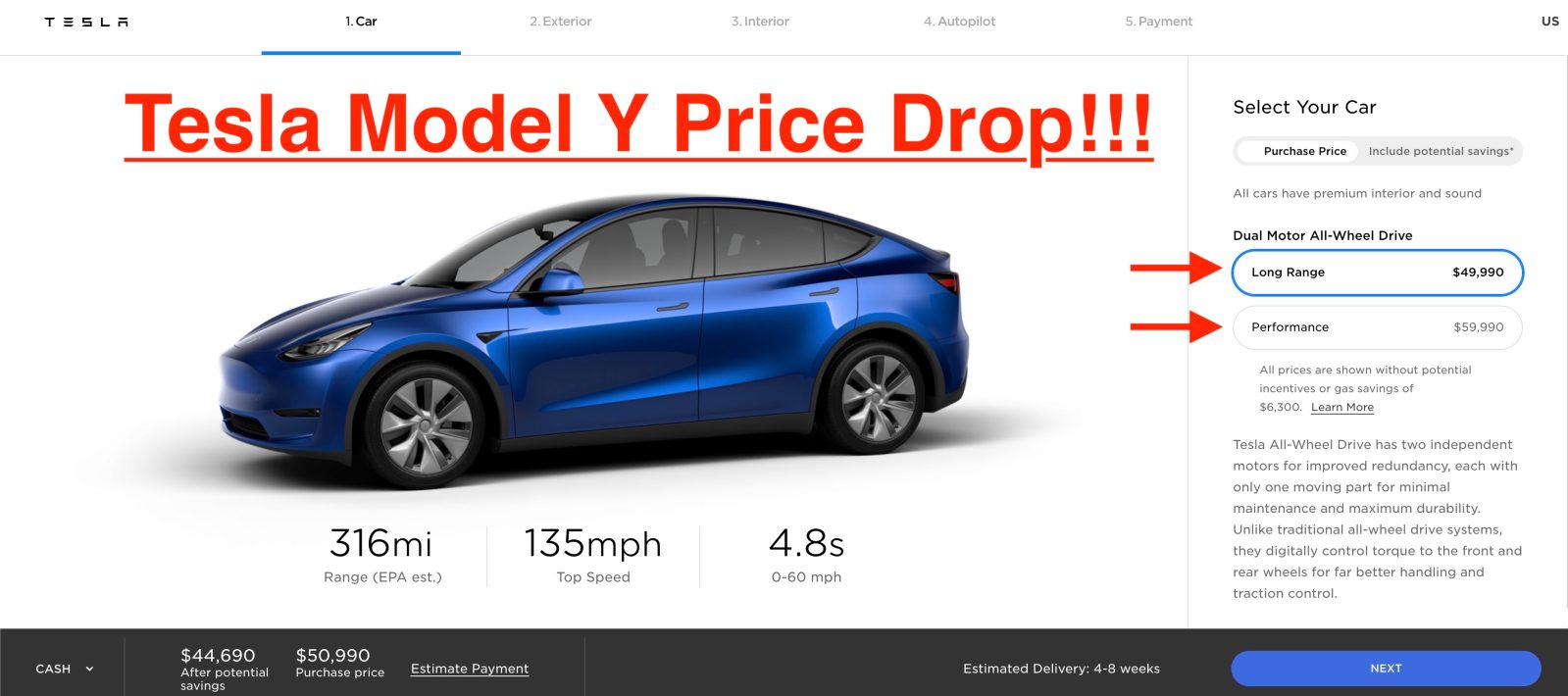

Tesla's Model Y is an electric car, which is equipped with some of the most advanced technology on the market. It is an impressive vehicle, with its sleek design, advanced safety features and luxurious interior. As with any car, insurance is a necessary expense. It is important to know the average cost of Tesla Model Y insurance before making a purchase. Knowing the average cost of insurance can help you budget for the car and make sure you are able to afford it.

Factors That Determine Cost

There are many factors that go into determining the average cost of Tesla Model Y insurance. These include the driver's age, driving record, location, and the type of coverage. The age of the driver is one of the biggest factors in determining the cost of the insurance. Younger drivers are more likely to be involved in an accident and are therefore seen as a higher risk by insurance companies. Drivers with a clean driving record will pay less than those who have been involved in accidents or have multiple moving violations. Location is also an important factor, as rates vary based on the state and city in which you live.

Types of Coverage

The types of coverage you choose will also affect the average cost of Tesla Model Y insurance. Liability coverage is required by law in most states and pays for damages caused by the driver to other parties. Comprehensive insurance covers damage to the car caused by something other than a collision, such as theft or vandalism. Collision insurance pays for damages caused by a collision to the car itself. There are also optional coverages that can be added, such as roadside assistance, rental car coverage, and gap insurance.

Getting the Best Price

The best way to get the best price on Tesla Model Y insurance is to shop around and compare rates from different insurance companies. It is also important to make sure you are getting all the discounts you qualify for, such as good driver discounts, multi-vehicle discounts, and discounts for safety features. Some insurance companies also offer discounts for bundling other types of insurance, such as homeowners or renters insurance, with the auto insurance policy. You can also lower your premiums by increasing your deductible.

Final Thoughts

The average cost of Tesla Model Y insurance is determined by many factors, such as the driver's age, driving record, location, and the type of coverage chosen. Shopping around and comparing rates from different insurance companies is the best way to get the best price. Be sure to look for discounts and bundle policies to save money. The cost of insurance can be a major factor when purchasing a car, so it is important to do your research and make sure you are getting the most coverage for the best price.

Tesla Model Y Insurance - How Much Will it Cost? (November 2022)

Tesla Model Y Insurance Cost / Tesla Insurance How Much Does Tesla Car

How Much Does Tesla Insurance Cost? How Does the Price Vary by Model

True Cost of the Tesla Model Y - Full Breakdown of Costs - Daniel's Brew

How Much Does Tesla Insurance Cost / How Much Does A Tesla Model 3 Cost