Average Cost Of Medicare Gap Insurance

Average Cost of Medicare Gap Insurance

What is Medicare Gap Insurance?

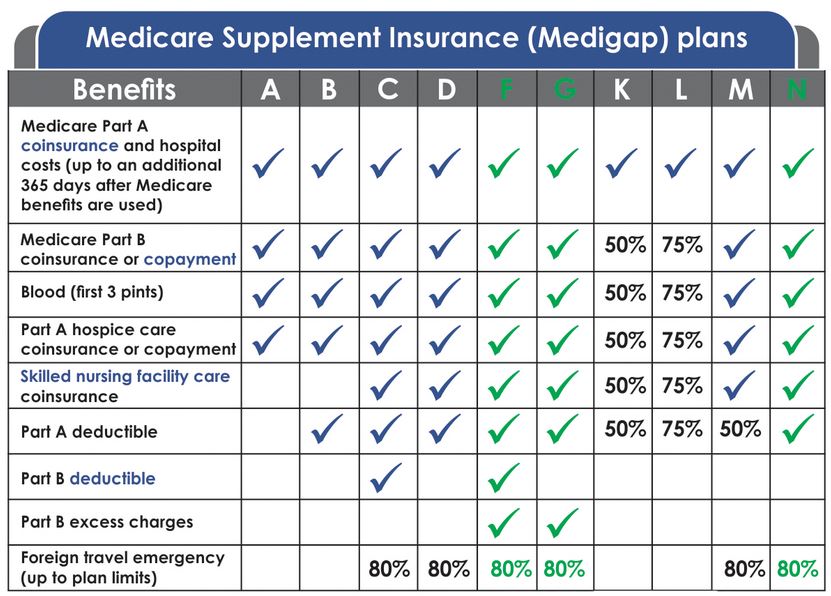

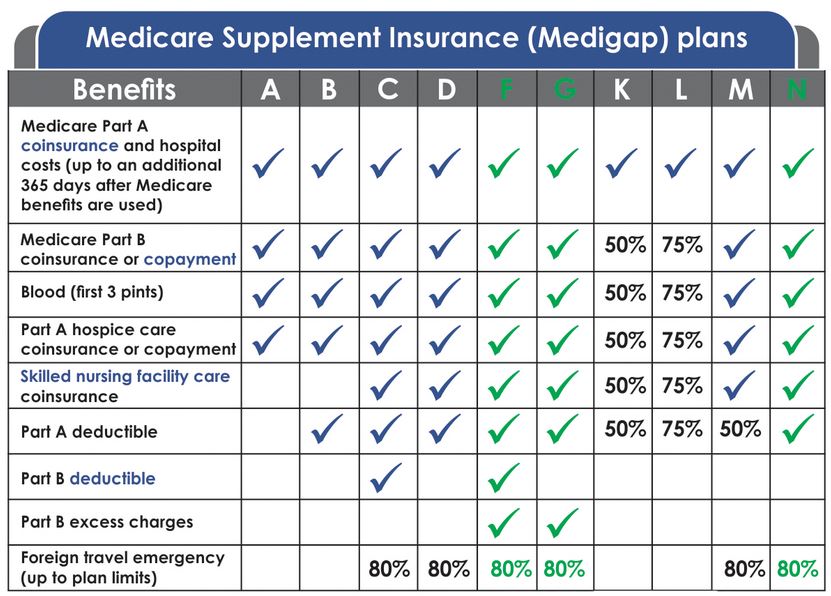

Medicare gap insurance is a type of supplemental insurance designed to cover the costs of medical care not covered by Medicare. It is also known as Medigap insurance. The cost of gap insurance depends on the type of coverage you choose, the age of the insured, the state you live in, and the insurance provider. Medicare gap insurance can be used to cover the costs of deductibles, coinsurance, copayments and other out-of-pocket costs that Medicare doesn’t cover. It also covers some services not covered by Medicare, such as routine hearing and vision care.

Average Cost of Medicare Gap Insurance

The cost of Medicare gap insurance depends on the type of coverage you choose. Generally, the more comprehensive the coverage, the higher the cost. The average cost of a Medicare gap insurance policy can range from $30 to $200 per month, depending on the type of coverage and the state you live in. In some states, the cost can be much higher. Additionally, the cost of gap insurance can vary by age. Typically, the older you are, the higher the cost of coverage.

What Factors Impact the Cost of Medicare Gap Insurance?

The cost of Medicare gap insurance varies depending on the type of coverage you choose, the state you live in, and the insurance provider. Some of the factors that can impact the cost of gap insurance include:

- The type of coverage you choose: the more comprehensive the coverage, the higher the cost.

- The state you live in: some states have higher premiums than others.

- The insurance provider: different insurance providers can charge different rates.

- Your age: typically, the older you are, the higher the cost of coverage.

What is the Best Way to Find Affordable Gap Insurance?

The best way to find an affordable Medicare gap insurance policy is to shop around. Compare rates from several different insurance providers to find the best rate. It’s also important to make sure the policy you choose covers all the services you need. Additionally, it’s important to make sure the policy you choose is accepted by your doctor and other health care providers.

What Should You Consider Before Buying Gap Insurance?

Before buying Medicare gap insurance, it’s important to consider all your options. Read the policy carefully and make sure it covers all the services you need. Don’t forget to compare rates from several different insurance providers to find the best rate. Additionally, make sure the policy you choose is accepted by your doctor and other health care providers.

Conclusion

Medicare gap insurance can be a great way to cover the costs of medical care not covered by Medicare. The cost of gap insurance depends on the type of coverage you choose, the state you live in, and the insurance provider. The best way to find an affordable policy is to shop around and compare rates from several different insurance providers. Before you buy a policy, make sure it covers all the services you need and is accepted by your doctor and other health care providers.

What Is The Cost Of Supplemental Medicare Insurance

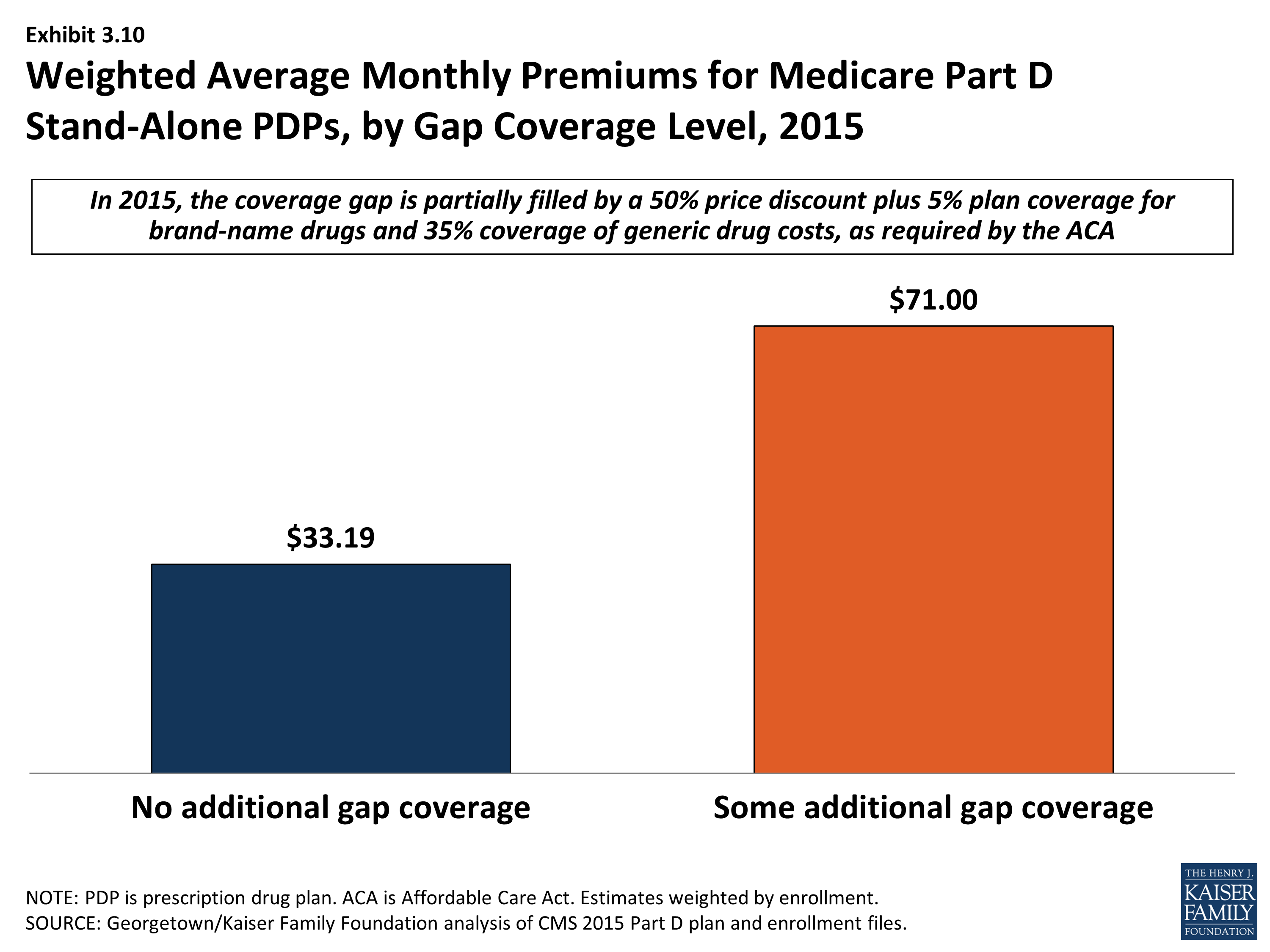

Medicare Part D at Ten Years – Section 3: Part D Benefit Design and

These are the most and least expensive states for Medigap coverage

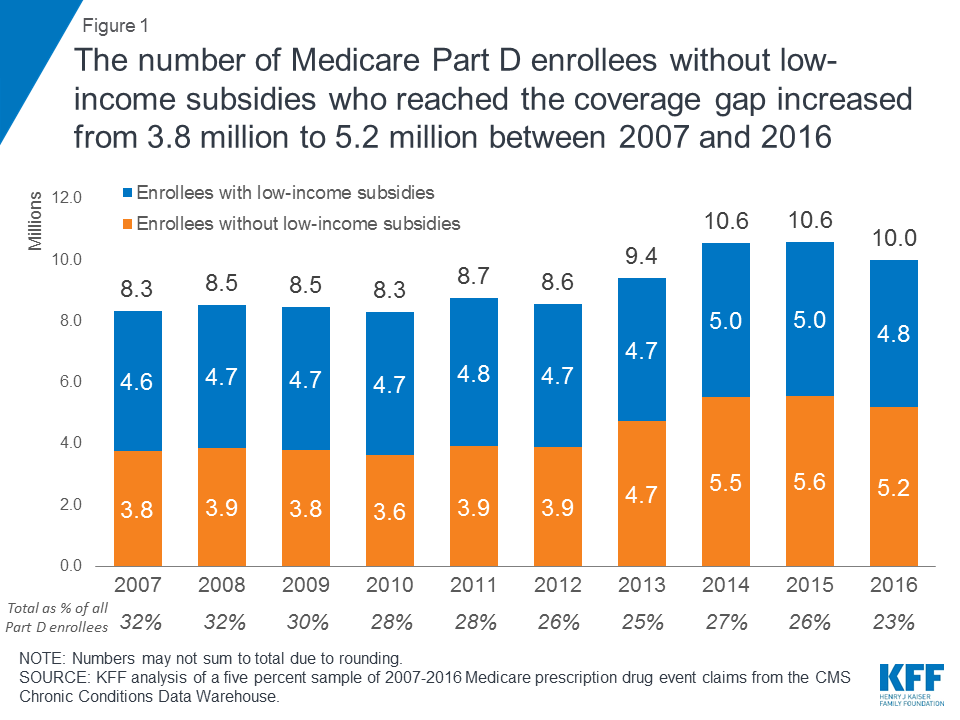

Closing the Medicare Part D Coverage Gap: Trends, Recent Changes, and