Which Group Pays More For Car Insurance Married Or Single

Married vs Single: Who Pays More for Car Insurance?

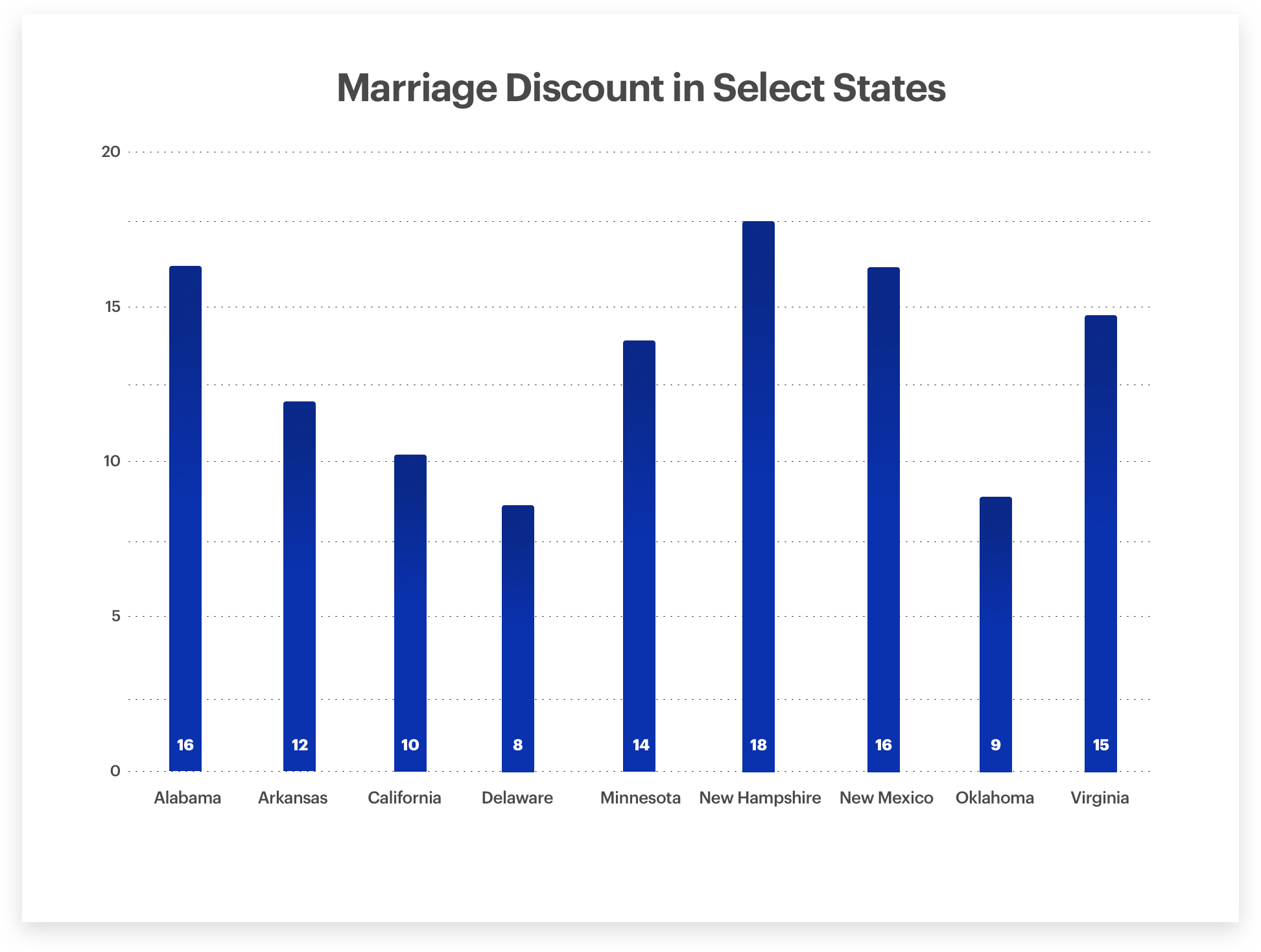

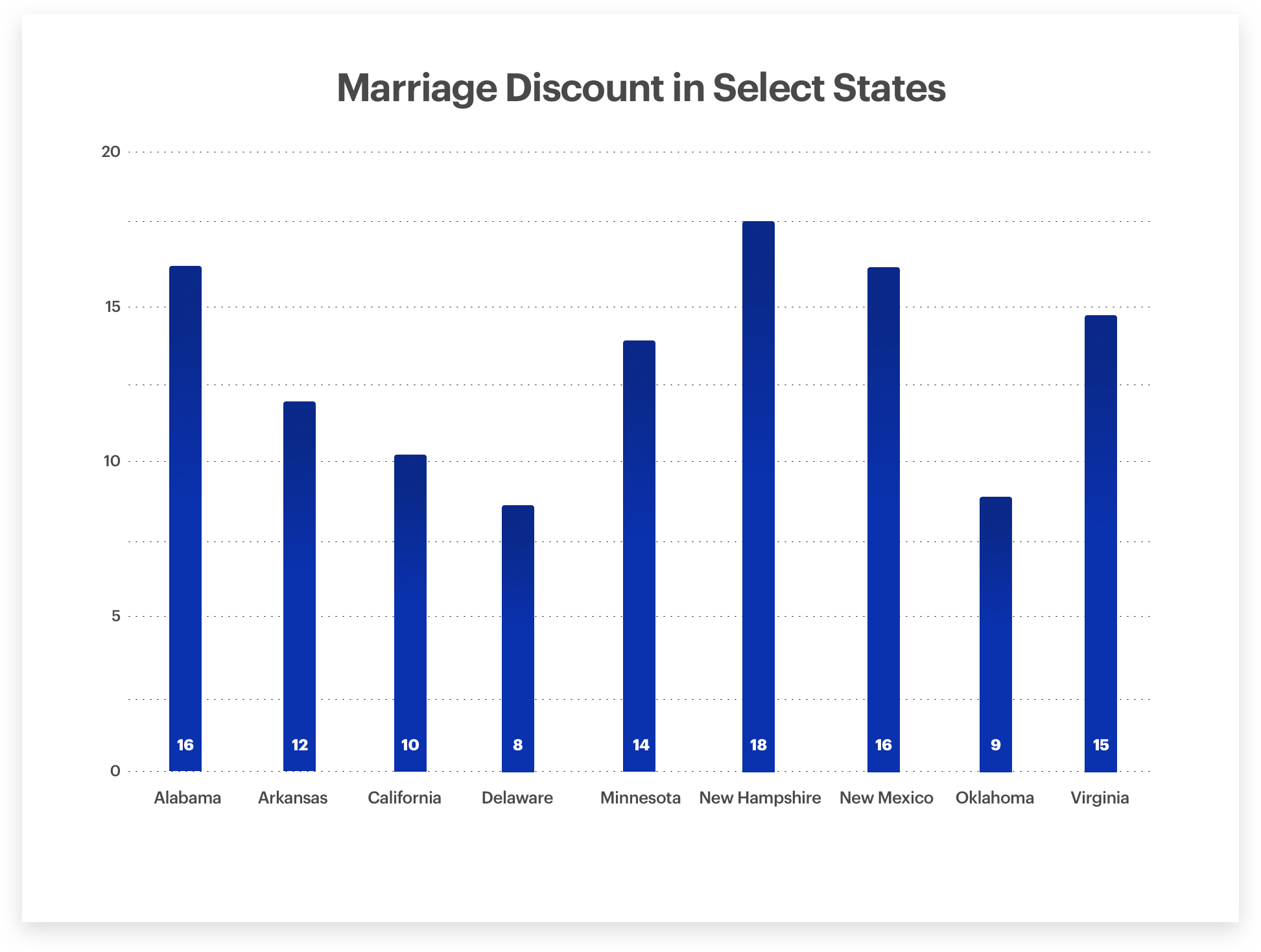

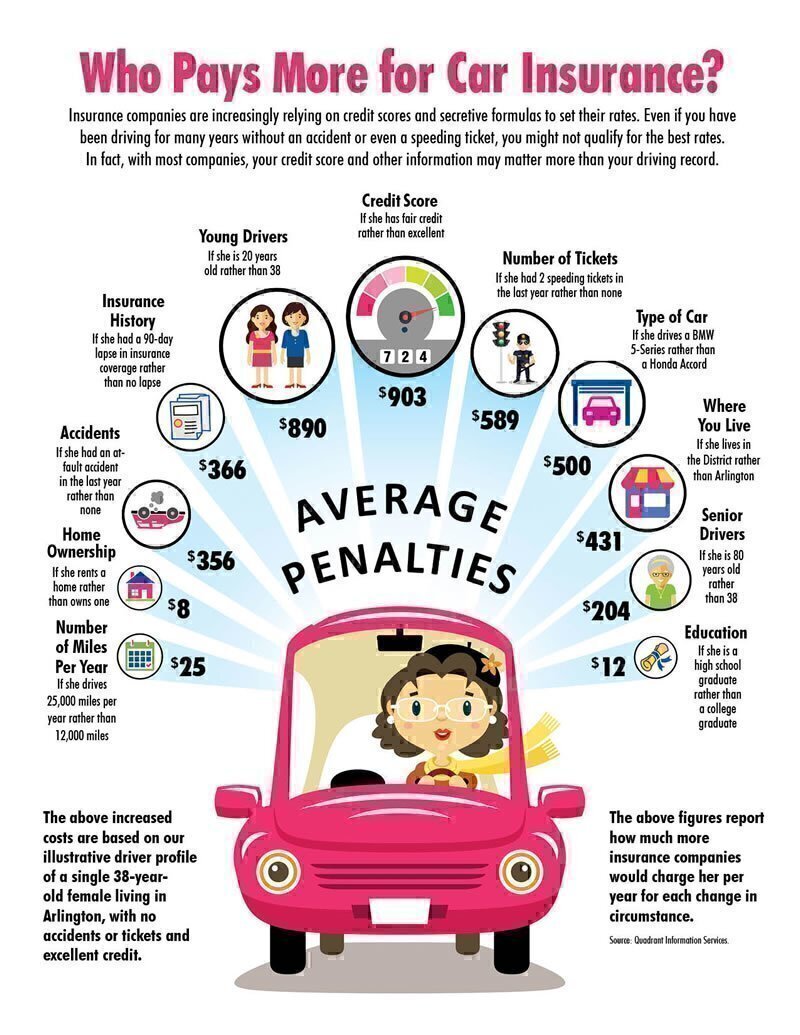

Car insurance is a necessity for anyone that owns a car. The cost of car insurance can vary depending on a variety of factors, including your age, driving record, and the type of car you drive. One factor that can have a big impact on your car insurance rates is your marital status. Married couples typically enjoy lower rates than single people do, but is the difference worth getting married for? Let’s take a closer look at the issue.

Married Couples And Car Insurance

Married couples benefit from several advantages when it comes to car insurance. For starters, married couples tend to have lower overall risk factors than single people. This is due to the fact that married couples often share resources, such as cars, which reduces the need for additional insurance coverage. Married couples are also viewed as more stable and responsible than single people, which can help them to get better rates.

Additionally, married couples often qualify for discounts that single people don’t. For example, some insurance companies offer discounts to married couples who both carry separate policies. Other companies offer discounts to married couples who have multiple cars insured. Finally, married couples can often bundle their car insurance with other types of insurance, such as homeowners or life insurance, which can result in significant savings.

Single People And Car Insurance

Single people don’t enjoy the same advantages as married couples when it comes to car insurance. Single people often have higher overall risk factors, such as a lack of sharing resources or a higher likelihood of being in an accident due to a lack of experience. Additionally, single people don’t qualify for the same discounts that married couples do, which can result in higher rates.

It’s also worth noting that single people who are under the age of 25 typically have higher rates than older drivers. This is due to the fact that younger drivers are generally seen as more likely to be involved in an accident. Finally, single people also don’t get the benefit of bundling their car insurance with other types of insurance, which can result in higher overall costs.

The Bottom Line

As you can see, married couples typically pay less for car insurance than single people do. This is due to a variety of factors, including lower overall risk factors, discounts, and the ability to bundle their car insurance with other types of insurance. While there is no one-size-fits-all answer when it comes to car insurance, married couples can typically expect to pay lower rates than single people.

If you’re trying to decide whether or not to get married for the sake of cheaper car insurance, you should consider all of the factors involved. While getting married can result in lower car insurance rates, it’s important to think about the long-term implications of marriage before making a decision. Ultimately, the decision to get married should be based on more than just car insurance rates.

Car Insurance Married vs Single: Why Discounts for Couples Aren't

5 Seemingly Harmless Things That Can Get You In Trouble With Your Car

Car Insurance Married vs Single: Why Discounts for Couples Aren't

Who Pays the Most for Car Insurance? - Washington Consumers' Checkbook

Car Insurance Groups List Usa