Car Third Party Insurance Cost

Everything You Need to Know About Car Third Party Insurance Cost

What is Third Party Insurance?

Third party insurance is a type of car insurance that provides coverage for any legal liability to a third party that may arise from an accident or incident involving the insured vehicle. Third party insurance is the most basic form of insurance cover, and while it is not legally required in most countries, it is strongly recommended. This type of insurance covers any damage to a third party’s property, and any injury or death to a third party caused by the insured vehicle. It does not, however, provide any coverage for the insured vehicle in case of an accident.

Why is Third Party Insurance Important?

Third party insurance is important because it provides protection to the policy holder in the event of a legal liability to a third party. Without this type of insurance, the policy holder would be responsible for any costs associated with a third party’s property damage, injury or death caused by the insured vehicle. This type of insurance is especially important for those who drive regularly or for those who use their car for business purposes, as it provides protection for the policy holder in the event of an accident.

How Much Does Third Party Insurance Cost?

The cost of third party insurance will vary depending on several factors, such as the age and make of the car, the driver’s age and driving record, the type of coverage required and the amount of coverage desired. Generally, the cost of third party insurance is less expensive than comprehensive and collision insurance, as it is not providing coverage for the insured vehicle itself. Additionally, the cost of third party insurance can vary depending on the insurer and the type of policy.

What Factors Affect the Cost of Third Party Insurance?

The cost of third party insurance is affected by a variety of factors, such as the age and make of the car, the age and driving record of the driver, the type of coverage required and the amount of coverage desired. Additionally, the cost of third party insurance can be affected by the insurer and the type of policy chosen. It is important to consider all of these factors when determining the cost of third party insurance.

What is the Difference Between Comprehensive and Third Party Insurance?

The main difference between comprehensive and third party insurance is that comprehensive insurance covers all damages to the insured vehicle, while third party insurance only covers damages to a third party’s property, and any injury or death to a third party caused by the insured vehicle. Additionally, comprehensive insurance is typically more expensive than third party insurance.

Conclusion

Third party insurance is a type of car insurance that provides coverage for any legal liability to a third party that may arise from an accident or incident involving the insured vehicle. This type of insurance is important as it provides protection to the policy holder in the event of an accident. The cost of third party insurance will vary depending on several factors, such as the age and make of the car, the driver’s age and driving record, the type of coverage required and the amount of coverage desired. Additionally, the cost of third party insurance can be affected by the insurer and the type of policy chosen. It is important to consider all of these factors when determining the cost of third party insurance.

Third Party Car Insurance: Third Party Insurance With Registration

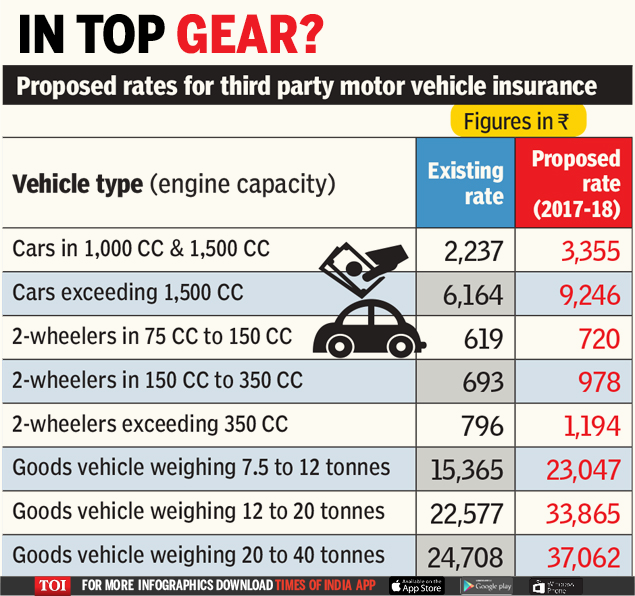

Infographic: Third party insurance to become more pricey | India News

Third Party Property Car Insurance | iSelect

What is third party insurance | Online insurance, Compare insurance

Third Party Insurance: Online Car & Bike Insurance -COCO by DHFL GI