Auto Insurance For High Risk Driver

Auto Insurance for High Risk Drivers

Being a high risk driver can be both stressful and expensive. Having your license suspended or revoked can make finding affordable auto insurance a challenge. High risk drivers often find it difficult to get the coverage they need to stay on the road. The good news is that there are options available for high risk drivers to get the insurance coverage they need.

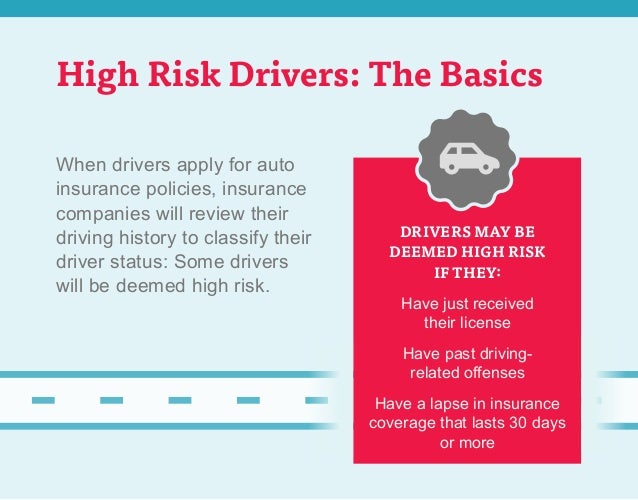

What is a High Risk Driver?

A high risk driver is someone who has been convicted of driving offenses or has a history of accidents or traffic violations. Driving while under the influence of drugs or alcohol, reckless driving, and multiple speeding tickets are all examples of driving offenses that can make a driver high risk. High risk drivers are seen as more likely to be involved in an accident and thus pose a greater risk to insurance companies.

How does High Risk Driver Status Affect Auto Insurance?

High risk drivers are seen as higher risk customers by insurance companies. As a result, they are often charged higher premiums for auto insurance coverage. In addition, some insurance companies may refuse to insure a high risk driver. This can make it difficult for a high risk driver to get the coverage they need.

What are the Options for High Risk Drivers?

Fortunately, high risk drivers have options when it comes to auto insurance. Many states have high risk pools that provide coverage to high risk drivers. These pools are funded by insurance companies, and they allow high risk drivers to obtain auto insurance coverage at a reasonable rate. Some states also offer special programs for high risk drivers that can help them find affordable auto insurance.

How Can High Risk Drivers Find Affordable Auto Insurance?

High risk drivers should shop around for the best rates. Comparing rates from different insurance companies can help a high risk driver find a policy that fits their budget. High risk drivers should also consider taking a driver safety course. Completing a driver safety course can help reduce insurance premiums and help the driver become a better, safer driver.

Conclusion

High risk drivers may face challenges when it comes to finding affordable auto insurance. However, there are options available for high risk drivers that can help them get the coverage they need. Comparing rates from different insurance companies and taking a driver safety course can help high risk drivers find an affordable auto insurance policy.

How to get cheapest car insurance for high risk drivers | Car insurance

High Risk Car Insurance: Best Insurance for High-Risk Drivers | Car

Auto Insurance for High Risk Drivers - 2017 High Risk Auto Insurance

2017 Cheap Car Insurance | High Risk Drivers 2017 Car Insurance Policy

I'm A High Risk Driver - What Do I Do?