Car Insurance With Full Coverage

Do You Really Need Full Coverage Car Insurance?

When it comes to car insurance, there are several different types of coverage available to drivers. One of the most comprehensive is full coverage car insurance. This type of insurance provides the most robust protection for drivers, but it also carries a higher price tag. Is full coverage car insurance right for you? Let's explore the topic to help you decide.

What Does Full Coverage Car Insurance Include?

Full coverage car insurance includes the following types of coverage: collision coverage, comprehensive coverage, liability coverage, and uninsured motorist coverage. Collision coverage pays for repairs to your car when you are involved in a crash. Comprehensive coverage pays for damage to your car due to fire, theft, or other non-accident-related events. Liability coverage pays for damage to another person's car if you are at fault for the crash. Uninsured motorist coverage pays for damage to your car if it is hit by an uninsured driver.

When Should You Consider Full Coverage Car Insurance?

If you are a driver with a newer car, it is generally a good idea to get full coverage car insurance. The reason is that new cars typically cost more to repair, and full coverage car insurance can provide the necessary protection. If you have an older car with a low book value, then you likely don't need full coverage car insurance. In this case, basic liability coverage may be sufficient to protect you financially.

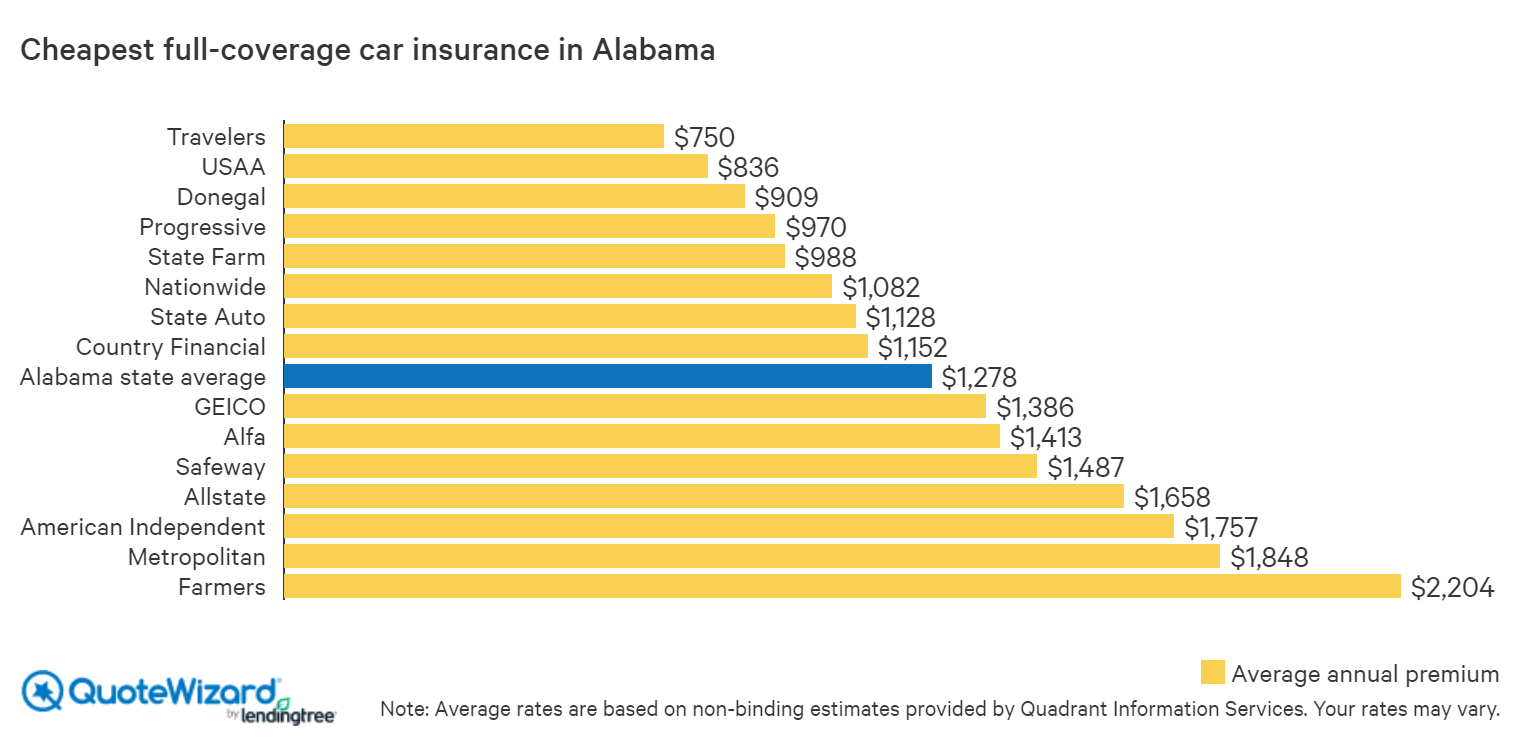

How Much Does Full Coverage Car Insurance Cost?

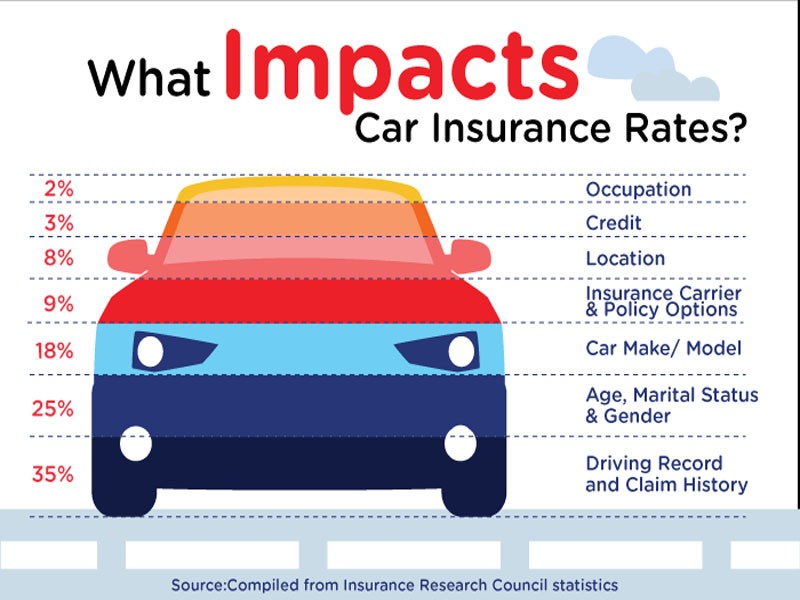

The cost of full coverage car insurance varies depending on several factors, including the make and model of your car, your driving record, and the insurer. Generally, drivers with a good driving record and newer cars will pay more for full coverage car insurance than those with an older car and a spotty driving record. However, it's a good idea to shop around and compare quotes from different insurers to get the best rate.

What Are the Benefits of Full Coverage Car Insurance?

The biggest benefit of full coverage car insurance is that it provides the most comprehensive protection available. If you are involved in an accident, your insurer will pay for the repairs to your car regardless of who is at fault. This can save you a lot of money if you are in a crash, as the cost of repairs can be very expensive. Full coverage car insurance also provides legal protection in case you are sued for damages after an accident.

Do You Really Need Full Coverage Car Insurance?

Whether or not you need full coverage car insurance depends on several factors, including the make and model of your car, your driving record, and your budget. If you have an older car and a good driving record, then you may be able to get by with basic liability coverage. On the other hand, if you have a newer car and a less-than-perfect driving record, then full coverage car insurance is probably a good idea. Ultimately, it's important to weigh your options and decide what works best for you.

Full coverage car insurance in california by Promax Insurance Agency

What is Full Coverage Car Insurance? - eTrustedAdvisor

Cheap Full Coverage Car Insurance

+11 What Is Considered Full Coverage Auto Insurance In Florida 2022 - SPB

Find Cheap Car Insurance in Alabama | QuoteWizard