Admiral Gap Insurance Terms And Conditions

Thursday, November 7, 2024

Edit

Admiral Gap Insurance Terms And Conditions

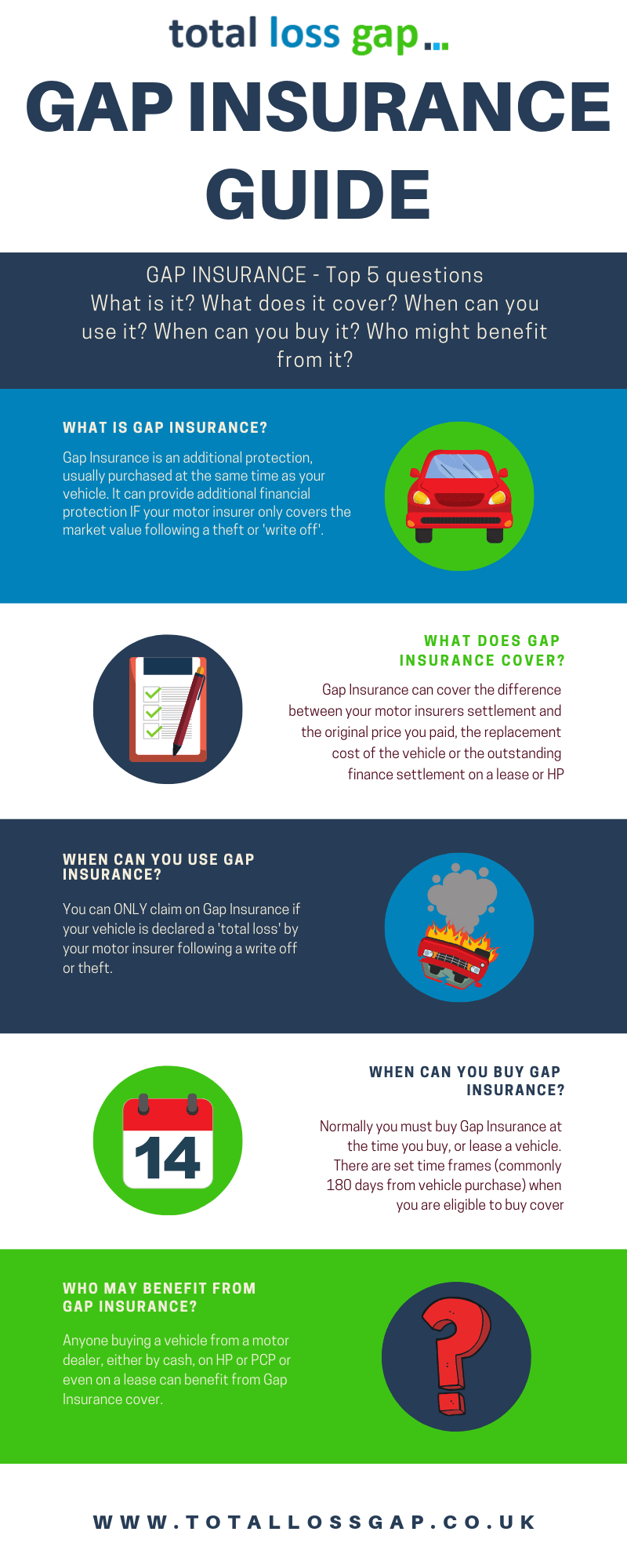

What is Gap Insurance?

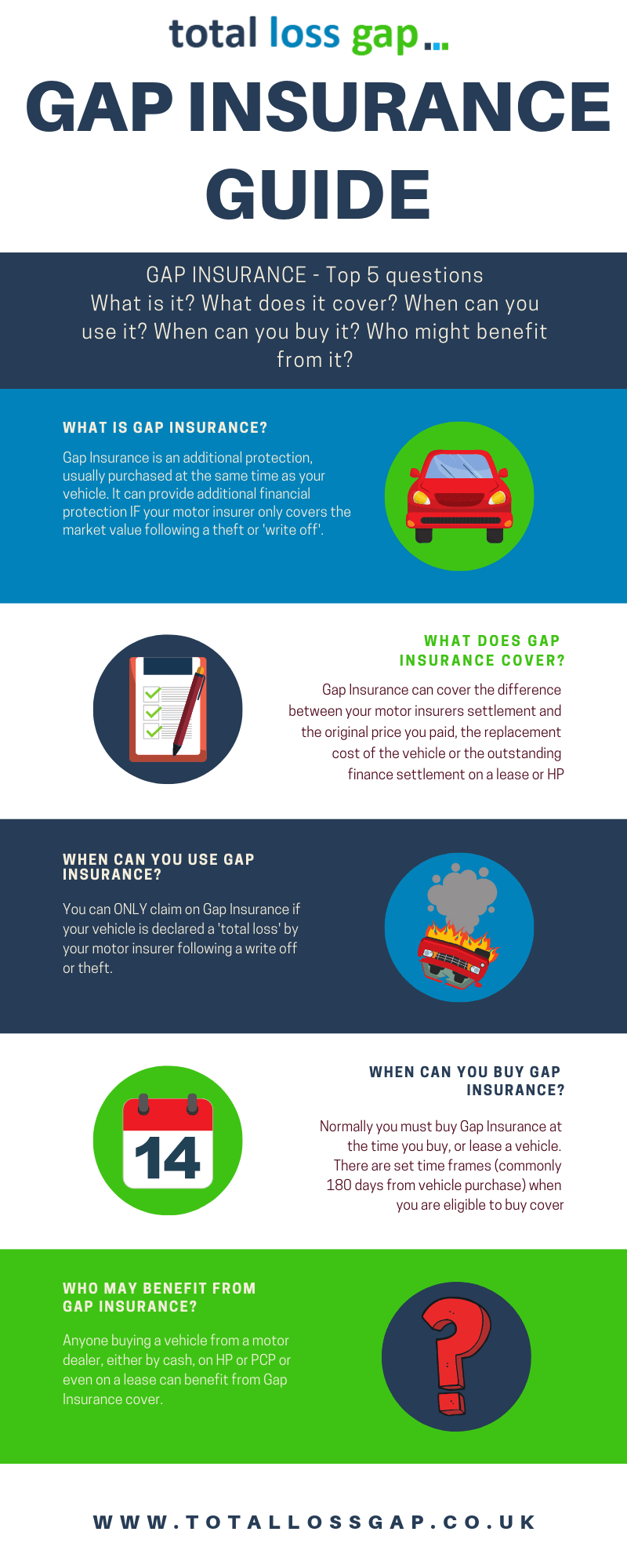

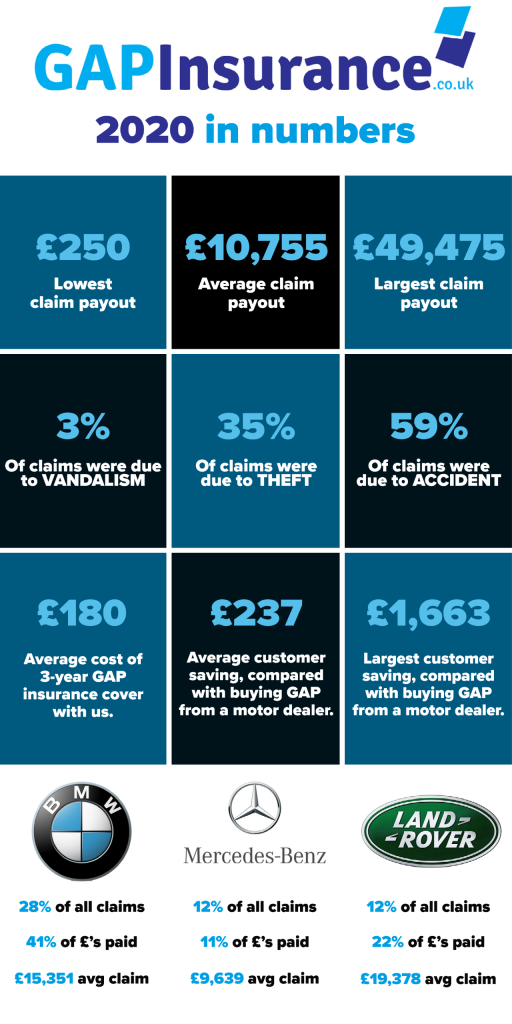

Gap insurance is a type of auto insurance coverage that protects you when you owe more money on your car loan than the car is worth. It is also known as loan/lease gap coverage, or “Guaranteed Auto Protection” (GAP). It is often an add-on to a comprehensive or collision car insurance policy.

When a car is totaled in an accident, or stolen and not recovered, the insurance company pays the car’s actual cash value (ACV) to the lienholder. The ACV is the amount the car was worth at the time of the accident, minus any applicable deductibles. If you owe more on the car than its ACV, you have what’s known as an “upside down” loan.

Gap insurance makes up the difference between the ACV and what you owe on the car loan. This protects you from having to pay out of pocket for the difference. It’s important to remember that gap insurance only covers the difference between the ACV and the loan balance, and does not cover any late fees or other expenses associated with the loan.

When to Buy Gap Insurance?

You should buy gap insurance when you buy a new car or lease a car. It is typically offered at the time of purchase by the dealership, but you may be able to purchase it from your insurance company as well.

Gap insurance is especially important if you’re financing a new car and you put a large down payment on the car or if you are leasing a car, as you may be upside down on the loan for several years.

Admiral Gap Insurance Terms and Conditions

Admiral gap insurance is a type of auto insurance coverage that covers the difference between the actual cash value of your car and the balance owed on your car loan. It is offered at the time of purchase by the dealership, but you may also be able to purchase it from your insurance company.

Admiral gap insurance is subject to the following terms and conditions:

1. Admiral gap insurance only covers the difference between the actual cash value of the car and the balance owed on the car loan. It does not cover any late fees or other expenses associated with the loan.

2. Admiral gap insurance only applies when the car is totaled in an accident or stolen and not recovered.

3. Admiral gap insurance does not cover any deductibles that may be applicable to your comprehensive or collision policy.

4. Admiral gap insurance does not cover any additional costs incurred in replacing the car, such as taxes, registration fees, or other related costs.

5. Admiral gap insurance is optional and must be purchased separately from your comprehensive or collision policy.

6. Admiral gap insurance is subject to a 30-day waiting period.

Advantages of Gap Insurance

Gap insurance is an important form of protection for those who are financing or leasing a car, as it protects them from having to pay out of pocket for the difference between the ACV of the car and the balance owed on the loan. In addition, gap insurance typically has a lower premium than a standard comprehensive or collision policy, making it an affordable way to protect your investment.

Conclusion

Admiral gap insurance is an important form of protection for those who are financing or leasing a car. It covers the difference between the actual cash value of the car and the balance owed on the car loan, protecting you from having to pay out of pocket for the difference. It is subject to certain terms and conditions, and it is important to read and understand them before buying.

GAP Insurance - Explained in a Complete Guide | TotalLossGap

Is GAP insurance worthwhile? - babybmw.net

Admiral Insurance to use Facebook profile to find out whether you're a

What Is Gap Insurance? - Lexington Law

GAP Insurance Guaranteed Asset Protection Policy. Stock Photo - Image