Is It Cheaper To Pay Car Insurance Monthly Or Yearly

Is It Cheaper To Pay Car Insurance Monthly Or Yearly?

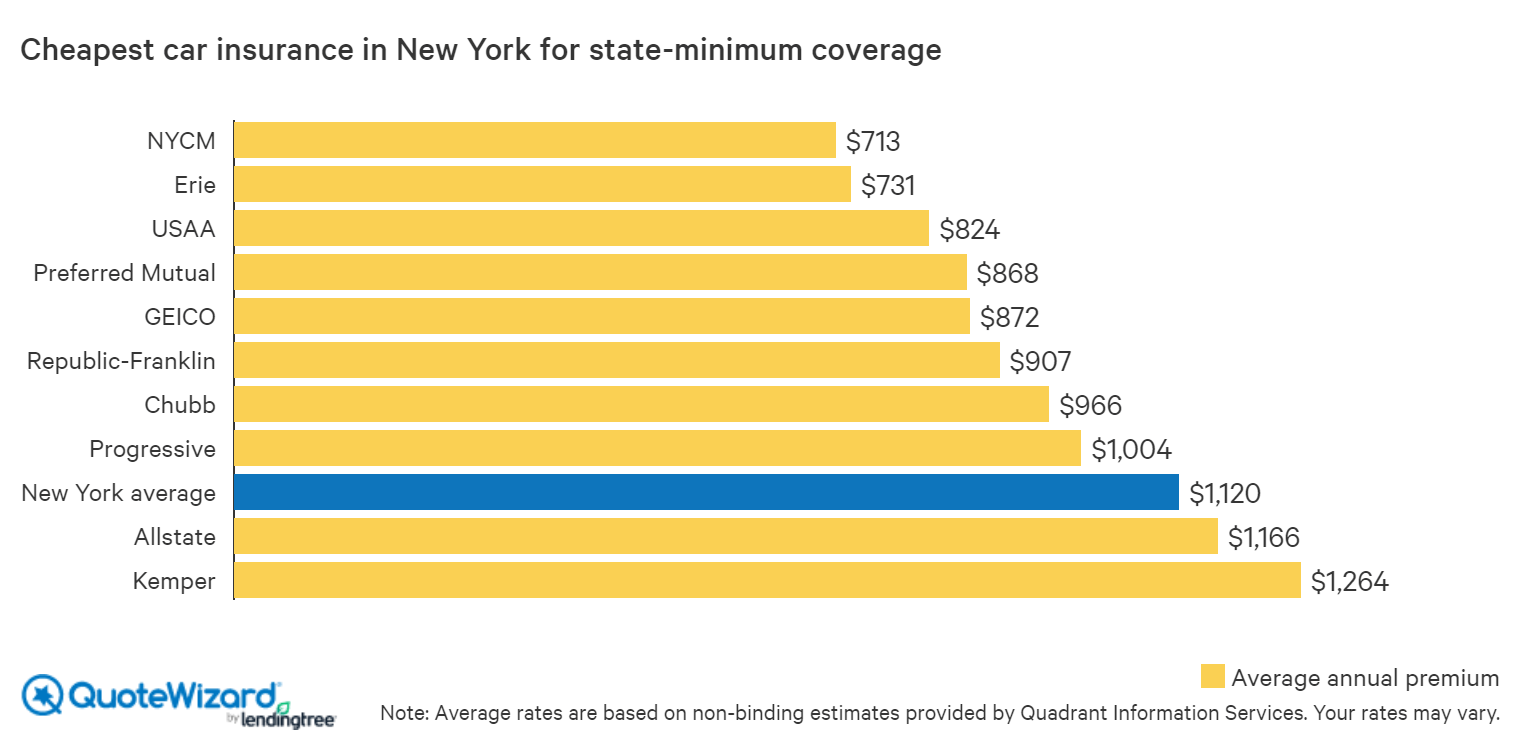

The Cost of Car Insurance

When it comes to car insurance, everyone wants to know the cheapest way to pay for it. There is no one-size-fits-all answer to this question, as the best option for one driver could be different for another. The cost of car insurance depends on a variety of factors, such as the type of car, the age of the driver, the driver’s driving record and the coverage amounts. In order to determine which payment option is the most cost-effective, it’s important to understand the costs associated with each.

Monthly Payment Plans

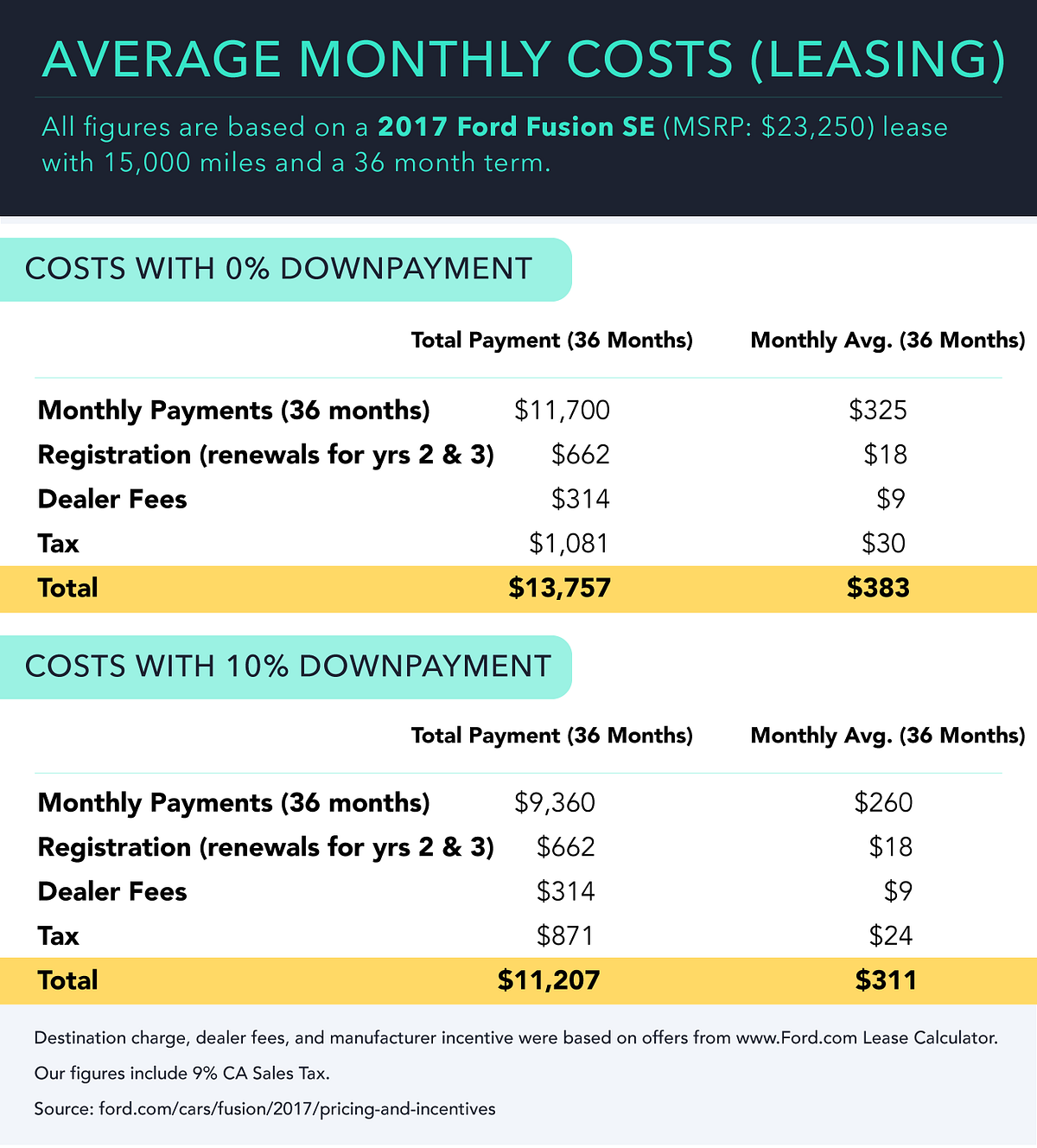

The most common way to pay for car insurance is with a monthly payment plan. Many insurance companies offer payment plans that allow drivers to spread the cost of their insurance over the course of a year. This makes it easier for drivers to budget for their insurance premiums. Most insurance companies also offer discounts for drivers who sign up for long-term payment plans, so drivers may be able to save money by signing up for a longer term plan.

One of the drawbacks of paying for car insurance on a monthly basis is that the monthly payments can add up over the course of a year. Drivers who opt for monthly payments will pay more in the long run than they would if they paid their premiums in one lump sum. Additionally, some insurance companies charge an additional fee for processing monthly payments, which can increase the overall cost of car insurance.

Yearly Payment Plans

Paying for car insurance in one lump sum is typically the least expensive payment option. Most insurance companies offer discounts for drivers who pay for their insurance in full at the start of their policy. Additionally, drivers who pay in full don’t have to worry about additional processing fees. Paying for car insurance in full can also help drivers avoid late payment fees, which can add to the cost of car insurance.

The main downside to paying for car insurance yearly is that it can put a strain on a driver’s budget. While it may be cheaper in the long run, drivers who don’t have the funds to pay in full may have to look for other options. Additionally, drivers who sign up for yearly plans may also have to pay a higher up-front premium, which may not be feasible for some drivers.

Which Payment Option Is Right for You?

The best way to determine which payment option is best for you is to compare all of your options. Contact your insurance company to learn more about their monthly and yearly payment options, and compare them to see which one is the most cost-effective. Remember, the cheapest plan isn’t always the best, as it may not provide the coverage you need. Make sure to do your research and choose the payment option that is best for your budget and your coverage needs.

Average Price Of Car Insurance Per Month - designby4d

Download New Insurance Images Pictures

Average Monthly Car Insurance Payment / Texas Car Insurance

What do Americans Pay for Car Insurance in 2019?

Monthly Car Insurance Payment - Insurance Reference