Average Insurance Cost For Tesla Model Y

Average Insurance Cost For Tesla Model Y

Insurance Cost for Tesla Model Y

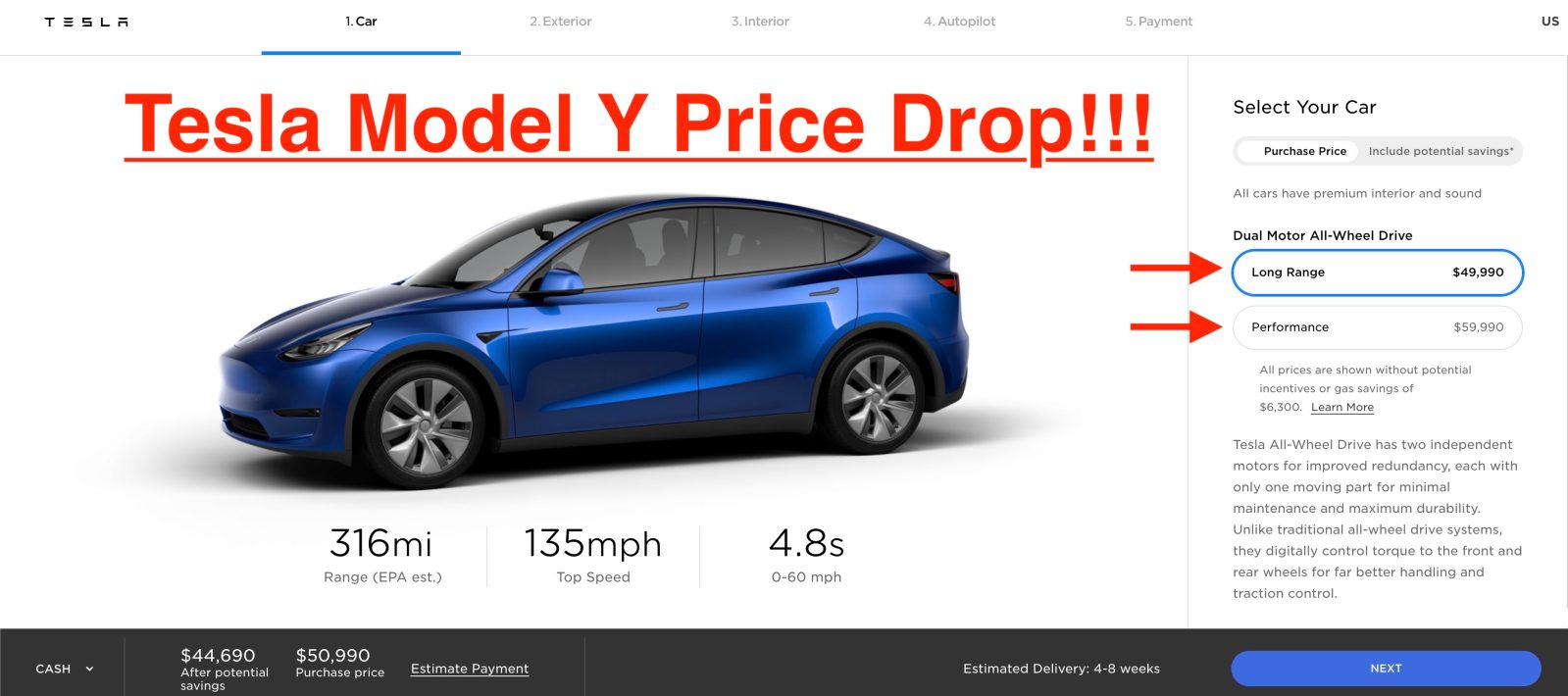

Tesla Model Y is an all-electric crossover SUV, unveiled in March 2019 and produced in January 2020. It is a four-door mid-size SUV that is based on the same platform as the Tesla Model 3. The Model Y has a range of up to 300 miles (480 km) and can accelerate from 0 to 60 mph in 3.5 seconds. As with all Tesla vehicles, the Model Y comes with Autopilot driver-assist technology.

The cost of insuring a Tesla Model Y can vary significantly depending on a variety of factors, such as the driver’s age, driving record, and the state they live in. Generally, insurance companies view electric vehicles as safer, since they have fewer parts that can malfunction and cause accidents. Additionally, Tesla’s Autopilot system can help reduce the risk of accidents, thus reducing insurance costs.

Average Insurance Cost

On average, insuring a Tesla Model Y will cost around $1,500 per year. This is slightly higher than the average cost of insuring other mid-size SUVs, but significantly lower than the cost of insuring a luxury vehicle. However, due to the high cost of the Tesla Model Y, insurance companies may charge higher premiums for this vehicle than for other SUVs.

In addition to the cost of the vehicle, other factors can also impact the cost of insurance for the Tesla Model Y. For example, drivers who are younger than 25 may have to pay higher premiums due to the higher risk associated with inexperienced drivers. Additionally, drivers who live in an area with a high rate of car theft or accidents may also have to pay more for insurance.

How to Get Cheaper Insurance

There are several ways to get cheaper insurance for the Tesla Model Y. One way is to shop around and compare quotes from different insurance companies. Additionally, drivers can also look for discounts and incentives, such as multi-vehicle discounts or good-driver discounts, which may reduce the cost of their insurance.

Drivers can also take steps to reduce their risk of accidents, such as driving safely and maintaining their vehicle in good condition. This can help lower their insurance premiums, as insurance companies view these drivers as lower-risk. Finally, drivers can consider raising their deductible, which is the amount of money they would have to pay out of pocket for repairs before their insurance company pays for them. Raising the deductible can lower the cost of their insurance premiums.

Conclusion

In conclusion, insuring a Tesla Model Y can be expensive, but there are ways to reduce the cost. Drivers can shop around and compare quotes from different insurance companies, look for discounts and incentives, and take steps to reduce their risk of accidents. Additionally, they can consider raising their deductible to lower their insurance premiums.

Tesla Model Y Insurance Cost / Tesla Insurance How Much Does Tesla Car

Here's A Breakdown Of Actual Monthly Tesla Model Y Ownership Cost

True Cost of the Tesla Model Y - Full Breakdown of Costs - Daniel's Brew

Tesla Model Y (Why!) – Price, release date, specs, range - Autopromag

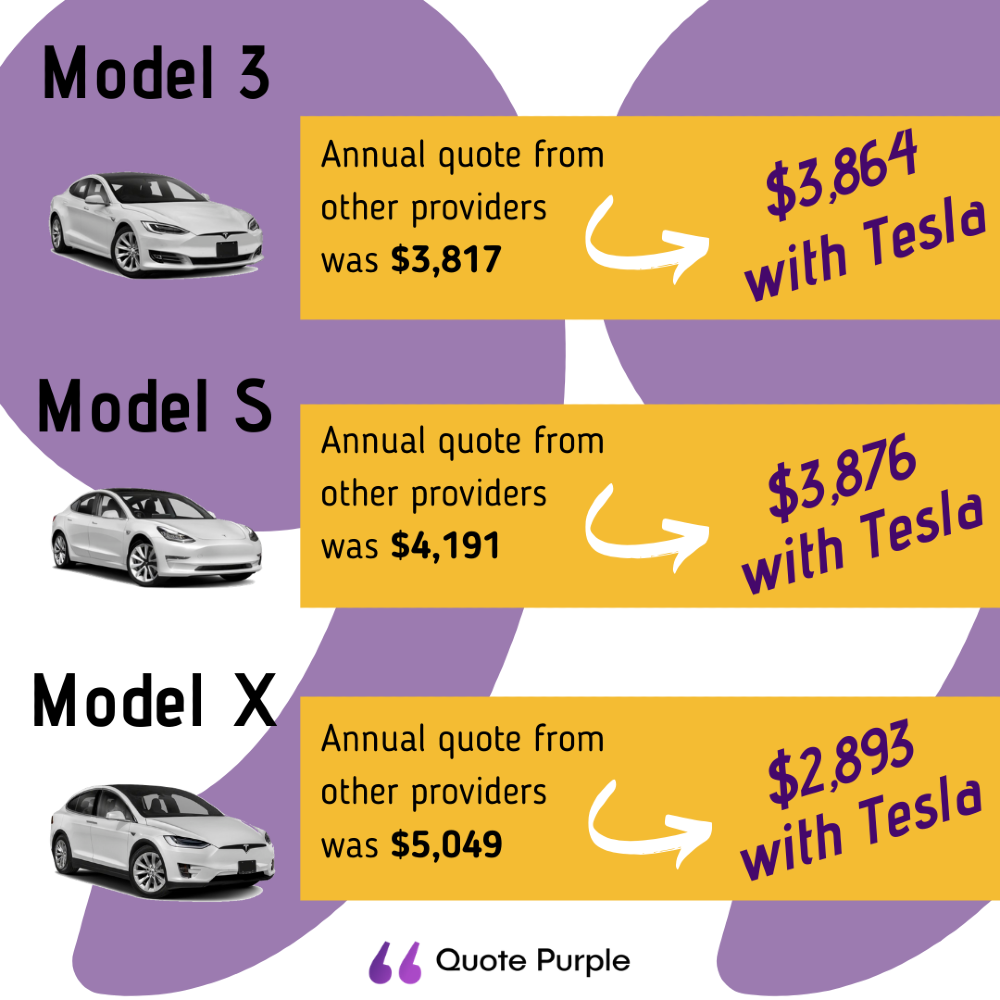

Tesla Insurance - How Does it Compare to Normal Insurance?