State Minimum Car Insurance Az

Tuesday, September 24, 2024

Edit

The Essential Car Insurance Guide for Arizona Drivers

As a state in the United States, Arizona has laws requiring car owners to have a minimum amount of car insurance. This is done in order to protect the drivers and other people on the road from financial losses in the event of an accident. In this guide, we’ll go over the minimum car insurance requirements for Arizona drivers and provide some additional tips for finding the best car insurance coverage.

State Minimum Car Insurance Requirements for Arizona Drivers

In order to drive legally in Arizona, drivers must have car insurance that meets the minimum requirements of the state. The minimum car insurance coverage requirements in Arizona include:

- Bodily Injury Liability Coverage: $15,000 per person and $30,000 per accident

- Property Damage Liability Coverage: $10,000

- Uninsured/Underinsured Motorist Coverage: $15,000 per person and $30,000 per accident

These are the minimum requirements for car insurance in Arizona, but it’s important to note that the state does not require drivers to have any other types of coverage. This means that drivers may not be protected from financial losses in the event of an accident if they only have the minimum coverage.

Additional Types of Car Insurance Coverage

In addition to the state minimum car insurance, drivers in Arizona may want to consider purchasing additional types of coverage. For example, drivers may want to purchase Collision coverage, which covers repairs to your vehicle if it is damaged in an accident. Additionally, drivers may want to consider purchasing Comprehensive coverage, which covers losses from events other than accidents (such as theft or vandalism).

Tips for Finding the Best Car Insurance in Arizona

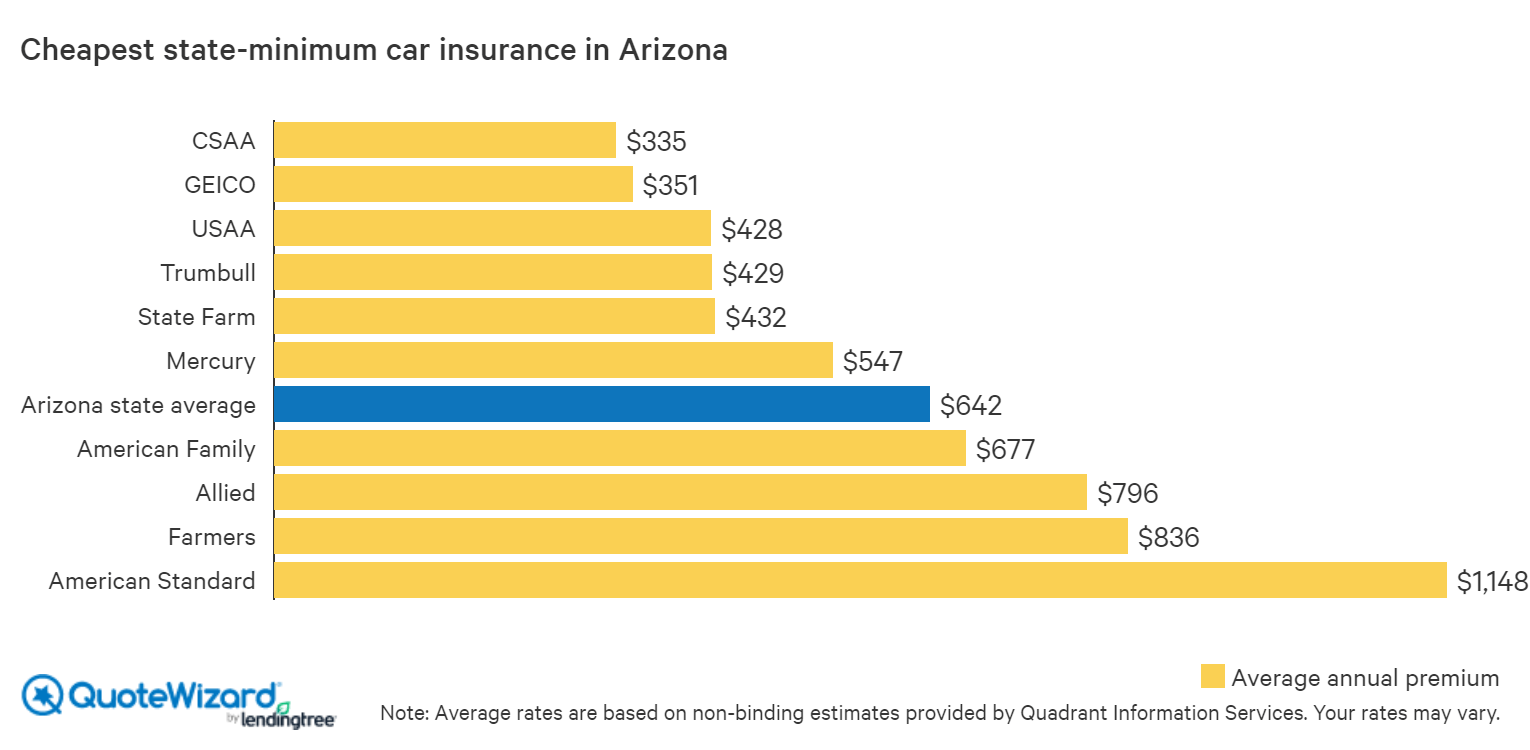

When searching for car insurance in Arizona, it’s important to shop around and compare rates from different insurance companies. Additionally, drivers should look for discounts that can help lower their car insurance premiums. For example, many insurance companies offer discounts for having a good driving record, being a student, or having multiple cars insured with the same company. It’s also important to read the fine print of any policy and make sure that the coverage meets your needs and budget.

Conclusion

The state of Arizona requires drivers to have a minimum amount of car insurance in order to drive legally. This includes Bodily Injury Liability Coverage, Property Damage Liability Coverage, and Uninsured/Underinsured Motorist Coverage. It’s important to note that these are the minimum requirements and drivers may want to consider purchasing additional types of coverage in order to be fully protected. When searching for car insurance, it’s important to shop around and look for discounts that can help lower your car insurance premiums.

Car Insurance AZ - State Minimum Car Insurance - YouTube

Cheap Car Insurance in Arizona | QuoteWizard

What's the Cost of State Minimum Car Insurance? | Car Insurancee

What Is The State Minimum Car Insurance - mewowdesigns