How Does Car Insurance Work With A Lease

How Does Car Insurance Work With A Lease?

Understanding the Basics of Car Leasing

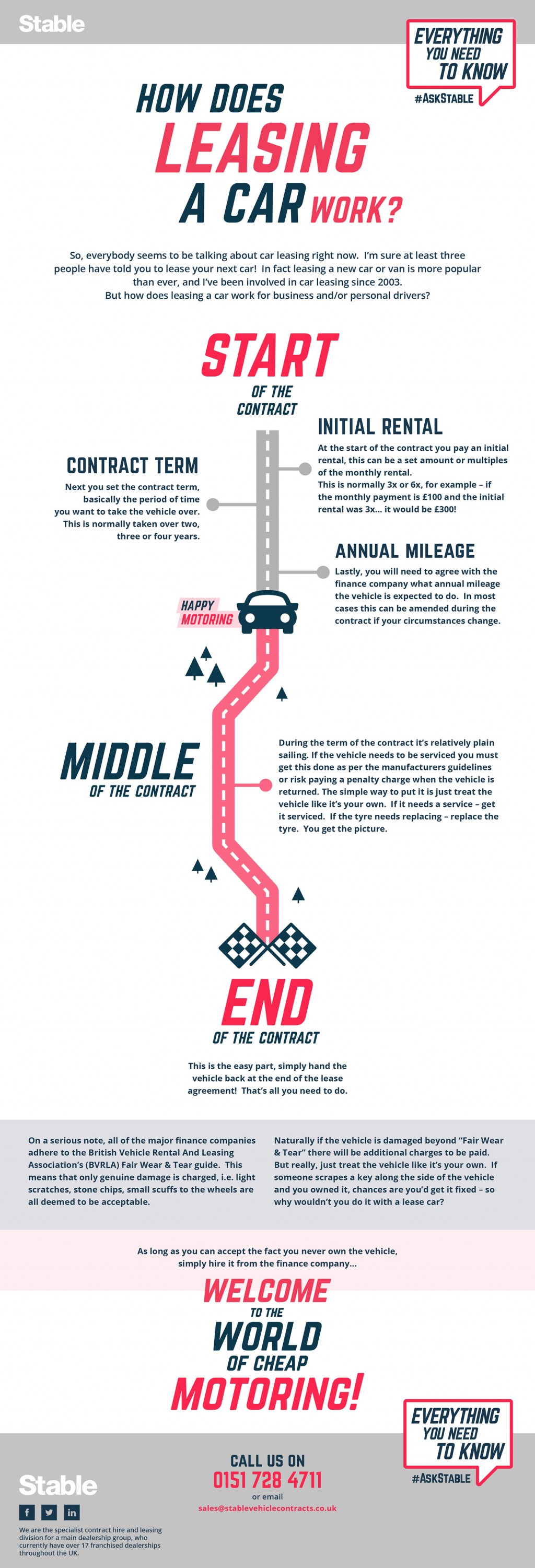

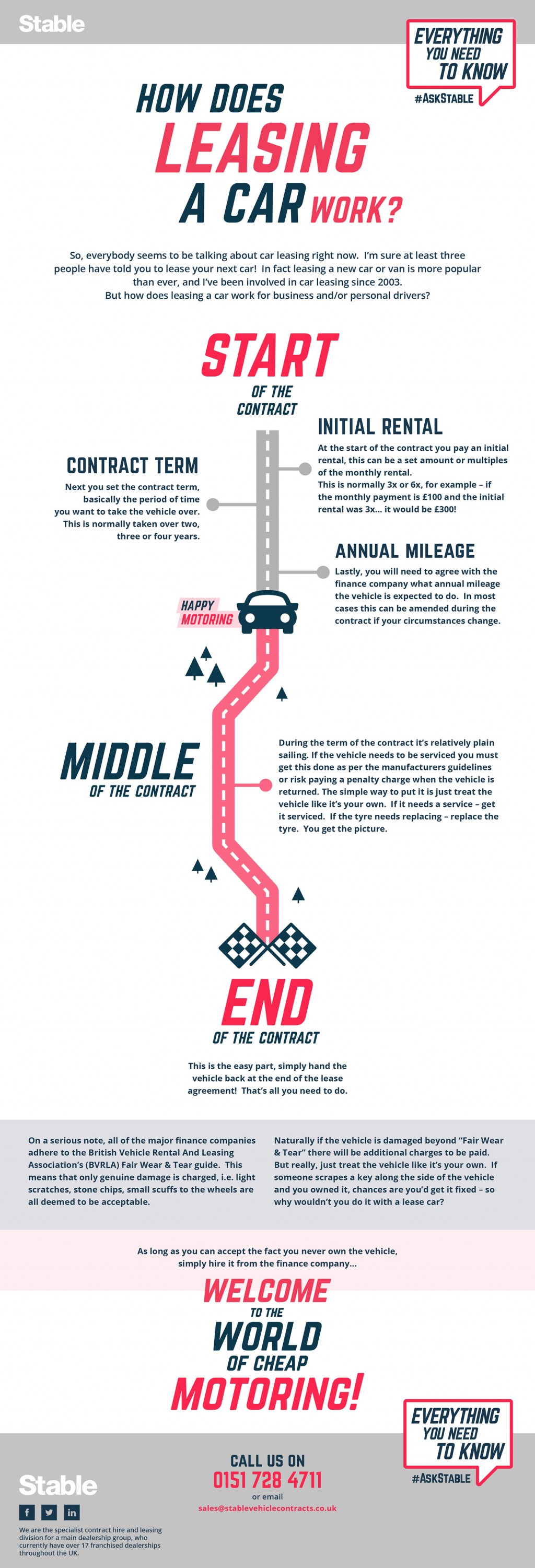

When you lease a car, you are essentially entering into an agreement with a lender to use the vehicle for an agreed-upon period of time, typically two to four years. The car is owned by the lender, and you make regular payments on the lease agreement. At the end of the lease, you return the car to the lender. Car leasing offers a variety of advantages compared to buying, such as lower monthly payments, the ability to get a newer car more often and the opportunity to drive a more expensive car than you could afford to buy.

The Role of Car Insurance in a Lease

When you sign a lease agreement, you are legally responsible for the vehicle and any damages that may occur during your lease period. This is why it’s important for you to have car insurance. Car insurance helps protect you from financial losses in the event of an accident or other covered losses. Car insurance is usually a requirement for leasing a car, and most lenders will want to see proof that you have a car insurance policy in place before you sign the lease agreement.

Types of Car Insurance

There are a variety of car insurance policies that you can purchase, and you should choose one that meets your needs. The most common types of car insurance are liability, comprehensive and collision. Liability insurance covers damages that you cause to other people or property in an accident. Comprehensive insurance covers damages to your vehicle from things other than an accident, such as theft, fire, weather damage, etc. Collision insurance covers damages to your vehicle from an accident.

Lease Requirements

Different car leasing companies have different requirements when it comes to car insurance. Some may require that you have a certain amount of liability coverage, while others may require you to have comprehensive and collision coverage. It’s important to make sure that you have the right car insurance coverage in place before you sign a lease agreement.

Your Lease Agreement

When you sign a lease agreement, the leasing company will typically include a clause that states that you must maintain the car insurance coverage that you have on the vehicle for the duration of the lease term. This means that if you want to switch car insurance companies, you will need to make sure that you keep the same level of coverage. Otherwise, you could be in breach of your lease agreement.

Conclusion

Car insurance is an important part of a car lease agreement. It protects you from financial losses in the event of an accident or other covered losses. Different car leasing companies have different requirements when it comes to car insurance, so make sure you understand your lease agreement and the car insurance coverage that you need to maintain for the duration of the lease.

Infographic: How does leasing a car work?

Car Lease Steps and Process - Explained - by LeaseGuide.com

Lease Car Insurance Requirements Florida - empowered-crazybitch

RentalCover.com: How It Works — RentalCover.com