Barclays Premier Life Rac Breakdown Cover

Tuesday, September 3, 2024

Edit

Barclays Premier Life Rac Breakdown Cover

As a Barclays Premier Life customer, you can enjoy the added security of RAC Breakdown Cover, which provides assistance to you and your vehicle, whenever you need it. With this breakdown cover you can be confident that, should the unexpected happen, you’ll have the support you need to get back on the road again.

What does RAC Breakdown Cover provide?

RAC Breakdown Cover offers 24/7 breakdown assistance wherever you are in the UK, with no upper mileage limit. Whether you’re driving to the shops or taking a trip across the country, you can be confident that you’ll be taken care of by RAC.

This cover includes the following services:

- Accident recovery, including towing

- At-home assistance

- Onward travel costs

- Accommodation costs

- Replacement vehicle hire

- Message relay service

- Repair by the roadside

- Repatriation of your vehicle

Who is eligible?

If you are a Barclays Premier Life customer, you are eligible for RAC Breakdown Cover. This cover is provided by RAC Motoring Services, and is available to customers who have held a Barclays Premier Life account for at least three months. The cover does not include any protection for foreign travel, but does provide cover for the UK.

What are the benefits?

RAC Breakdown Cover offers a range of benefits to Barclays Premier Life customers. These include 24/7 roadside assistance and recovery, at-home assistance, onward travel costs, accommodation costs, replacement vehicle hire, message relay service, repair by the roadside and repatriation of your vehicle. All of these services are designed to help you get back on the road as quickly as possible.

With RAC Breakdown Cover, you can be confident that you’ll have the support you need if the unexpected happens. Whether your car breaks down or you have an accident, you can rely on RAC to provide you with the assistance you need.

How do I get started?

If you are a Barclays Premier Life customer and want to take advantage of RAC Breakdown Cover, it is easy to get started. All you need to do is to contact RAC Motoring Services and they will arrange the cover for you. You will then be sent a welcome pack with all the details you need to get started.

Once you have the cover in place, you can be confident that you have the support you need if the unexpected happens. With RAC Breakdown Cover, you can be sure that you’ll get back on the road as quickly as possible, with the minimum of fuss.

Conclusion

Barclays Premier Life customers can benefit from the added security of RAC Breakdown Cover. This cover provides 24/7 roadside assistance and recovery, at-home assistance, onward travel costs, accommodation costs, replacement vehicle hire, message relay service, repair by the roadside and repatriation of your vehicle.

If you are a Barclays Premier Life customer, it is easy to get started with RAC Breakdown Cover. Simply contact RAC Motoring Services and they will arrange the cover for you. With RAC Breakdown Cover, you can be confident that you’ll have the support you need if the unexpected happens.

50% off RAC Breakdown Cover, £4.50 | LatestDeals.co.uk

RAC Breakdown Cover - UK Contact Numbers

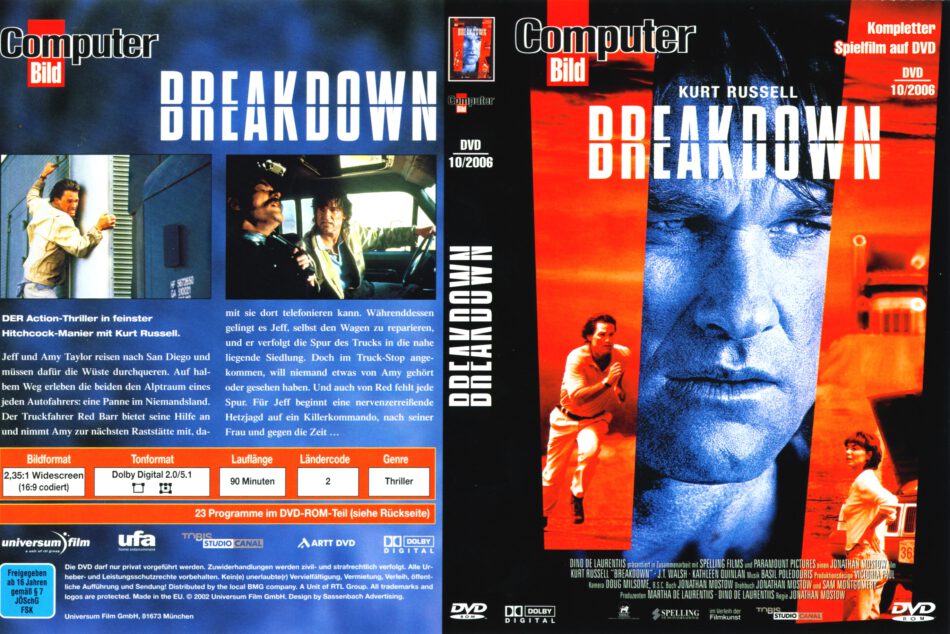

Breakdown (2002) R2 DE DVD Covers - DVDcover.Com

RAC Taxi Breakdown Cover

RAC and 1ST CENTRAL announce breakdown cover partnership | The RAC