Average Car Insurance Cost New Jersey

Wednesday, September 11, 2024

Edit

Average Car Insurance Cost in New Jersey

What is the Average Cost of Car Insurance in New Jersey?

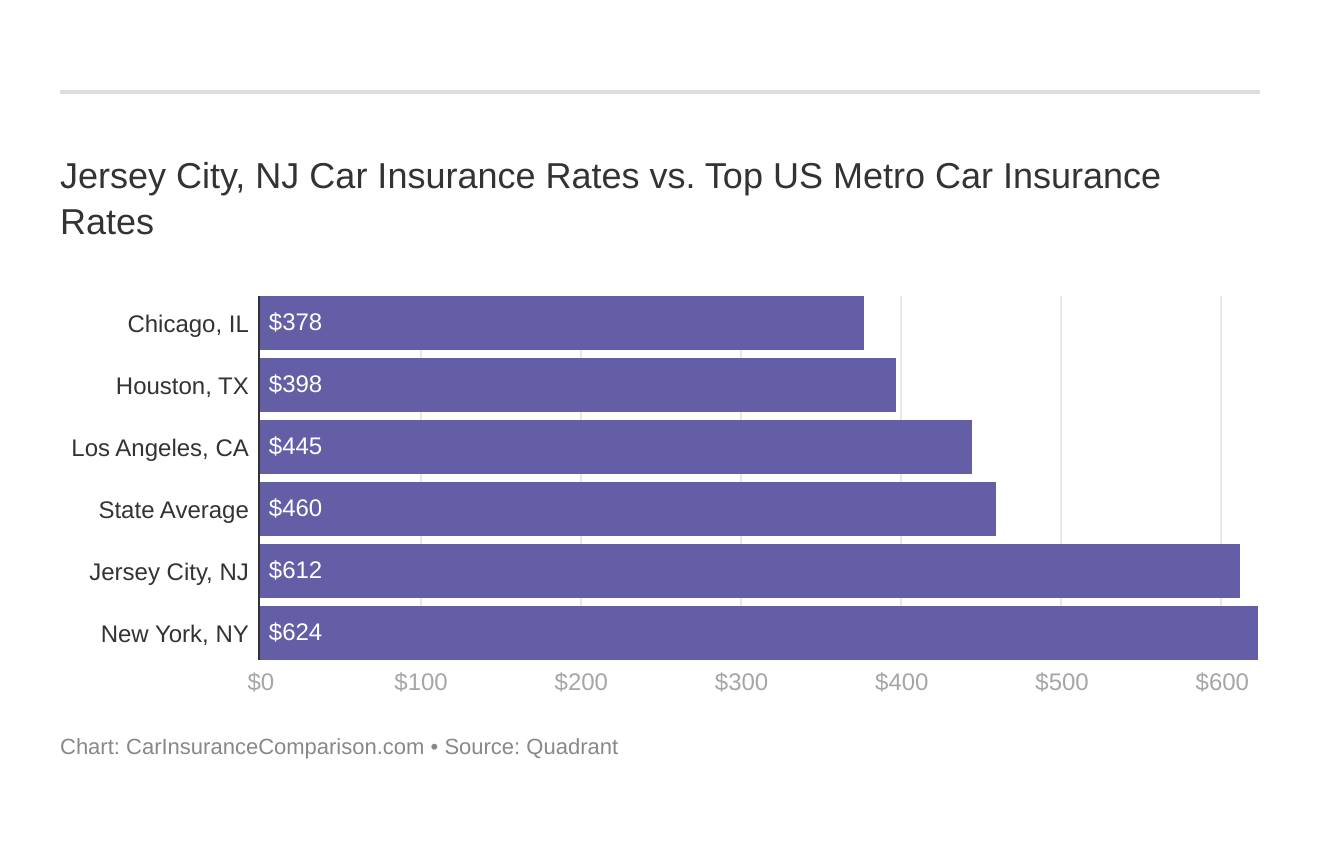

Car insurance rates in New Jersey are some of the highest in the nation. The average cost of car insurance for the state of New Jersey is about $2,216 per year, which is about $185 per month. However, the actual cost of car insurance in New Jersey can vary significantly from place to place, based on factors such as the type of car, the driver’s age and driving record, and the coverage level.

What Factors Affect Car Insurance Rates in New Jersey?

There are several factors that can affect car insurance rates in New Jersey. These include the type of car being insured, the driver’s age and driving record, the coverage level, and the location of the vehicle. Generally, cars that are newer and more expensive will cost more to insure, as will drivers who are considered to be higher risk due to age or driving record. The coverage level will also have an impact on the cost, as higher levels of coverage tend to cost more. Lastly, the location of the vehicle will affect the cost of insurance, as some areas may be considered higher risk than others.

What Types of Discounts are Available in New Jersey?

There are several types of discounts available to drivers in New Jersey that can help reduce the cost of car insurance. Drivers who have a good driving record may qualify for a safe driver discount, while those who have taken a driver safety course may qualify for a defensive driving discount. Other discounts may include multi-car discounts, multi-policy discounts, and good student discounts. Additionally, some insurance companies may offer discounts for vehicles that have certain safety features or for vehicles that are equipped with anti-theft devices.

Are There Any Other Options for Lowering Car Insurance Costs in New Jersey?

In addition to discounts, there are other ways to lower car insurance costs in New Jersey. One way is to shop around for the best rates and compare different insurance companies. It is also a good idea to look for policy discounts that may be available to drivers in New Jersey. Additionally, drivers can increase their deductibles in order to lower their premiums, although this should be done with caution as it will also increase the cost of any claims. Finally, drivers should make sure they are only buying the coverage they need.

What is the Cheapest Car Insurance in New Jersey?

The cheapest car insurance in New Jersey will depend on several factors, including the type of car being insured, the driver’s age and driving record, the coverage level, and the location of the vehicle. Generally, the cheapest car insurance in New Jersey will be offered to drivers who have a good driving record, are considered lower risk due to age or driving record, and have a low level of coverage. Additionally, drivers who live in areas considered to be lower risk may be able to find cheaper car insurance than those who live in higher risk areas.

Conclusion

Car insurance rates in New Jersey are some of the highest in the nation. However, drivers can take steps to lower their car insurance costs, such as shopping around for the best rates, taking advantage of discounts, increasing deductibles, and only buying the coverage they need. Additionally, drivers who live in lower risk areas may be able to find cheaper car insurance than those who live in higher risk areas.

Average Car Insurance Cost in New Jersey - [Rates + Cheapest Vehicles]

![Average Car Insurance Cost New Jersey Average Car Insurance Cost in New Jersey - [Rates + Cheapest Vehicles]](https://mk0insuravizcom0fmqo.kinstacdn.com/wp-content/uploads/dataviz/new-jersey-vs-northeast-region-car-insurance-cost.png)

Who Has the Cheapest Car Insurance in New Jersey?

How Much Is Car Insurance In Nj Per Month - How To Reduce Your Car

How Much Is Car Insurance? Average Car Insurance Cost 2020

Car Insurance Jersey City ~ artfirstdesign