Can I Extend My Car Insurance By One Month

Can I Extend My Car Insurance By One Month?

Are you looking for a way to extend your car insurance by one month? It is possible, depending on the insurance company and your individual situation. Many insurance companies offer short-term insurance options, such as one-month car insurance policies. This can be the perfect solution if you are looking to extend your existing car insurance policy or if you need to insure a car for a short period of time. In this article, we will discuss more about short-term car insurance options and how you can extend your car insurance policy by one month.

What Is Short-Term Car Insurance?

Short-term car insurance is a type of insurance policy that is designed to provide coverage for a set period of time. Most short-term policies are for periods of three months or less. This type of insurance can be a great option for those who need car insurance for a short period of time, such as for a rental car or for a car you are borrowing from a friend or family member. It can also be a great option for those who need to extend their existing car insurance policy.

Can I Extend My Car Insurance By One Month?

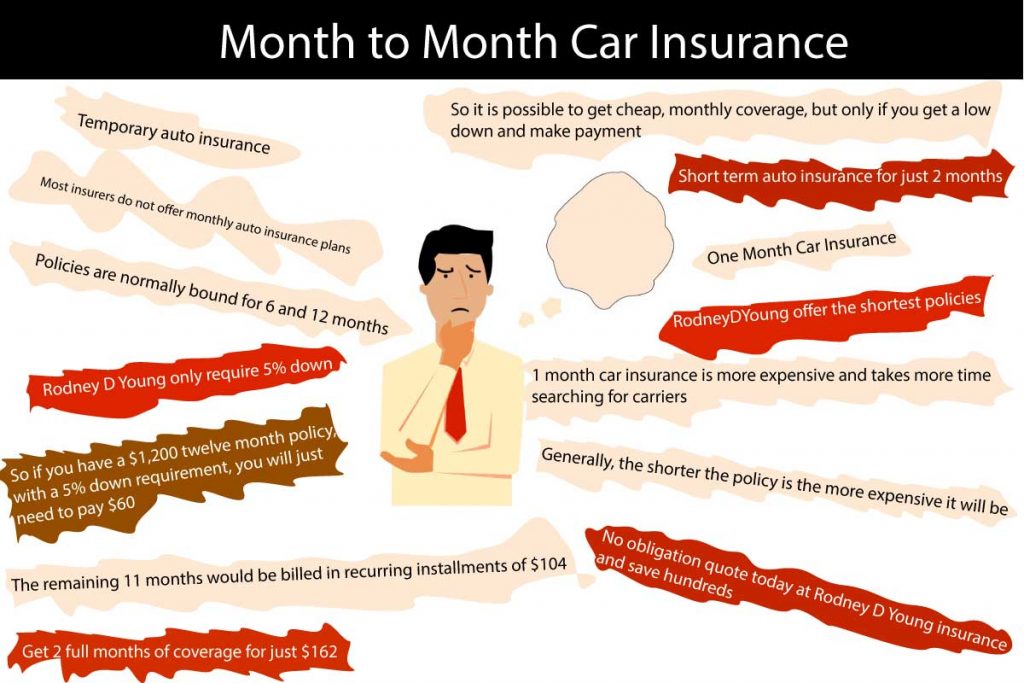

Yes, it is possible to extend your car insurance by one month. Many insurance companies offer short-term policies that can be used to extend your existing policy. These policies usually last for a period of three months or less and can be a great way to get the coverage you need without having to pay for a full-year policy. However, it is important to note that the cost of a short-term policy may be higher than the cost of a full-year policy, so it is important to shop around and compare rates before making a decision.

How Much Does Short-Term Car Insurance Cost?

The cost of short-term car insurance will vary depending on the type of coverage you choose and the length of the policy. Generally speaking, the longer the policy, the more expensive it will be. However, it is important to remember that short-term policies are usually much less expensive than a full-year policy, so they can be a great option for those who need coverage for a short period of time. Be sure to shop around and compare rates before committing to a short-term car insurance policy.

What Are The Benefits Of Short-Term Car Insurance?

Short-term car insurance can be a great option for those who need car insurance for a short period of time. It can also be a great way to extend your existing policy without the need for a full-year policy. Additionally, short-term policies are usually much less expensive than full-year policies, so you can save money without sacrificing coverage. Finally, short-term policies are flexible and can be tailored to your individual needs.

Conclusion

It is possible to extend your car insurance by one month. Many insurance companies offer short-term policies that can be used to extend your existing policy. These policies usually last for a period of three months or less and can be a great way to get the coverage you need without having to pay for a full-year policy. Be sure to shop around and compare rates before committing to a short-term car insurance policy.

What Age Does Car Insurance Go Down,At 25 for male and female. > Etechbag

Can I Sell My Car Without Insurance Cover? - We Explain!

Can T Remember My Car Insurance

Month to Month Car Insurance | Just at Rodney D Young

Why Did My Car Insurance Go Up? - Harry Levine Insurance