Average Cost Of Car Insurance A Month

Thursday, August 29, 2024

Edit

Average Cost Of Car Insurance A Month

The Rising Cost of Car Insurance

Car insurance is a necessary expense for drivers and it's only getting more expensive. According to the Insurance Information Institute, the average cost of car insurance in the United States is $1,548 annually. That's a 6.3% increase from the year before. Drivers are feeling the pinch of this steadily rising cost, but there are some things they can do to help keep their costs down.

Factors That Affect Car Insurance Costs

There are many factors that go into the cost of car insurance, such as the age and driving history of the driver, the type of car, and the coverage chosen. Insurance companies also take into account things like where the driver lives, their credit score, and the amount of miles driven per year. All of these factors can affect how much a driver will pay for car insurance each month.

Average Cost Of Car Insurance Per Month

The average cost of car insurance per month can vary greatly, depending on all of the factors listed above. For a driver who is 25 years old with a clean driving record, the average cost of car insurance per month can range from as low as $50 to as high as $200. For an older driver with a less-than-perfect driving record, the average cost of car insurance per month can be even higher.

How to Lower Car Insurance Costs

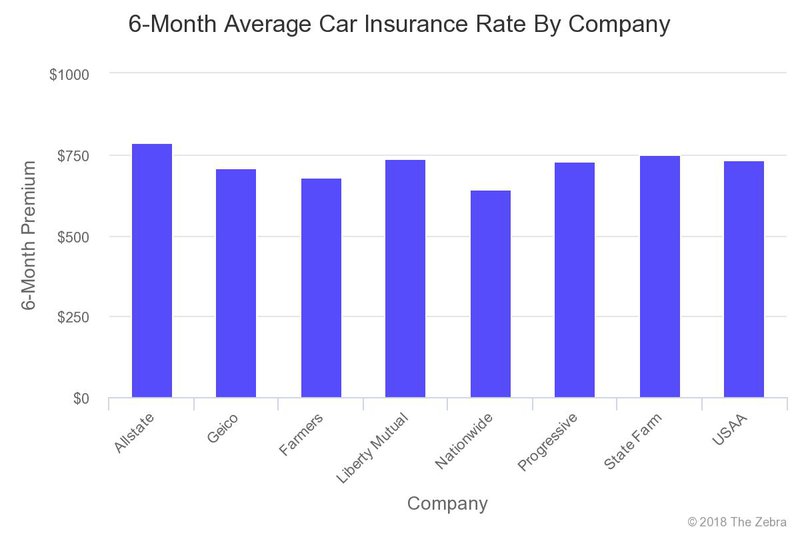

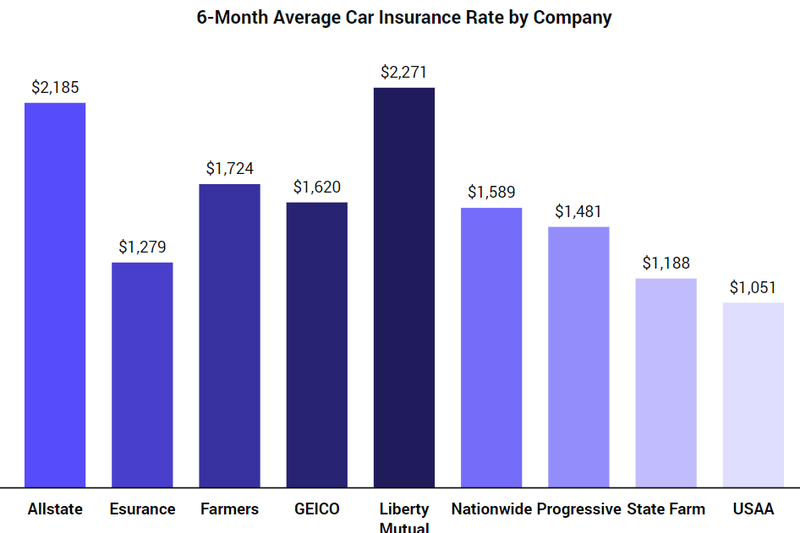

There are a few ways to lower the cost of car insurance. One of the best ways to lower car insurance costs is to shop around. Different insurance companies offer different rates, so it pays to compare quotes. Drivers should also consider increasing their deductible, which is the amount they pay out-of-pocket before the insurance company pays. A higher deductible will result in lower monthly premiums.

Discounts That Can Lower Car Insurance Costs

Insurance companies offer various discounts that can help lower car insurance costs. These can include discounts for maintaining a good driving record, having a certain type of car, or being a certain age. Drivers should make sure to ask their insurance company if they qualify for any discounts.

Final Thoughts On The Average Cost Of Car Insurance A Month

The cost of car insurance is rising, but there are ways to help keep costs down. Drivers should shop around for the best rates and ask their insurance company about any discounts they may qualify for. By taking the time to compare quotes and look for discounts, drivers can hopefully find a policy that fits their budget.

ALL You Need to Know About the Average Car Insurance Cost

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Average Cost of Car Insurance UK 2020 | NimbleFins

What is the Average Cost of Car Insurance in the US? | The Zebra

Average Price Of Car Insurance Per Month - designby4d