Average Cost Of Car Gap Insurance

What is Car Gap Insurance?

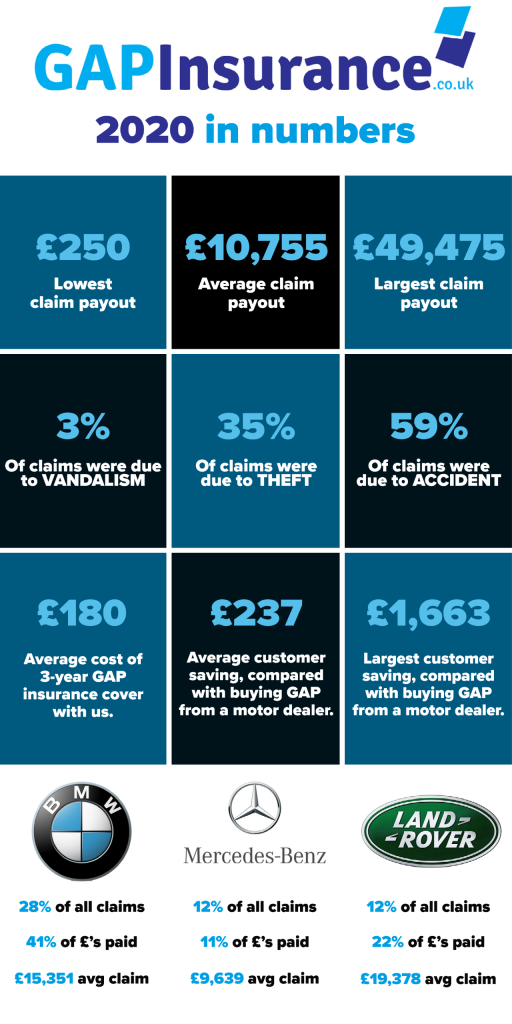

Car Gap Insurance is an insurance policy that covers the difference between the market value of your car and the amount you owe on your loan or lease. It may also be referred to as Loan/Lease Payoff, or Loan/Lease Gap Insurance. This type of policy is important for people who have recently purchased a new car and financed it with an auto loan. In the event of a total loss, such as a major accident or theft, the insurance company will only cover the market value of the car, which is often less than the amount you still owe on your loan. This gap between the market value and the loan amount can be covered by a Gap Insurance policy.

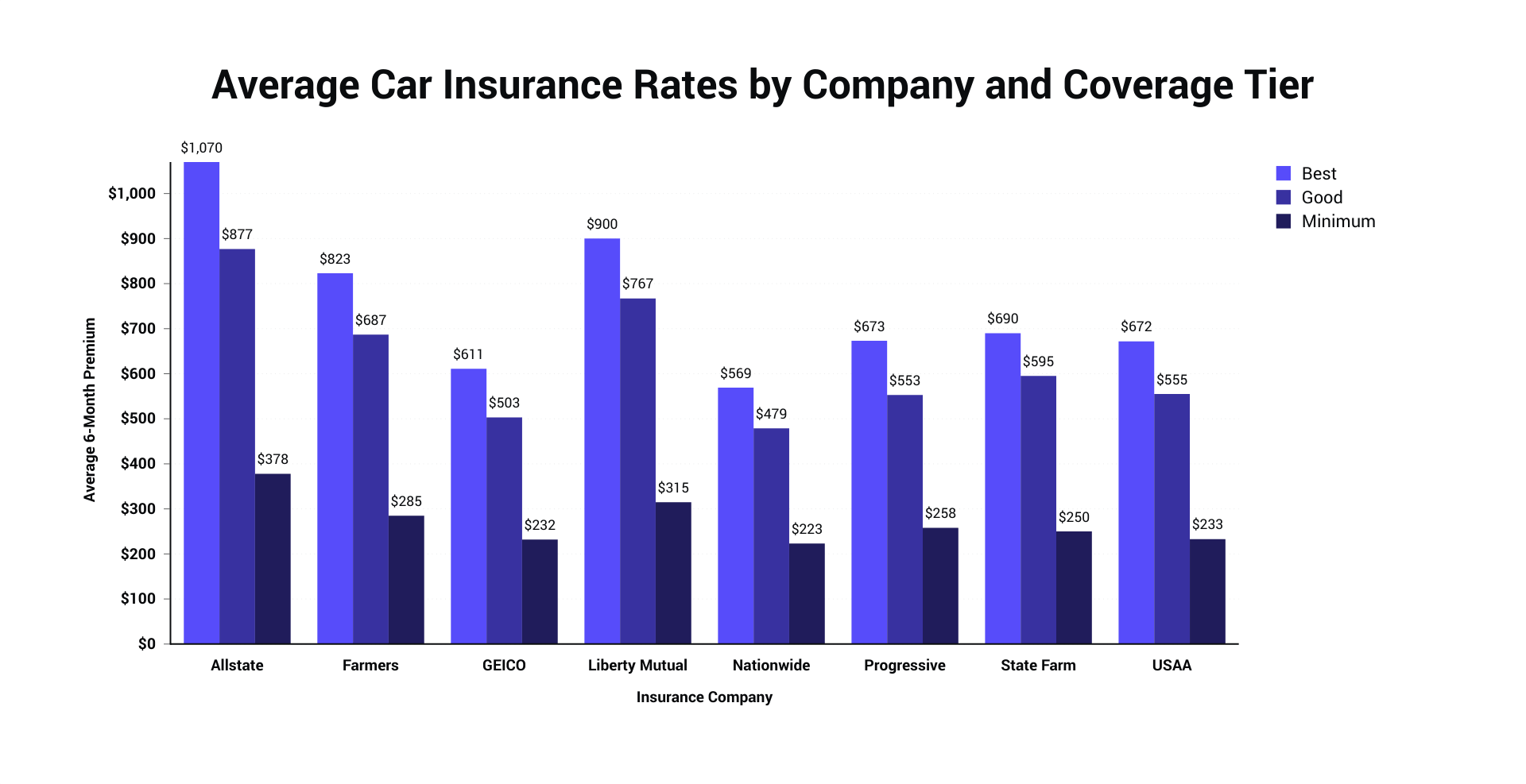

What Does Car Gap Insurance Cost?

The average cost of Car Gap Insurance depends on a variety of factors, including the make and model of the car, the amount of coverage purchased, and the insurance company you choose. Generally, policies range from $20 to $200 per year. Most insurance companies offer discounts for multiple vehicles or multiple policies, which can help to reduce the overall cost. Gap Insurance is usually an add-on to an existing auto insurance policy and is usually offered as part of a bundle of coverage.

When Do You Need Car Gap Insurance?

Car Gap Insurance is typically recommended for people who have recently purchased a new car and taken out a loan or lease. This type of policy is important for anyone who has financed a car, as it can help to protect you from losing money in the event of a total loss. You should also consider purchasing Gap Insurance if you have a low down payment on your car loan, if you made a large down payment and rolled the remaining balance into your loan, or if you are leasing a car. Additionally, if you are considering an extended warranty, it may be a good idea to purchase Gap Insurance as well.

What Does Car Gap Insurance Cover?

Car Gap Insurance covers the difference between the market value of your car and the amount you owe on your loan or lease in the event of a total loss. This type of policy can help to protect you from owing money on a car that no longer exists. In the event of a total loss, the Gap Insurance policy will pay the difference between the value of the car and the amount you still owe on the loan or lease.

Is Car Gap Insurance Worth It?

Car Gap Insurance is a relatively inexpensive way to protect yourself from owing money on a car that no longer exists. This type of policy may be especially beneficial for people who have recently purchased a new car and taken out a loan or lease, as it can help to protect them from losing money in the event of a total loss. While the cost of Car Gap Insurance varies depending on a variety of factors, it is generally an affordable way to protect yourself from financial losses.

Where Can You Purchase Car Gap Insurance?

Car Gap Insurance is typically offered as an add-on to an existing auto insurance policy and is usually available through most major insurance companies. You may also be able to purchase Gap Insurance through an independent insurance agent or broker. It is important to compare policies and prices from different insurance companies in order to find the best deal. Additionally, it is important to understand the terms and conditions of the policy and to make sure that it meets your needs.

Is GAP insurance worthwhile? - babybmw.net

How Much Car Insurance Do You Really Need? | DaveRamsey.com

ALL You Need to Know About the Average Car Insurance Cost

How Much Is Car Worth For Insurance

How Much Does Car Insurance Cost on Average? | The Zebra