What Is Property Damage Liability Coverage

What Is Property Damage Liability Coverage?

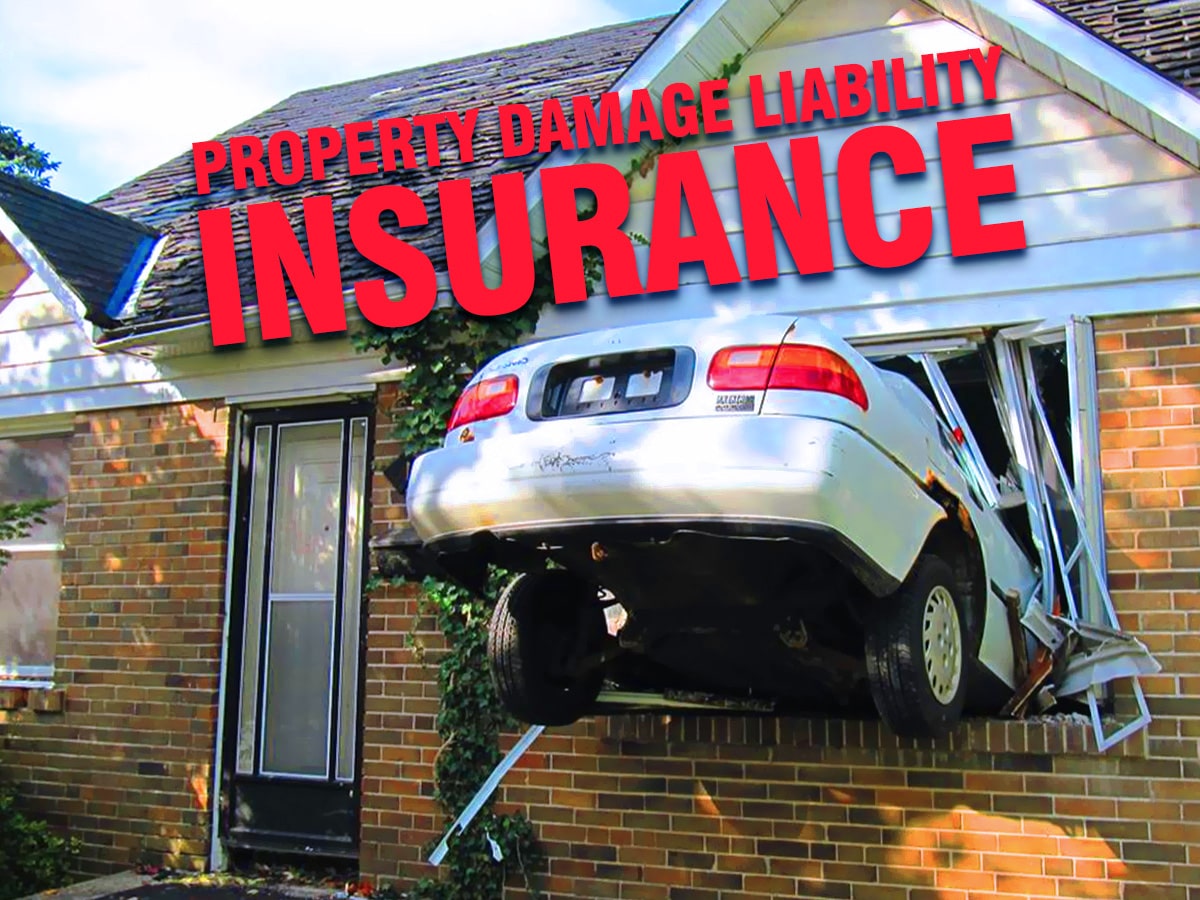

Property damage liability coverage is a type of insurance policy that provides protection against damage to another person's property that is caused by the policyholder. This coverage protects the policyholder from financial losses if they are found liable for damages caused to someone else's property as a result of their negligence. It is important to understand that this type of coverage only applies to property damage and does not provide protection for any bodily injury or medical expenses that may be incurred as a result of an accident.

Types of Property Damage Liability Coverage

Property damage liability coverage can be purchased in a variety of forms. Most commonly, it is offered as part of an auto insurance policy and is designed to cover damages to another person's vehicle in the event that the policyholder is deemed at fault for an accident. It may also be included as part of a homeowner's policy and is designed to cover damages to other people's property that is caused as a result of something like a fire or a natural disaster.

Benefits of Property Damage Liability Coverage

Property damage liability coverage is an important type of insurance coverage that can help protect the policyholder from financial losses in the event that they are found liable for damages to another person's property. Without this coverage, the policyholder would be responsible for any costs associated with the damage they caused, which could be substantial. The policyholder would also be responsible for any legal costs associated with defending themselves in court, which could also be quite costly.

Limits of Property Damage Liability Coverage

Property damage liability coverage does have limits and these limits will vary depending on the policy. Generally, the coverage limit is the maximum amount that the insurance company will pay out for any one incident. It is important to understand that this coverage does not provide protection from any bodily injury or medical expenses that may be incurred as a result of an accident, so it is important to consider purchasing additional coverage if these risks are present.

Cost of Property Damage Liability Coverage

The cost of property damage liability coverage will vary depending on the type of policy purchased and the amount of coverage chosen. Generally, this type of coverage is relatively affordable and is an important part of any comprehensive insurance policy. It is important to understand that this coverage does not provide protection from any bodily injury or medical expenses that may be incurred as a result of an accident, so it is important to consider purchasing additional coverage if these risks are present.

Final Thoughts

Property damage liability coverage is an important type of insurance coverage that can provide financial protection to the policyholder if they are found liable for damages to another person's property. It is important to understand the limitations of this coverage and to consider purchasing additional coverage if the risks of bodily injury or medical expenses are present. The cost of this coverage is generally quite affordable, so it is worth considering as part of any comprehensive insurance policy.

Property Damage Liability Coverage Phrase on the Page Stock Photo

Property Damage Liability Coverage Health Travel Stock Vector (Royalty

Definition Of Property Damage Auto Insurance - STAETI

Property Damage Liability Insurance coverage quotes

Bodily Injury & Property Damage Liability - RAELST