1 Month Car Insurance Policy

1 Month Car Insurance Policy

Overview

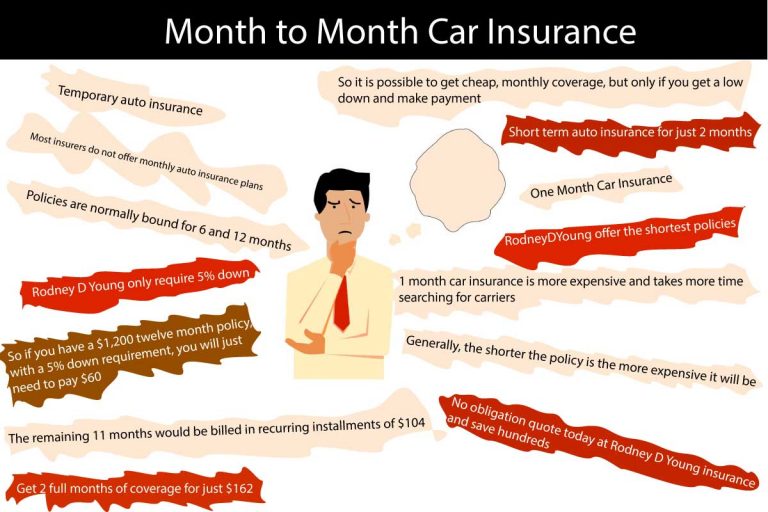

When you need to insure your car for a short period of time, purchasing a 1 Month Car Insurance policy may be the best option for you. It is important to know that the policy will cover you for a full month, up to 30 days, and that it is usually much more affordable than taking out an annual policy. Not all car insurance providers offer 1 month policies, so it is important to shop around to find the best deal for you.

Who is Eligible for a 1 Month Car Insurance Policy?

In order to be eligible for a 1 Month Car Insurance policy, you must meet certain criteria. You must be at least 18 years old and have a valid driver’s license. Additionally, you must have a vehicle that is registered in the country in which you intend to drive. Lastly, you must have a valid insurance policy in place that covers you and your vehicle for the duration of the policy period.

What Does a 1 Month Car Insurance Policy Cover?

A 1 Month Car Insurance policy will typically cover you for all the same types of incidents as an annual policy. This includes liability, collision, and comprehensive coverage. Liability coverage will cover you if you are at fault for an accident and have to pay for property damage or medical bills. Collision coverage will cover you if you are involved in an accident and your vehicle is damaged. Comprehensive coverage will cover you for any other incidents, such as theft, fire, or vandalism.

What Are the Benefits of a 1 Month Car Insurance Policy?

The biggest benefit of a 1 Month Car Insurance policy is that it is much more affordable than taking out an annual policy. Additionally, it is a great option for those who don’t need to insure their car for an entire year. A 1 Month Car Insurance policy is also a great option for those who are borrowing a car for a short period of time, or for those who are renting a car for a month or two.

How to Find the Best Deal on a 1 Month Car Insurance Policy

In order to find the best deal on a 1 Month Car Insurance policy, it is important to shop around and compare rates from different providers. It is also important to make sure that the policy you are considering covers all of your needs. Additionally, it is important to read the policy carefully and make sure you understand all of the terms and conditions. Finally, it is important to make sure that the policy is valid for the full month, up to 30 days.

Conclusion

A 1 Month Car Insurance policy can be a great option for those who need to insure their car for a short period of time. It is important to shop around and compare rates from different providers in order to find the best deal. Additionally, it is important to make sure that the policy you are considering covers all of your needs. Finally, it is important to make sure that the policy is valid for the full month, up to 30 days.

One month car insurance policy

1 Months Car Insurance – Get Short Term Car Insurance Online

One Month Insurance Plan Car - วิริยะประกันภัย | THE VIRIYAH INSURANCE

Month to Month Car Insurance | Just at Rodney D Young