What Is The Best Medicare Gap Insurance

What Is The Best Medicare Gap Insurance?

What Is Medicare Gap Insurance?

Medicare gap insurance is a type of insurance policy that can help you pay for expenses that aren't covered by Medicare. Medicare is the federal health insurance program for people who are 65 and older and certain younger people with disabilities. Medicare covers a wide range of medical services, but it doesn't cover everything. That's where gap insurance comes in. Gap insurance is designed to help you pay the "gap" between what Medicare pays and the cost of your medical care. It can help you pay for such expenses as co-pays, deductibles, and coinsurance. Gap insurance can also help you pay for health care services not covered by Medicare, such as hearing aids, eyeglasses, and long-term care.

Types of Gap Insurance

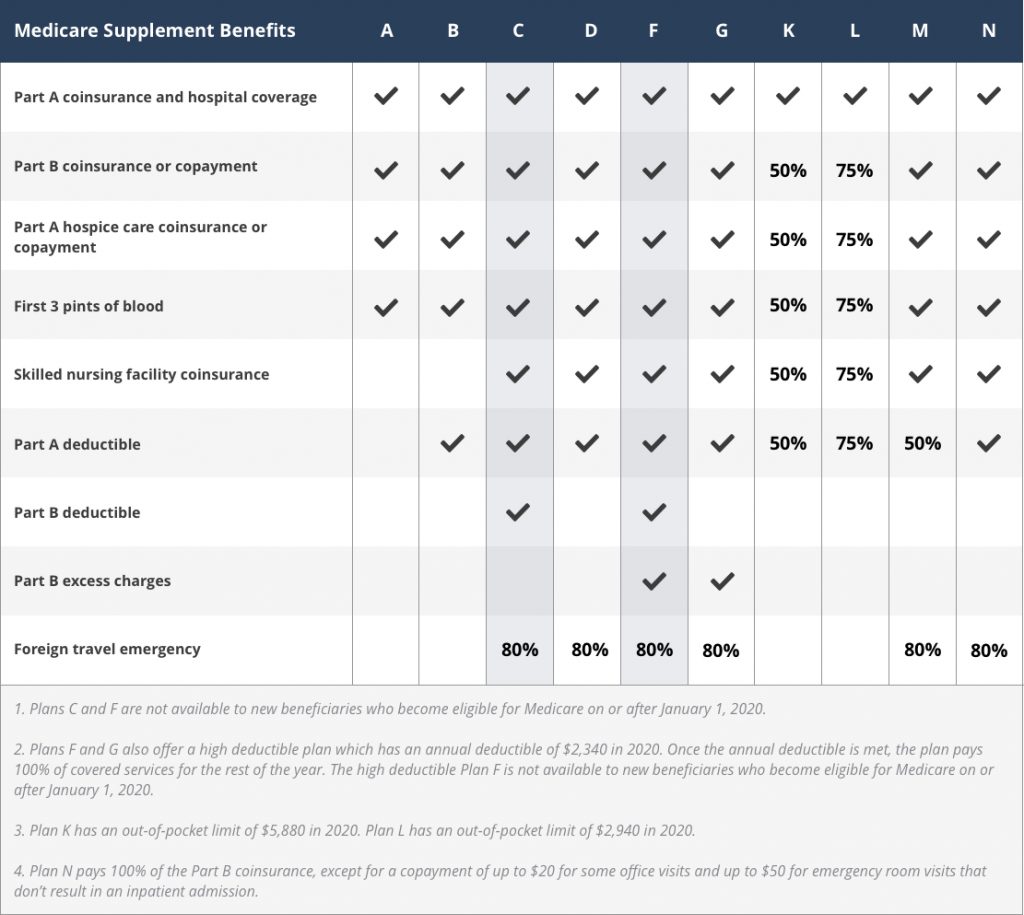

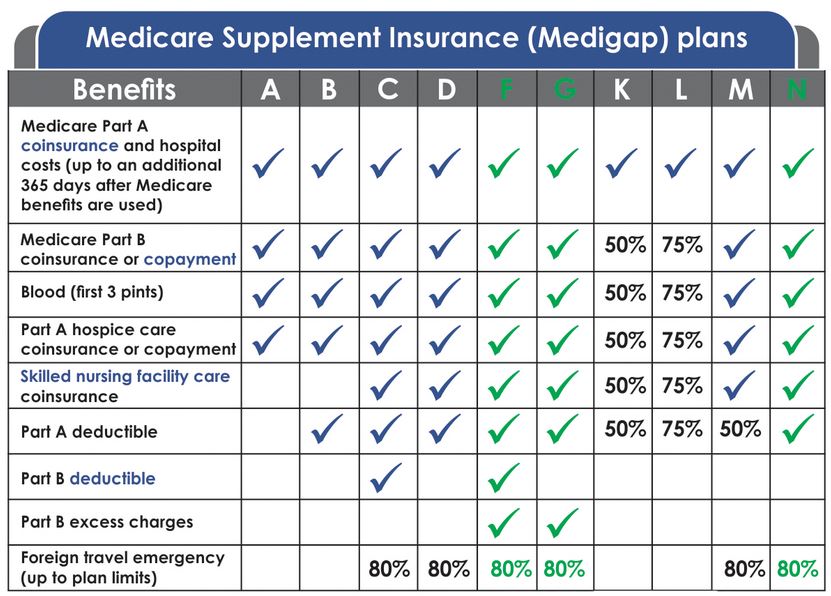

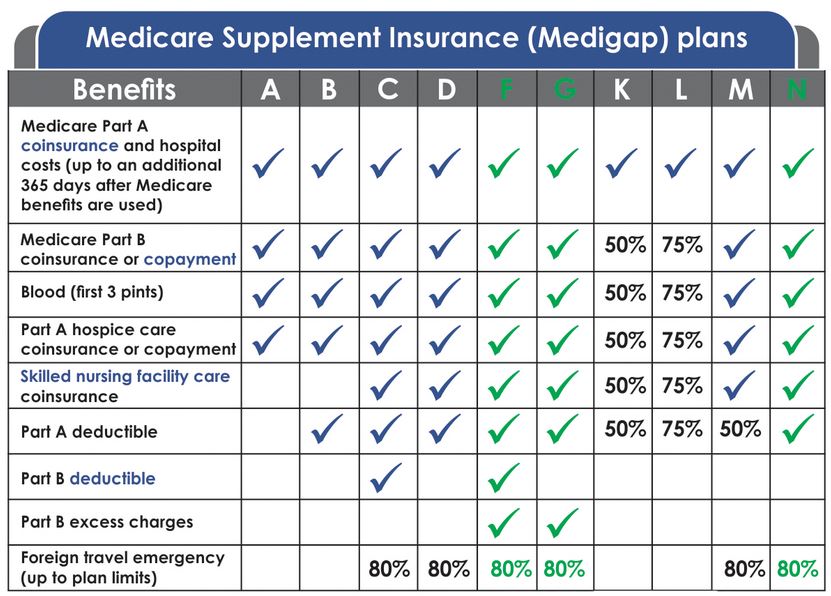

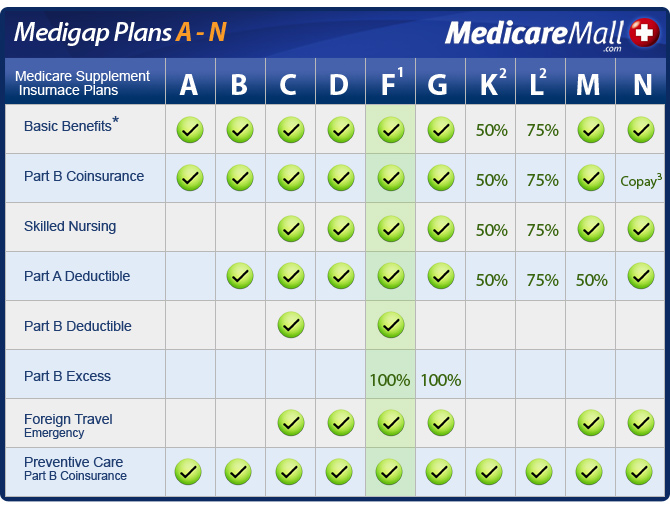

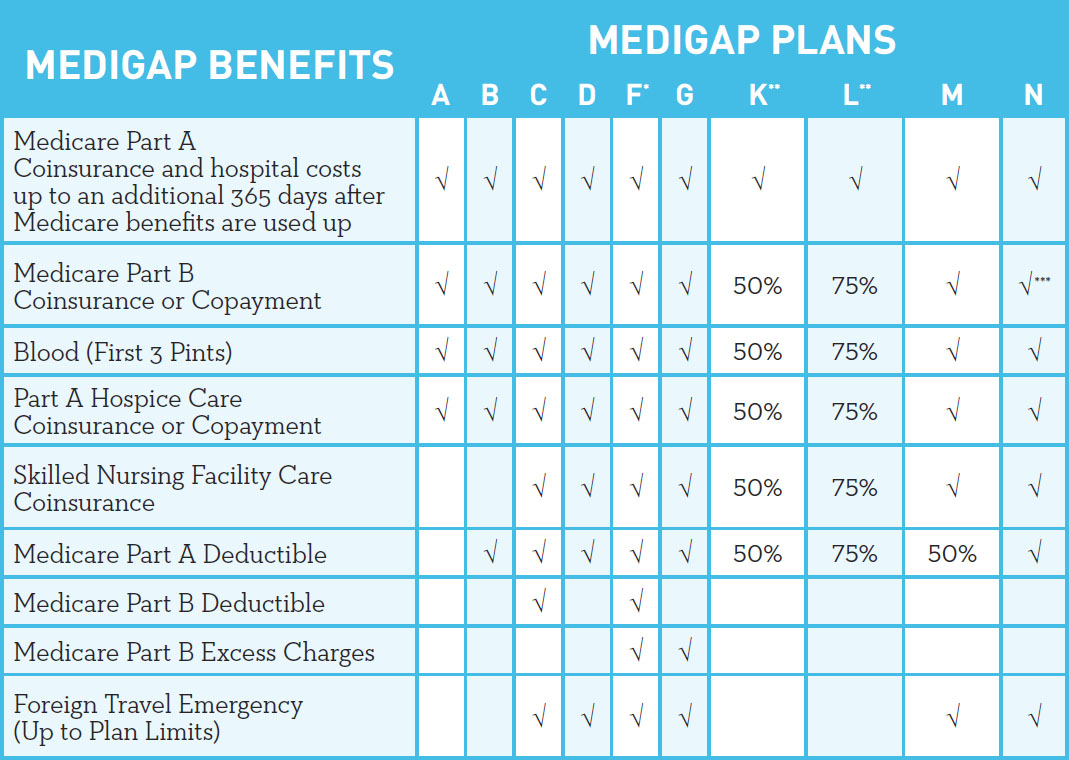

There are several types of gap insurance policies available. The most common type is a Medicare supplement insurance policy, also known as Medigap. Medigap policies are sold by private insurance companies and can help you pay for expenses not covered by Medicare. These policies can also help you pay for co-pays and deductibles. Other types of gap insurance policies include long-term care insurance, vision insurance, and dental insurance.

What to Look for in a Gap Insurance Policy

When shopping for a gap insurance policy, it's important to compare the different policies available. Look for a policy that offers the coverage you need and one that fits into your budget. Make sure to read the fine print and understand the policy's coverage limits. Also, be sure to check the policy's exclusions and any pre-existing condition clauses.

Benefits of Gap Insurance

Gap insurance can be a lifesaver for those who are faced with medical expenses that aren't covered by Medicare. Gap insurance can help you pay for co-pays, deductibles, and coinsurance. It can also help you pay for health care services not covered by Medicare, such as hearing aids, eyeglasses, and long-term care. Gap insurance can provide peace of mind, knowing that you are protected from unexpected medical expenses.

How to Find the Best Gap Insurance

Finding the best gap insurance policy for your needs can be a daunting task. The best way to start your search is to compare the different policies available. Consider the coverage limits, exclusions, and pre-existing condition clauses of each policy. Also, read online reviews of the insurance companies to make sure they have a good reputation. Finally, talk to a licensed insurance agent who can advise you on the best gap insurance policy for your needs.

Conclusion

Gap insurance can be a great way to pay for medical expenses that aren't covered by Medicare. It can provide peace of mind knowing that you are protected from unexpected medical expenses. When shopping for a gap insurance policy, make sure to compare the different policies available and read the fine print. Also, talk to a licensed insurance agent to make sure you are getting the best policy for your needs.

The Best Medicare Supplement? Plan F vs Plan G vs Plan N

Buying a Medicare Supplement Insurance Plan | Top 10 Things to Know

Medicare Supplement

The Top 10 Medicare Supplement Insurance Companies | 2020 Medigap Plans