What Does Full Coverage Car Insurance Cover

What Does Full Coverage Car Insurance Cover?

Introduction

When it comes to car insurance, there’s no one-size-fits-all policy. Depending on where you live, the coverage options available to you, and the type of car you drive, you may be able to get a basic policy, or a more comprehensive policy. One of the most popular types of car insurance coverage is full coverage car insurance. But what does full coverage car insurance cover, and is it the right choice for you?

What Is Full Coverage Car Insurance?

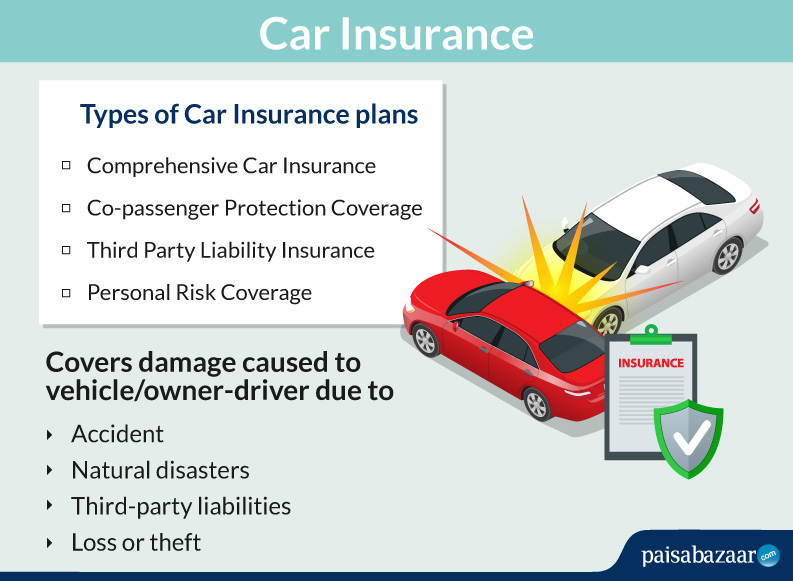

Full coverage car insurance is a type of insurance policy that covers a wide range of potential damages and losses that may be incurred in a car accident. It is typically more comprehensive than a basic policy and covers both liability and physical damage. This type of policy is usually more expensive than a basic policy, but it provides more protection and peace of mind. It can also provide additional benefits such as rental car coverage, roadside assistance, and medical payments coverage.

What Does Full Coverage Car Insurance Cover?

Full coverage car insurance typically covers the following:

- Liability coverage, which pays for damages that you are legally liable for in an accident.

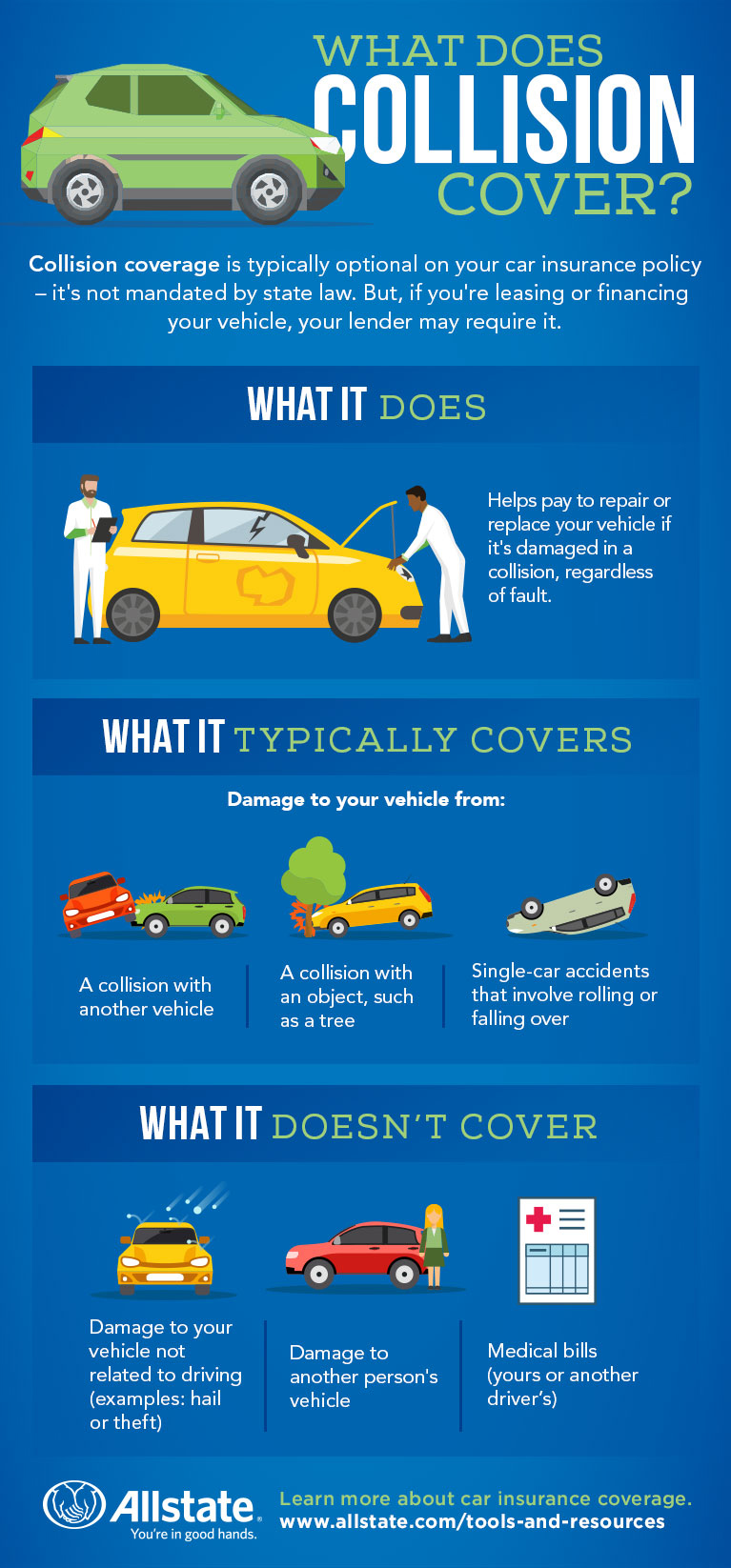

- Collision coverage, which pays for damages to your vehicle if you hit another vehicle or object.

- Comprehensive coverage, which pays for damages to your vehicle caused by vandalism, theft, or natural disasters.

- Uninsured/Underinsured motorist coverage, which pays for damages if you are hit by a driver who does not have insurance or does not have enough insurance.

- Medical payments coverage, which pays for medical expenses related to an accident.

- Rental car coverage, which pays for a rental car while your vehicle is being repaired.

- Roadside assistance coverage, which pays for towing and other services if your car breaks down.

Do I Need Full Coverage Car Insurance?

The answer to this question depends on your personal situation. If you are financing or leasing a car, your lender may require you to have a full coverage policy. If you own your car outright, you may be able to get by with a basic policy. However, if you want the most protection and peace of mind, a full coverage policy may be the best option for you.

Conclusion

Full coverage car insurance is a type of policy that covers a wide range of potential damages and losses that may be incurred in a car accident. It typically includes liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, rental car coverage, and roadside assistance coverage. Whether or not you need full coverage car insurance depends on your personal situation, but it can provide additional protection and peace of mind.

What Is Comprehensive Auto Insurance? | Allstate

Auto / Car Insurance - Downey CA & Los Angeles CA - The Point Insurance

What is Collision Insurance?—Allstate

Car Insurance: Coverage, Claim & Renewal

PPT - Full coverage car insurance in California PowerPoint Presentation