Typical Car Insurance Cost For 21 Year Old

Typical Car Insurance Cost For 21 Year Old

Introduction

Being a 21 year old, you have to be extra careful when it comes to your car insurance costs. The truth is, you're going to be paying more than most drivers simply because you're younger. This is because insurers consider you to be more likely to get into an accident than more experienced drivers. That said, there are still ways to save money when it comes to car insurance for 21 year olds. It may not be easy, but it's possible. In this article, we'll look at the typical car insurance cost for 21 year olds and some tips on how to save money.

Average Cost of Car Insurance for 21 Year Olds

The average cost of car insurance for a 21 year old is $2,926 per year, according to the Insurance Information Institute. This is significantly higher than the national average of $1,548. Of course, this cost varies greatly depending on the type of car you drive, the insurer you choose, and where you live. In some states, the average cost of car insurance for a 21 year old can be as high as $3,500 or more.

Factors That Affect Your Rates

There are a few factors that can affect your car insurance rates, even if you're a 21 year old. For starters, the type of car you drive can have a big impact on your rates. Sports cars and luxury vehicles tend to be more expensive to insure, while more affordable vehicles tend to have lower rates. In addition, where you live can also play a role in your rates. Drivers in densely populated areas tend to pay more for car insurance due to the higher risk of accidents and theft.

Tips For Saving Money

Fortunately, there are plenty of ways to save money on car insurance as a 21 year old. One of the best ways is to shop around and compare rates from different insurers. Different insurers offer different rates, so it pays to compare. In addition, you can also look for discounts, such as good student discounts or safe driver discounts. Finally, you may want to consider raising your deductible in order to lower your rates. While this means you will have to pay more out of pocket in the event of an accident, it can significantly reduce your overall costs.

Conclusion

All in all, car insurance for a 21 year old can be expensive, but there are plenty of ways to save. Shopping around and comparing rates is a great way to find the best deal. In addition, you should also look for discounts and consider raising your deductible. With some research and patience, you can find a car insurance policy that fits your budget and provides the coverage you need.

How Much Is Car Insurance For A 21 Year Old ~ news word

How much is car insurance for a 21 year old - insurance

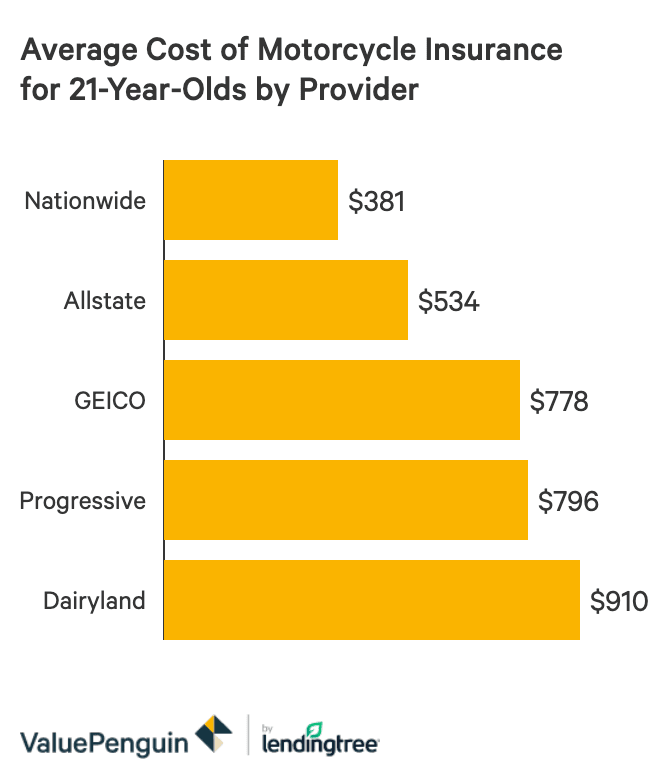

Average Motorcycle Insurance Cost for a 21-Year-Old - ValuePenguin

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra

Review Of Average Car Insurance Cost For 19 Year Old Uk Ideas - SPB