Short Term Car Insurance For International Driving Licence Uk

Understanding Short Term Car Insurance For International Driving Licence UK

If you are planning to drive in the UK, you might need to get a short-term car insurance for your International Driving Licence. This is an important factor to consider when travelling for a short period of time. It is important to understand the requirements for short-term car insurance and to make sure you have the right insurance before you begin your journey.

Short-term car insurance is a type of insurance coverage that provides protection for a specific period of time. This can be for a period of days, weeks, or months. It is important to understand the short-term car insurance requirements for the UK. You must be a resident of the UK and have an international driving licence to get short-term car insurance.

What Are The Requirements For Short Term Car Insurance?

There are a few requirements that must be met in order to be eligible for short-term car insurance. You must be at least 18 years of age and have a valid international driving licence. You must also be a resident of the UK and have a valid UK address. You must also be able to demonstrate proof of insurance that covers the vehicle you are driving for the duration of the policy. Finally, you must have a valid credit or debit card.

How Can I Get Short Term Car Insurance?

The easiest way to get short-term car insurance is to purchase it online. There are a number of companies that offer short-term car insurance for international driving licence holders. You can compare the different policies offered by each company and choose the one that best suits your needs. You can also purchase short-term car insurance from a local insurance broker. This is a more time consuming option, but it allows you to speak directly to an insurance agent who can answer any questions you may have.

What Does Short Term Car Insurance Cover?

Short-term car insurance usually covers liability and collision coverage. This means that if you are involved in an accident, the insurance company will cover the cost of any damages you cause to another person's property or vehicle. It also covers any medical expenses you may incur as a result of the accident. You may also be covered for any legal costs you may incur as a result of the accident. Depending on the policy you choose, you may also be covered for rental car expenses and towing costs.

Conclusion

Short-term car insurance for international driving licence holders is an important factor to consider when travelling for a short period of time. It is important to understand the requirements for short-term car insurance and to make sure you have the right insurance before you begin your journey. There are a number of companies that offer short-term car insurance for international driving licence holders and it is important to compare the different policies offered by each company. Short-term car insurance usually covers liability and collision coverage and may also cover rental car expenses and towing costs.

International Driving Licence Uk | Images and Photos finder

Short Term Car Insurance For Additional Driver https://goo.gl/9JYXYP

Driving Licence Points And Insurance : Driving licences UK has hidden

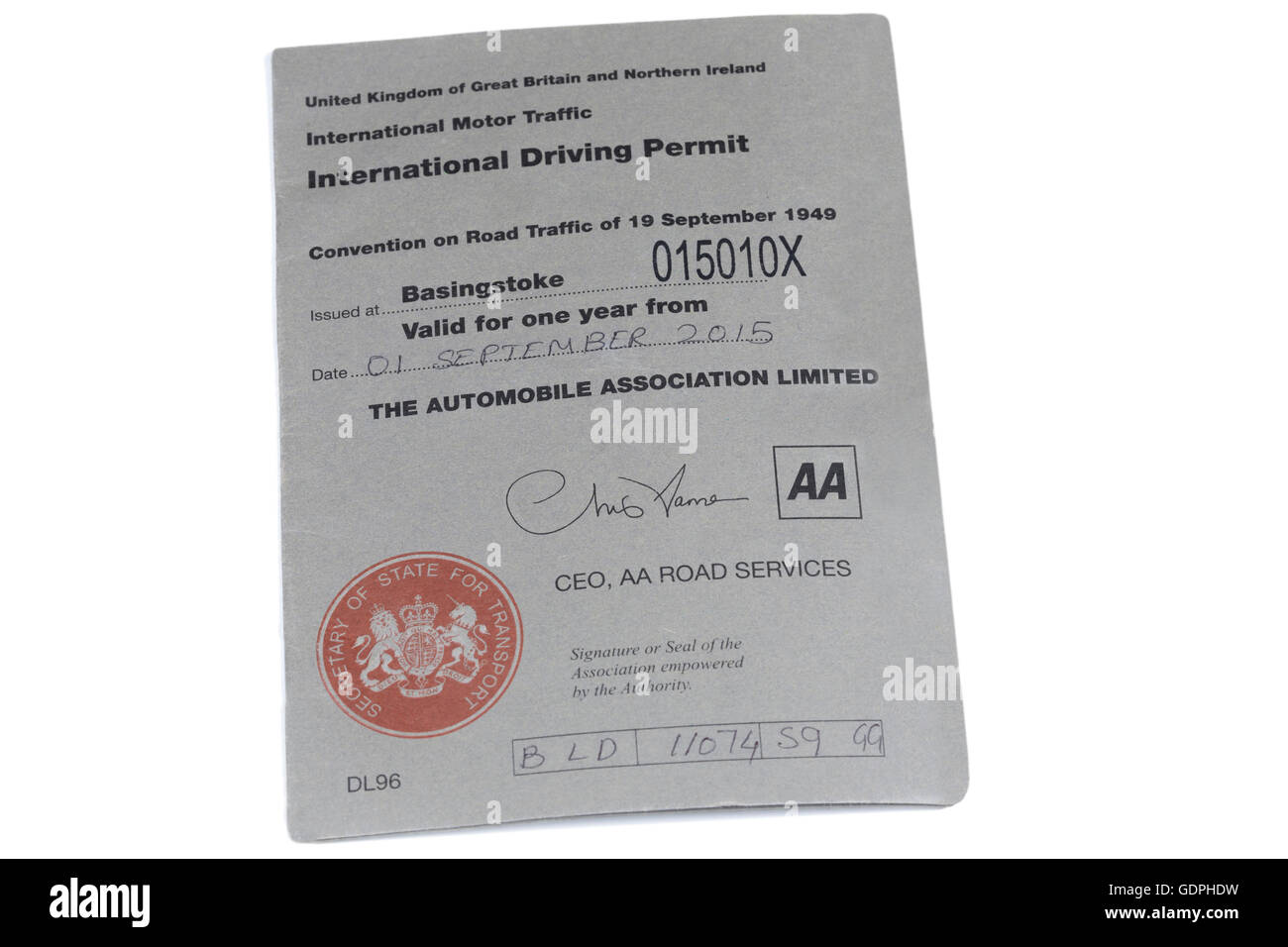

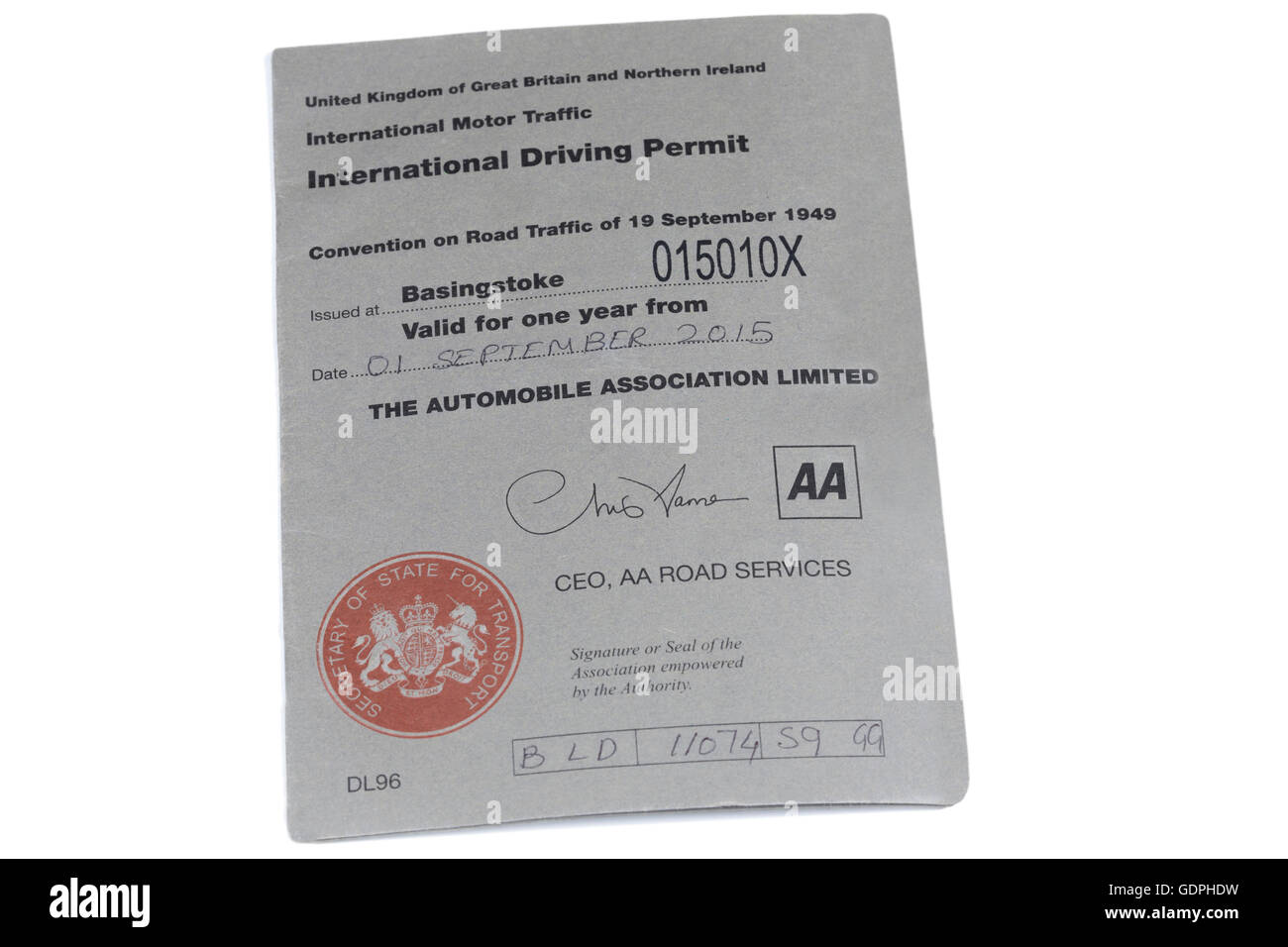

Specimen - International Driver's Licence. How looks International

International driving licence – Dokumencik