Car Insurance Cost Per Month Average

Sunday, June 16, 2024

Edit

Average Car Insurance Cost Per Month

What is Car Insurance?

Car insurance is a type of insurance that provides financial protection against loss or damage to your vehicle. It also covers you if someone is injured or killed as a result of an accident involving your car. Car insurance is a requirement in most states, and without it, you could face a hefty fine, or even jail time. It is important to understand how much car insurance you need and how much it will cost.

How Much Does Car Insurance Cost?

The cost of car insurance varies greatly depending on the type of coverage you choose and the company you purchase it from. Generally speaking, the average cost of car insurance per month is around $150. However, this can vary greatly depending on the factors mentioned above. Factors such as your age, driving record, and the make and model of your car all have an effect on the cost of your car insurance.

Factors That Affect Car Insurance Cost

There are several factors that go into determining the cost of car insurance. Age is one of the most important factors, as young drivers are often seen as more of a risk and therefore cost more to insure. Your driving record is also a factor, as those with a history of accidents or violations will typically pay more for their insurance. The make and model of your car is also a factor, as some cars are more expensive to repair and therefore cost more to insure.

How to Lower Your Car Insurance Costs

There are several ways to lower your car insurance costs. One of the most effective ways is to shop around and compare rates from different companies. Each company has its own set of criteria for determining rates, so it pays to shop around and find the best rate. Additionally, raising your deductible can help reduce your monthly car insurance premiums. This is because you will be taking on more of the risk yourself, and the insurance company will thus reduce your premiums.

Tips for Staying Safe on the Road

In addition to shopping around for the best rates on car insurance, there are several other ways to stay safe on the road. Always wear your seatbelt, drive the speed limit, and don't drink and drive. Additionally, make sure you are aware of your surroundings and pay attention to other drivers. These tips will help you stay safe on the road, and in turn, help keep your car insurance premiums low.

Conclusion

The cost of car insurance can vary greatly depending on several factors, such as age, driving record, and the make and model of your car. Shopping around and comparing rates from different companies is one of the best ways to save money on car insurance. Additionally, raising your deductible and following safe driving practices can help keep your premiums low. By understanding the factors that go into calculating car insurance costs, you can ensure that you get the best rate possible.

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra

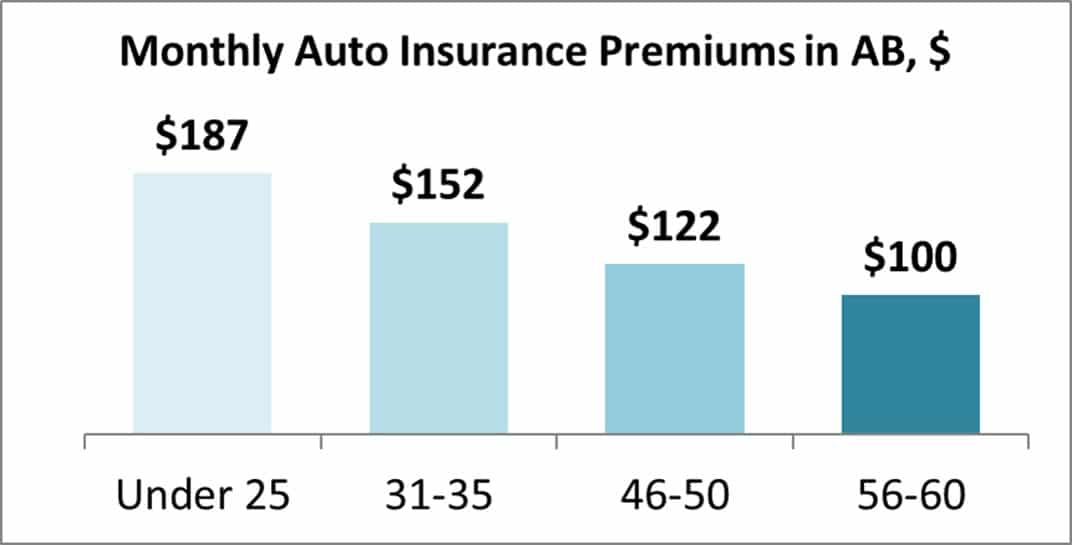

Alberta Car Insurance Costs Canadians on Average $122/month