Auto Owners Life Insurance Annuity

How Auto Owners Life Insurance Annuity Can Help You Prepare for Retirement

Retirement is a major milestone in life and it requires a lot of financial planning to ensure that you have the resources to enjoy your golden years. One of the best ways to achieve this is with an annuity from Auto Owners Life Insurance. An annuity is a financial instrument that provides a steady income stream to help cover your living expenses during retirement.

What Is An Annuity?

An annuity is a contract between you and a life insurance company, such as Auto Owners Life Insurance. The company agrees to pay a set amount of money to you on a regular basis for a set period of time. The payments can be made monthly, quarterly, or annually, depending on the type of annuity you purchase.

There are two main types of annuities: fixed and variable. A fixed annuity pays a fixed rate of return, while a variable annuity pays a rate that varies depending on the performance of the underlying investments in the annuity. Both types of annuities are guaranteed by the life insurance company and are always paid out, regardless of the performance of the investments.

How Does an Annuity Work?

When you purchase an annuity from Auto Owners Life Insurance, you make an initial payment or a series of payments, depending on the type of annuity you select. The life insurance company then invests the money in a range of investments, such as stocks, bonds, mutual funds, real estate, and other assets. The investments are then managed and overseen by the life insurance company's professional money managers.

When you begin to receive payments from the annuity, they are typically paid out on a monthly or quarterly basis. The payments are based on the performance of the underlying investments in the annuity, as well as other factors such as the length of the annuity, the age of the owner, and the type of annuity purchased.

Benefits of an Auto Owners Life Insurance Annuity

An annuity from Auto Owners Life Insurance offers several advantages when planning for retirement. First, the payments are guaranteed by the life insurance company, meaning you can count on them being paid out each month. Second, the investments in the annuity are managed by professional money managers, so you don't have to worry about making decisions or monitoring the performance of the investments.

Finally, an annuity can provide you with a steady income stream in retirement, so you can enjoy your golden years with the peace of mind that comes with knowing your bills are taken care of. Auto Owners Life Insurance offers several annuity options, so you can find one that meets your needs and helps you achieve your retirement goals.

Get Started with Auto Owners Life Insurance Annuity Today

If you're looking for a way to ensure a steady income stream in retirement, an annuity from Auto Owners Life Insurance may be the perfect solution. With a wide range of annuity options and the guarantee of payments from a trusted life insurance company, you can feel confident that your retirement is well taken care of. Contact us today to learn more about how Auto Owners Life Insurance Annuity can help you prepare for retirement.

Auto-Owners Insurance – Logos Download

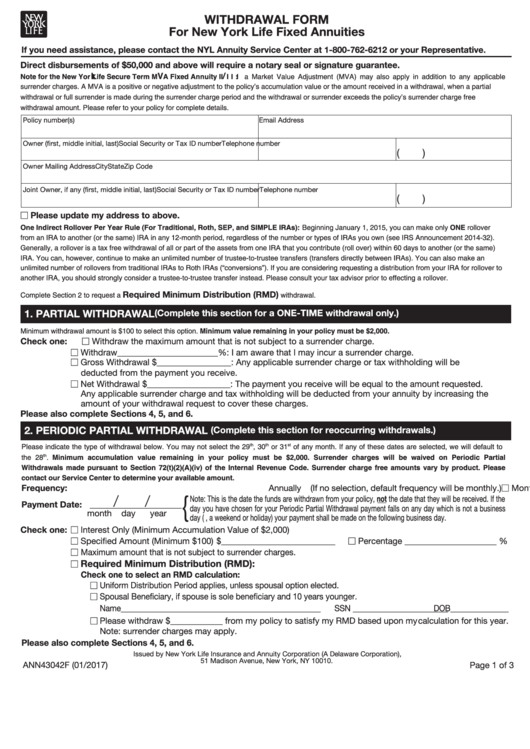

Form Ann43042f - Withdrawal Form For New York Life Fixed Annuities

Auto-Owners Insurance - Insurance - 6101 Anacapri Blvd, Lansing, MI

Top 10 Auto Insurance Infographics

American General Life Insurance Claims - Keijgoeskorea