When Does Car Insurance Go Down

When Does Car Insurance Go Down?

What is car insurance?

Car insurance is a type of insurance policy that helps provide financial protection for you and your vehicle. In exchange for paying a premium, you get coverage for losses that could occur if you are involved in a car accident. The coverage you receive depends on the type of policy you purchase. Car insurance typically covers things like medical expenses, damage to your car, and legal fees if you are found to be at fault in an accident. It also covers you if your car is stolen or damaged by a natural disaster.

When Does Car Insurance Go Down?

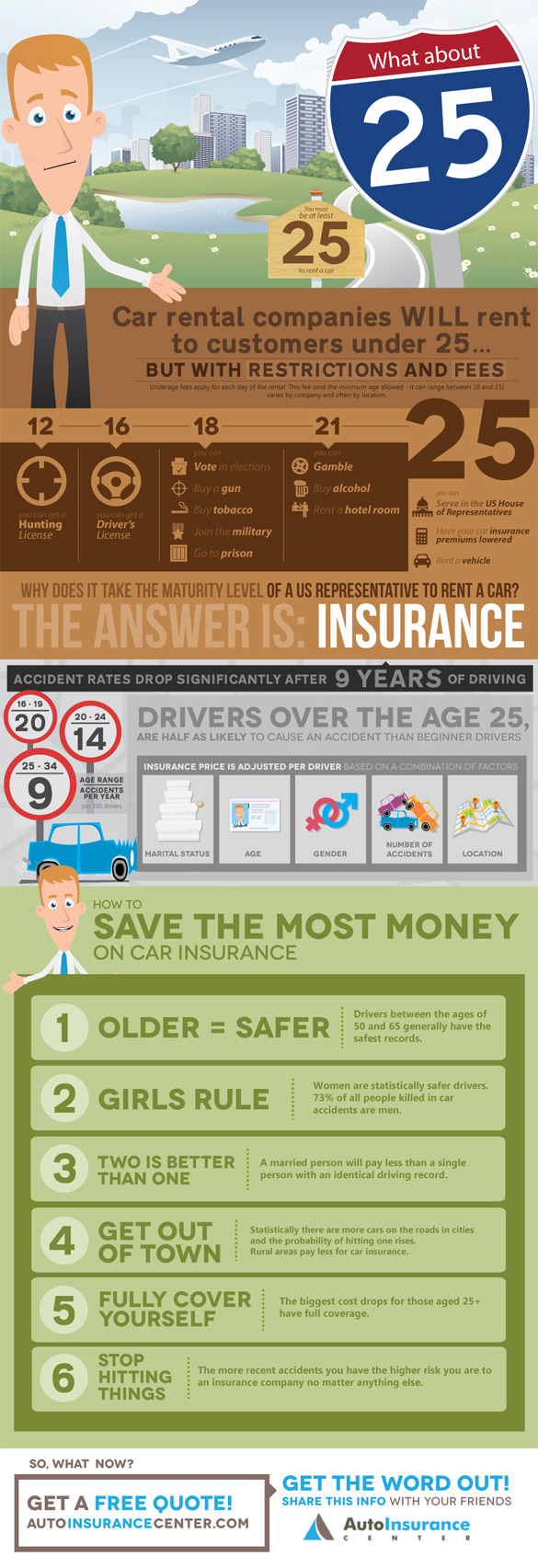

Car insurance rates go down over time as you become a more experienced driver and prove your responsibility behind the wheel. If you have a clean driving record, meaning you have no accidents or moving violations, your car insurance rate could potentially go down. Additionally, if you’ve been with your car insurance company for a while and have consistently paid your premiums on time, you could be eligible for a loyalty discount.

Age

Your age can also affect your car insurance rate. Generally speaking, as you get older your car insurance rate will go down. This is because older drivers tend to be more experienced, have fewer accidents, and are less likely to be involved in risky behavior. Additionally, most car insurance companies offer discounts for teens and young adults who complete driver’s education classes or maintain a certain grade point average.

Location

The location where you live can also affect your car insurance rate. Insurance rates vary by state and even by city, depending on the amount of traffic in the area and the number of car accidents that take place. Additionally, if you live in an area with a high crime rate, your car insurance rate might be higher than if you lived in a safer neighborhood. If you move to a different area, you should contact your car insurance company to see if you can get a better rate.

Car Type and Safety Features

The type of car you drive and the safety features it has can affect your car insurance rate as well. For example, if you drive a newer model car with safety features such as airbags and anti-lock brakes, you could get a lower rate than if you were driving an older model car without these features. Additionally, if you drive a luxury car or a sports car, your car insurance rate could be higher than if you drove a more economical vehicle.

Credit Score

Your credit score can also affect your car insurance rate. Insurance companies use credit scores to determine how likely you are to file a claim, and if you have a poor credit score, you could be seen as a higher risk and your car insurance rate could be higher. However, if you have a good credit score, you could be seen as a lower risk and could get a better rate.

Conclusion

Car insurance rates can go down over time as you become a more experienced driver and prove your responsibility behind the wheel. Additionally, your age, location, car type and safety features, and credit score can all affect your car insurance rate. If you want to get the best rate possible, make sure to shop around and compare rates from different companies.

Does Car Insurance Go Down After 6 Months? (Insurance Rates)

What Age Does Car Insurance Go Down And Why? - Cover

How Much Does Car Insurance Go Down After 1 Year with No Claims?

How Much Does Your Car Insurance Go Down Each Year - Car Retro

What Age Does Insurance Drop - Business insolvencies drop to lowest