Aflac Long Term Care Insurance Rating

Sunday, May 26, 2024

Edit

Aflac Long Term Care Insurance Rating

What Is Long Term Care Insurance?

Long term care insurance is a type of insurance policy that covers the costs associated with long-term care, such as nursing home care, home health care, and other medical expenses. The policy pays for a portion of the cost of these services, with the remainder being covered by the policyholder. It is designed to provide financial protection for those who may be unable to care for themselves due to age, illness, or disability, and can also help provide peace of mind for those already receiving long-term care.

What Does Aflac Long Term Care Insurance Offer?

Aflac Long Term Care Insurance offers a variety of coverage options to meet the needs of individuals and families. The policy provides coverage for in-home care, adult day care, nursing home care, and assisted living. It also covers medical expenses, such as doctor visits, prescription drugs, durable medical equipment, and medical transportation. Additionally, the policy can provide benefits for home modifications, respite care, hospice care, and other expenses related to long-term care.

What Is the Cost of Aflac Long Term Care Insurance?

The cost of Aflac Long Term Care insurance will depend on the type of coverage selected and other factors, such as the individual’s age, health, and lifestyle. The premiums can range from a few hundred dollars to several thousand dollars per year. It is important to note that the cost of the policy is typically more affordable when purchased as part of a group plan, such as through an employer.

How Is Aflac Long Term Care Insurance Rated?

Aflac Long Term Care Insurance is rated by A.M. Best, the leading independent rating agency for the insurance industry. A.M. Best assigns a rating to each policy that reflects the overall financial strength and stability of the insurer and its ability to meet its obligations to policyholders.

Aflac Long Term Care Insurance is currently rated “A+ (Superior)” by A.M. Best, which is the second-highest rating that the agency assigns. This rating indicates that Aflac is a financially strong and stable company, with a strong commitment to its policyholders.

What Are the Benefits of Purchasing Aflac Long Term Care Insurance?

Aflac Long Term Care Insurance offers a variety of benefits to policyholders, including:

-Financial protection in the event of a long-term illness or disability.

-Coverage for a variety of long-term care services and expenses.

-Flexible coverage options to meet individual needs.

-Peace of mind knowing that policyholders are protected if they are unable to care for themselves.

-A strong financial rating from A.M. Best.

Conclusion

Aflac Long Term Care Insurance is an excellent choice for those looking for financial protection and peace of mind in the event of a long-term illness or disability. The policy offers a variety of coverage options to meet individual needs, and is backed by a strong financial rating from A.M. Best. For those looking for an affordable and reliable long-term care insurance policy, Aflac Long Term Care Insurance is definitely worth considering.

√ Aflac - Aflac Wikipedia - This rating reflects the overall rating of

Cancer Aflac Insurance : Inspired By Savannah Help Cover Life S Real

Six in the Nest

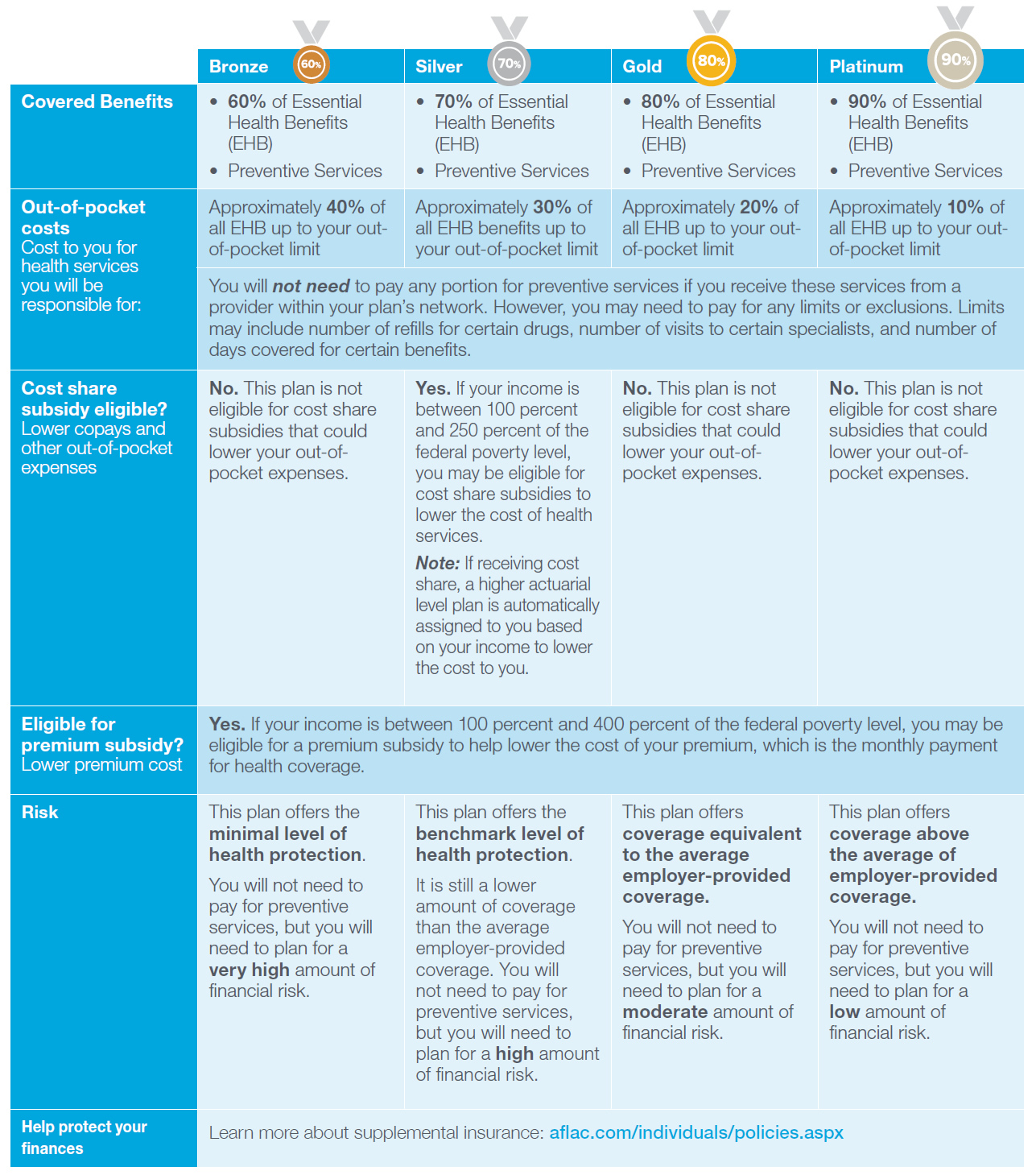

Best Individual Health Insurance Reference Guide | Aflac

Aflac Life Insurance Guide [Best Coverages + Rates]

![Aflac Long Term Care Insurance Rating Aflac Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/10/0713fff9-aflac-claim-4-1-e1572287038146.png)