What Is The Minimum Auto Insurance Coverage In South Carolina

What Is The Minimum Auto Insurance Coverage In South Carolina?

Understanding The South Carolina Automobile Insurance Requirements

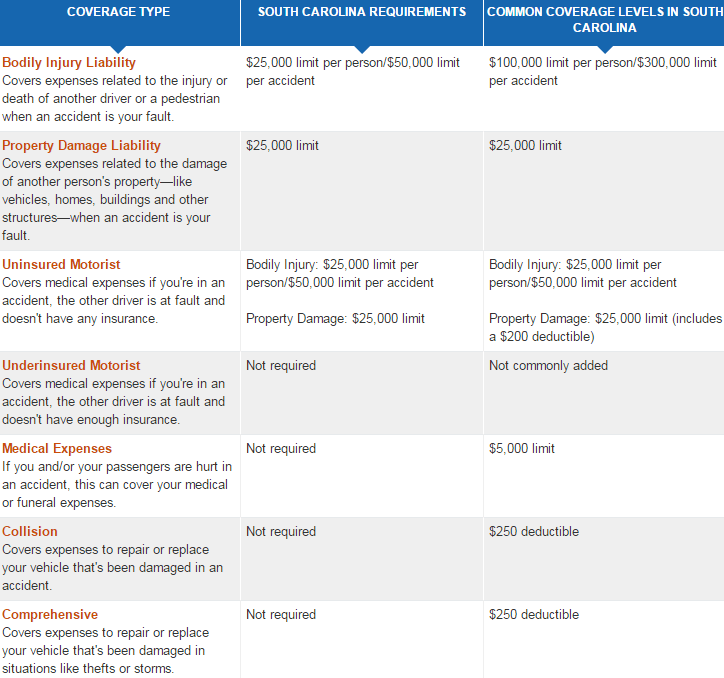

In South Carolina, all registered motor vehicles must carry a minimum amount of liability insurance. This is to protect drivers in case of an accident, and to ensure that any damage or injuries sustained in an accident will be covered. The minimum auto insurance coverage in South Carolina is 25/50/25. This means that the minimum amount of liability coverage is $25,000 for bodily injury for one person, $50,000 for bodily injury for two or more persons, and $25,000 for property damage.

Additional Coverage Options

In addition to the minimum auto insurance coverage, drivers may choose to purchase additional coverage options. These include comprehensive coverage, which covers damage to a vehicle caused by something other than a collision, such as a fire, theft, or vandalism. Collision coverage is also available, which covers damage to a vehicle caused by a collision with another vehicle or object. Uninsured/underinsured motorist coverage is another option that provides coverage for medical expenses and property damage caused by an uninsured or underinsured motorist. Other optional coverage includes towing, rental car reimbursement, and gap insurance.

Penalties for Not Having Insurance

Drivers who fail to carry the minimum amount of auto insurance in South Carolina face stiff penalties. These include fines, license suspension, and even jail time. Drivers must also pay for any damages or injuries caused in an accident, which can be financially devastating if the driver does not have insurance. In addition, drivers may be held liable for any medical expenses or property damage incurred by the other party in an accident.

Finding Affordable Auto Insurance

Finding affordable auto insurance in South Carolina can be a challenge. Drivers should shop around to compare rates and coverage options from different insurance companies. It is also important to consider any discounts that may be available, such as discounts for good driving records, multi-car policies, and good student discounts. It is also important to review the policy carefully to ensure that it meets the state's minimum requirements.

Conclusion

The minimum auto insurance coverage in South Carolina is 25/50/25, which means that drivers must carry at least $25,000 for bodily injury for one person, $50,000 for bodily injury for two or more persons, and $25,000 for property damage. Drivers may choose to purchase additional coverage options, such as comprehensive and collision coverage, uninsured/underinsured motorist coverage, and others. Drivers who are caught without the required insurance face stiff penalties, including fines, license suspension, and jail time. It is important to shop around for the best rates and coverage options to ensure that you are adequately protected.

Cheap Car Insurance in South Carolina 2019

Cheap Car Insurance in South Carolina 2019

car insurance - cheap car insurance in sc - Top 10 best insurance list

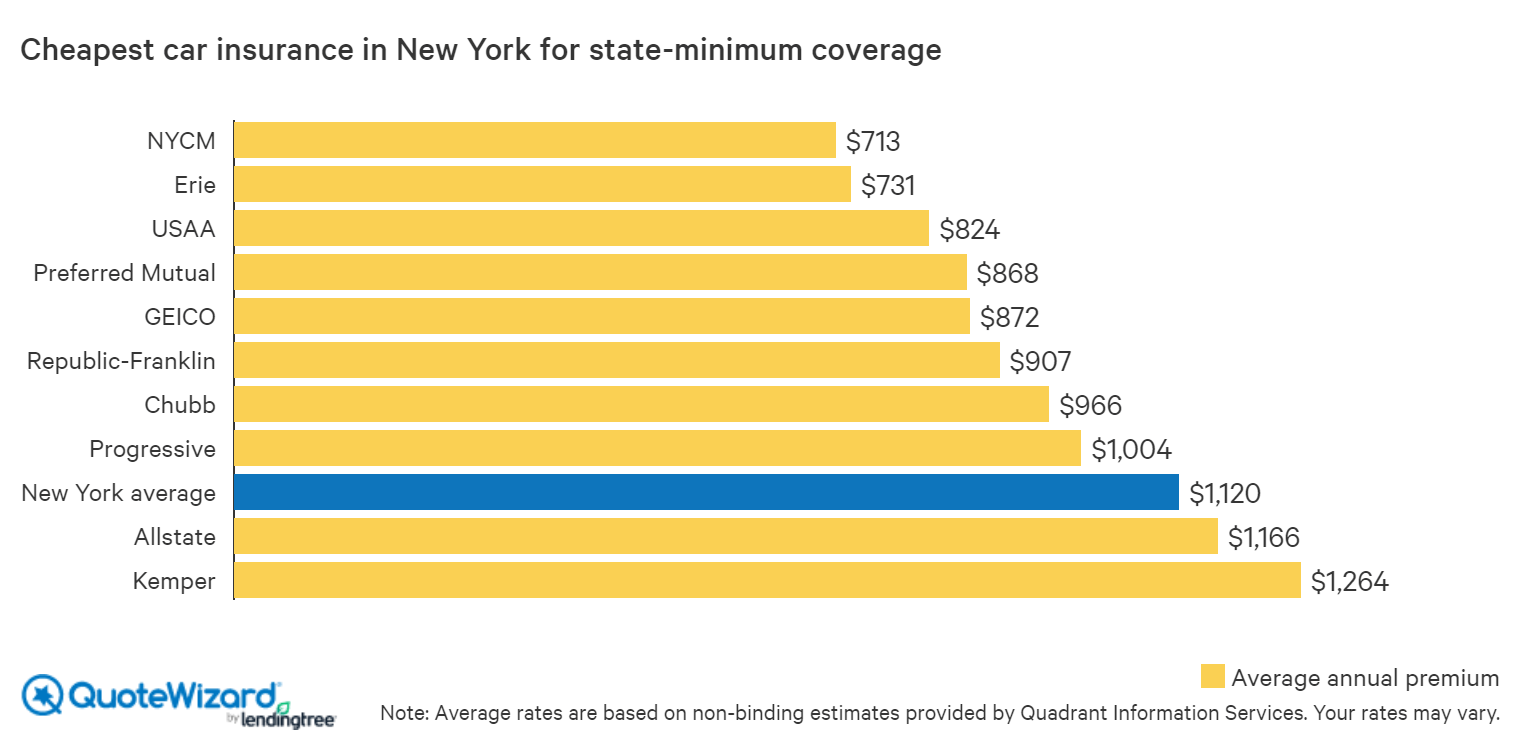

The Cheapest Car Insurance in New York | QuoteWizard