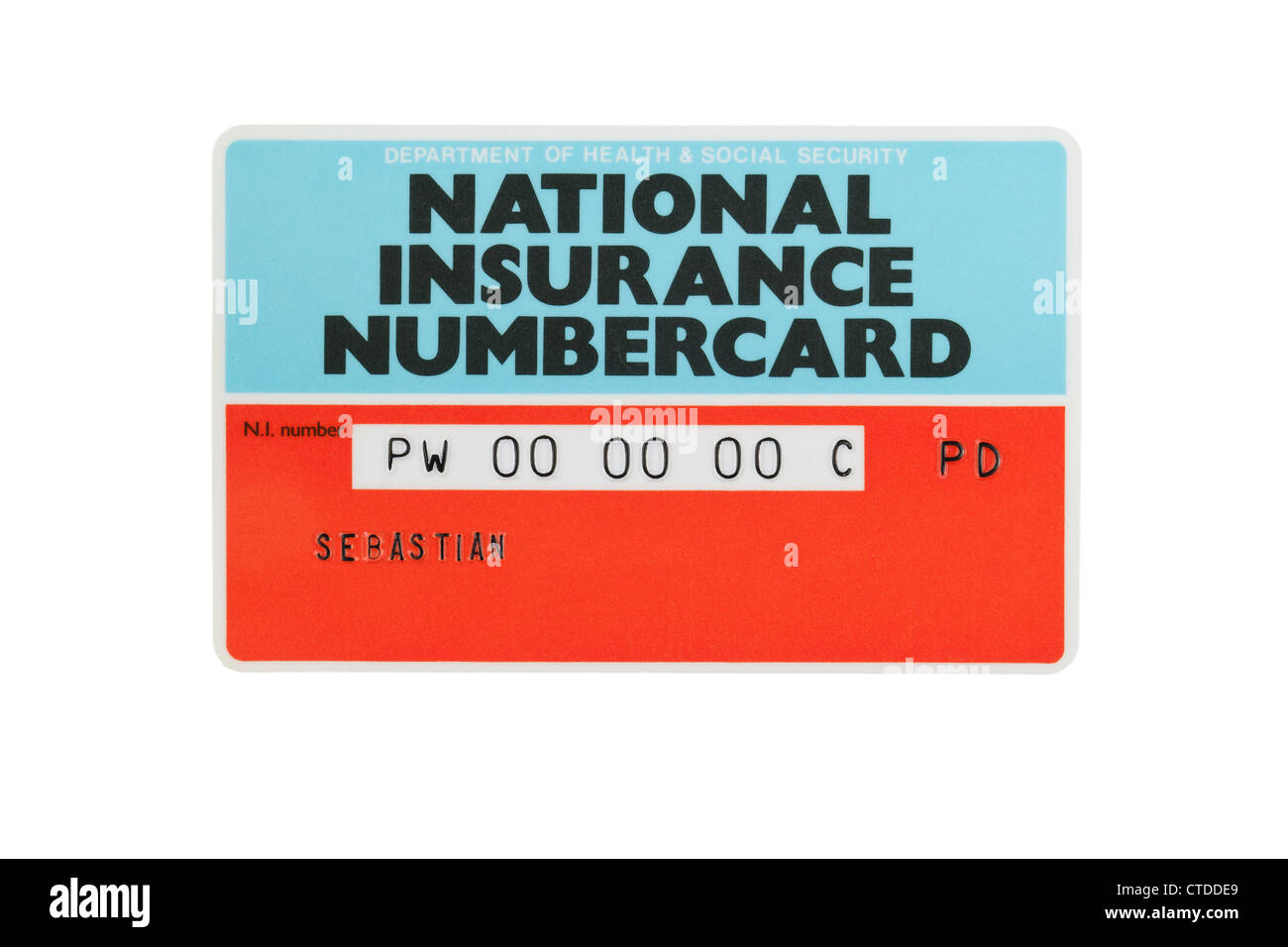

Provisional National Insurance Number Uk

What Is a UK Provisional National Insurance Number?

A Provisional National Insurance Number (PNIN) is a unique reference number issued by HM Revenue and Customs (HMRC) in the United Kingdom. It is used to identify individuals for tax, National Insurance and other government benefits. It is a 9-digit code which consists of three letters, followed by six numbers, and an optional letter at the end.

The primary purpose of the PNIN is to ensure that individuals are correctly identified for tax and National Insurance contributions. It also helps to prevent identity fraud, as it is unique to each individual.

Who Needs a PNIN?

Any individual who is required to pay tax or National Insurance contributions in the UK must have a PNIN. This includes both UK and non-UK nationals. Generally speaking, anyone who works in the UK, receives income from the UK, or is claiming benefits from the UK must have a PNIN.

How Do I Get a PNIN?

In order to obtain a PNIN, you must first register with HMRC. You will need to provide them with various documents and information, such as your name, address and date of birth. Once HMRC has processed your application, they will issue you with a PNIN.

What Do I Do With My PNIN?

Once you have been issued with a PNIN, you need to ensure that it is provided to any employer or other organisation that you deal with. This will enable them to correctly identify you for tax and National Insurance purposes. It is also important to keep a record of your PNIN for future reference.

What Happens If I Lose My PNIN?

If you lose your PNIN, you can contact HMRC and they will be able to provide you with a replacement. You will need to provide them with various pieces of information in order to get a new PNIN. It is important to remember that it is an offence to use someone else's PNIN, and you could be liable for prosecution if you do so.

Conclusion

The Provisional National Insurance Number (PNIN) is an essential part of life in the UK. It is used by HMRC to correctly identify individuals for tax and National Insurance purposes. Anyone who is required to pay tax or National Insurance contributions must obtain a PNIN. It is also important to remember that it is an offence to use someone else's PNIN, and you could be liable for prosecution if you do so.

Additional If you have any questions about PNINs or need help with obtaining one, you can contact HMRC directly. They will be able to provide you with the relevant information and advice.What Is A National Insurance Number / National Insurance Number card NI

Borawski Krzysztof: NINo National Insurance Number - Part 3

National Insurance Numbers Uk » Daily Blog Networks

UBEZBIECZENIE National Insurance Number (NINO) - Towarzystwo Pomocy Polakom

Can I Get A National Insurance Number Without A Job - Job Retro