New York No Fault Auto Insurance Law

New York No Fault Auto Insurance Law Explained

What is No Fault Auto Insurance?

No fault auto insurance is a type of auto insurance that covers you even if you are at fault in an accident. This type of insurance is used in New York and several other states. It is intended to provide protection for people who are injured in car accidents and to provide payment for medical expenses, lost wages, and other expenses related to the accident. In the state of New York, no fault auto insurance is required by law in order to operate a motor vehicle.

What Does New York No Fault Auto Insurance Cover?

No fault auto insurance in New York covers a variety of expenses related to an accident. This includes medical expenses for injuries to the driver or passengers, lost wages, and other expenses related to the accident. It also covers damage to the car and any other property that was damaged in the accident. This type of insurance also covers any legal costs that may be incurred if the accident resulted in a lawsuit.

What Are the Benefits of New York No Fault Auto Insurance?

The main benefit of New York no fault auto insurance is that it helps protect people from financial hardship in the event of an accident. This type of insurance pays for medical expenses and other expenses related to the accident, regardless of who was at fault. The other benefit is that it can help save money on car insurance premiums, since it is required by law. No fault auto insurance can also help protect people from having to pay out of pocket for medical expenses, as well as other expenses related to the accident.

What Are the Drawbacks of New York No Fault Auto Insurance?

The main drawback of no fault auto insurance is that it can be more expensive than other types of auto insurance. This is because it covers a wide range of expenses, regardless of fault. Additionally, no fault auto insurance does not cover damage to the car or other property that was damaged in the accident. This type of insurance also does not cover any legal costs associated with a lawsuit.

What Are the Requirements for New York No Fault Auto Insurance?

In order to be eligible for no fault auto insurance in New York, you must meet certain requirements. You must be a resident of New York and have a valid driver’s license. You must also have a minimum amount of insurance coverage and be able to provide proof of financial responsibility. Additionally, your insurance company must be licensed and approved by the state of New York.

Conclusion

New York no fault auto insurance is an important type of coverage for anyone who drives in the state. It helps protect people from financial hardship if they are involved in an accident and provides payment for medical expenses and other expenses. However, it can be more expensive than other types of auto insurance and does not cover damage to the car or other property. In order to be eligible for no fault auto insurance, you must meet certain requirements and be able to provide proof of financial responsibility.

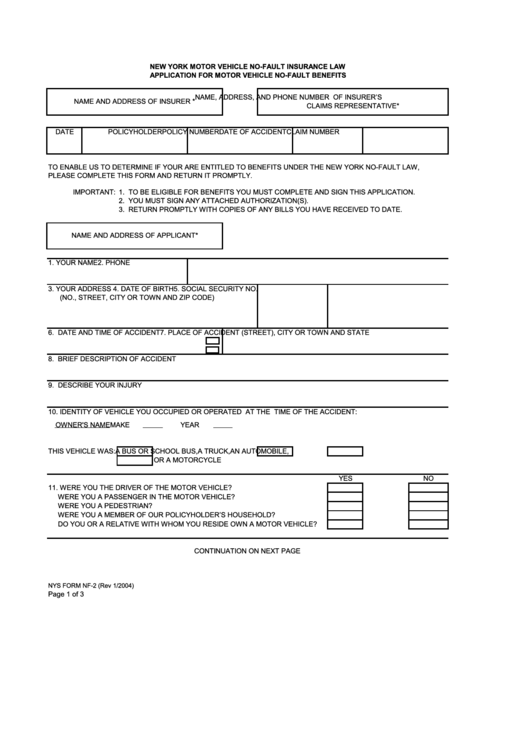

Fillable Nys Form Nf-2 - New York Motor Vehicle No-Fault Insurance Law

PPT - No-Fault Auto Insurance Fraud in New York State Trends

PPT - Auto Accident “No-Fault Law” in New York PowerPoint Presentation

Understanding New York No Fault

Understanding New York No Fault