Is Rental Property Insurance Cheaper Than Homeowners Insurance

Is Rental Property Insurance Cheaper Than Homeowners Insurance?

Rental property insurance and homeowners insurance are both forms of coverage that are designed to protect homeowners and property owners from financial losses due to a variety of risks. But which type of insurance is more affordable? The answer depends on the type of property you own and the risks you face.

What is Rental Property Insurance?

Rental property insurance is a type of coverage designed to protect landlords from financial losses related to their rental property. It is designed to cover a variety of risks, including property damage, liability, and loss of rental income. When a landlord purchases rental property insurance, they are typically required to insure their entire rental property, including the building and any structures that are attached to it. This type of insurance is usually more expensive than homeowners insurance because it covers a wider range of risks.

What is Homeowners Insurance?

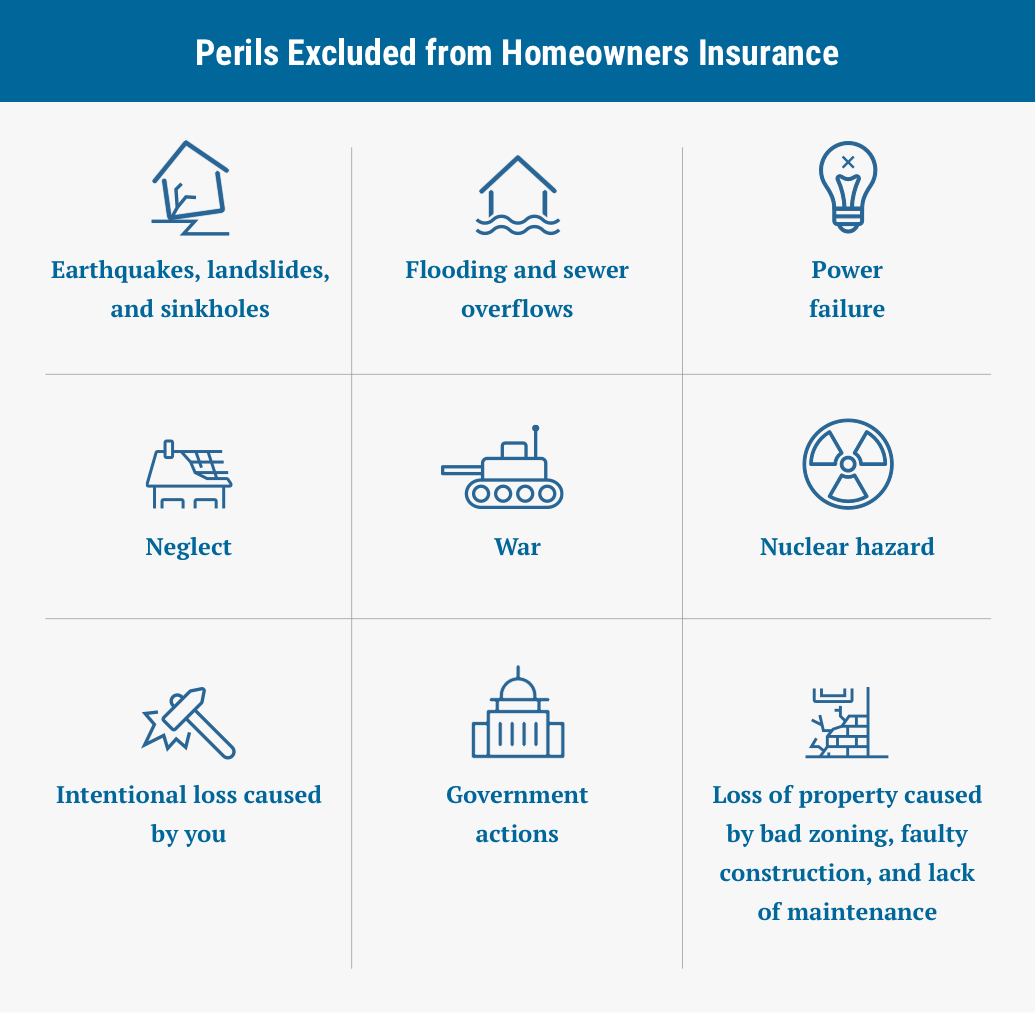

Homeowners insurance is a type of coverage designed to protect homeowners from financial losses related to their home and personal property. It covers a variety of risks, including property damage, liability, and loss of use. When a homeowner purchases homeowners insurance, they are typically required to insure their entire home, including the building and any structures that are attached to it. This type of insurance is usually less expensive than rental property insurance because it covers a more limited range of risks.

Is Rental Property Insurance Cheaper Than Homeowners Insurance?

The cost of rental property insurance and homeowners insurance can vary widely depending on the type of property and the specific risks faced by the owner. Generally speaking, rental property insurance is more expensive than homeowners insurance because it covers a wider range of risks. However, rental property insurance may be less expensive than homeowners insurance in certain circumstances. For example, if the rental property is located in an area that is prone to natural disasters, such as floods or hurricanes, the cost of rental property insurance may be lower than the cost of homeowners insurance.

Conclusion

Rental property insurance and homeowners insurance are both forms of coverage designed to protect homeowners and property owners from financial losses due to a variety of risks. While rental property insurance is typically more expensive than homeowners insurance, the cost can vary widely depending on the type of property and the risks faced by the owner. It is important to compare different policies and get quotes from multiple insurers in order to find the most affordable coverage for your particular situation.

Renter's Insurance on Nevada County and Placer County Rentals - Barrett

Renters Insurance Is Different Than Homeowners Insurance In That : A

What is Renters Insurance? | Allstate

Do You Need Home Insurance For Rental Property

The Best Homeowner’s Insurance Policy For Your Rental Property