Being Accused Of Dual Residency By Car Insurance

What is Dual Residency and Being Accused of it by Car Insurance?

Dual residency, also known as split residency, is a situation where an individual has two different areas of residence. This can be due to a variety of reasons, such as living in two different countries, living in two different states, or even living in two different cities. In any case, being accused of dual residency by car insurance can be a tricky situation, and one that can have serious implications.

When it comes to car insurance, there are certain criteria that are used when deciding how much coverage you need, and how much you will pay for it. One of these criteria is the location of your residence. If you live in two different locations, the insurance company may believe that you are not accurately representing yourself, and thus, they may levy a higher premium.

What are the Implications of Being Accused of Dual Residency?

When you are accused of dual residency, the implications can be quite serious. For one, the insurance company may refuse to offer you coverage at all. This means that you will be unable to drive legally and will have to pay higher fines and other costs that you would normally be required to pay with a valid driver's license. Additionally, the insurance company may also refuse to pay out on any claims that you make.

Additionally, being accused of dual residency can also affect your credit score. Insurance companies usually check the credit scores of potential customers, and if you are accused of dual residency, your credit score could be negatively impacted. This means that it could be difficult for you to get other types of loans or financing in the future.

What Can Be Done if You Are Accused of Dual Residency?

If you are accused of dual residency, it is important to take action. You should first contact the insurance company and explain the situation. Explain that you are not living in two different locations, but rather in one location, and provide proof of residence. This can include a utility bill, rental agreement, or other document that proves your residence.

If the insurance company refuses to budge, you may need to contact a lawyer. A lawyer can help you fight the accusations and prove that you are not dual-residing. In some cases, the insurance company may be willing to reduce your premium or to offer you a different type of coverage.

Finally, if you are accused of dual residency, it is important to take the necessary steps to prevent it from happening again. Make sure that you keep all of your documents in one place, and that you provide accurate information when applying for car insurance. Additionally, if you are living in two different locations, make sure to inform the insurance company so that they can adjust your premium accordingly.

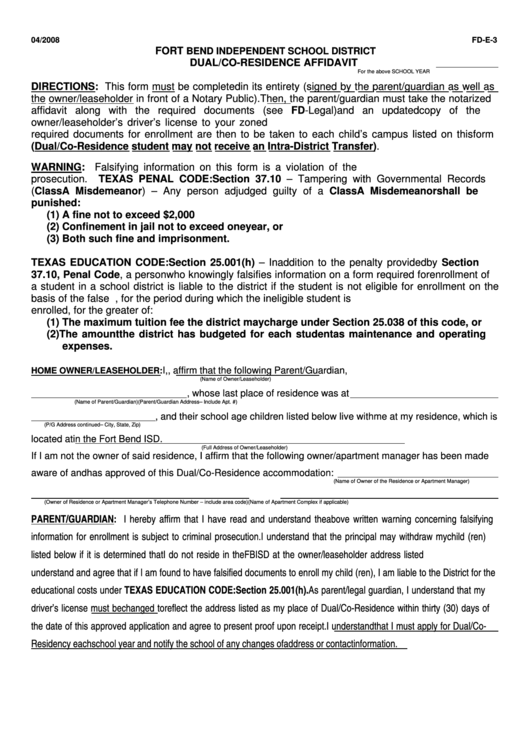

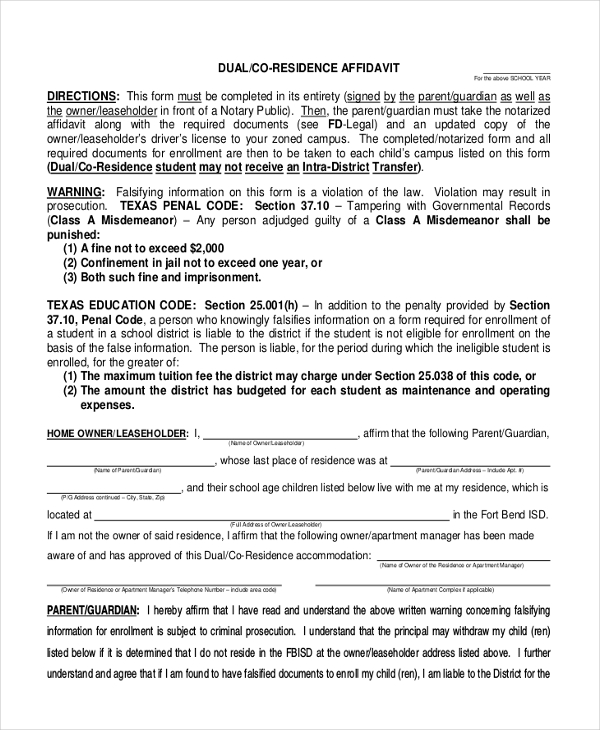

Dual Co Residence Affidavit printable pdf download

FREE 11+ Affidavit of Residency Forms in PDF | Ms Word | Excel

CPA accused of falsifying multiple life insurance applications - YouTube

Health insurance for $50 a year and Permanent residency - YouTube

How to Deal with Dual Residency as per the Income Tax Act - Vakilsearch