What Is Property Damage Liability On Car Insurance

Friday, March 8, 2024

Edit

What Is Property Damage Liability On Car Insurance

What Is Property Damage Liability?

Property damage liability is a type of car insurance coverage that helps pay for any damage you may cause to another person’s property while driving. This type of coverage is often required by law and can help you financially if you are found liable in an accident that results in another person's property being damaged. Property damage liability coverage typically helps pay for the repair or replacement of another person’s damaged automobile, fence, or other property.

How Does Property Damage Liability Work?

When you are found to be responsible for an accident, your property damage liability coverage helps pay for the damages incurred by another person. This type of coverage helps pay for the repair or replacement of the other person’s property and is typically limited to a certain amount. The amount of coverage you can purchase varies by state, and most states require a minimum amount of coverage.

Who Does Property Damage Liability Cover?

Property damage liability coverage is designed to help protect you financially in the event that you are found to be the responsible party in an accident. It provides coverage for the damage you cause to another person’s property, such as their car or fence. Property damage liability coverage does not provide coverage for damage to your own vehicle, your passengers, or any other property you may own.

Who Pays Property Damage Liability Claims?

Property damage liability claims are typically paid by the insurance company of the person who is found to be responsible for the accident. If you are found to be the responsible party, your insurance company will pay for the damages incurred to the other person’s property. This type of coverage is typically required by law, so it is important to make sure you have the proper coverage in place before you get behind the wheel.

What Is The Difference Between Property Damage Liability and Collision Coverage?

Property damage liability coverage and collision coverage are both types of car insurance coverage that help protect you financially in the event of an accident. The difference between the two is that property damage liability coverage helps pay for the damages you cause to another person’s property, while collision coverage helps pay for the damages to your own vehicle. Collision coverage is typically optional, while property damage liability coverage is typically required by law.

How Can I Get Property Damage Liability Coverage?

Property damage liability coverage is typically included in most car insurance policies. You can contact your insurance company to find out if you have the proper coverage in place or to purchase additional coverage. It is important to make sure you have the proper coverage in place before you get behind the wheel.

Property damage liability coverage can help provide you with financial protection in the event you are found to be responsible for an accident. This type of coverage is typically required by law and can help you financially if you are found liable in an accident that results in another person's property being damaged. It is important to make sure you have the proper coverage in place before you get behind the wheel.

The Benefits of Car Insurance in an Accident | Injury Law Firm of South

How To Get Property Damage Liability Car Insurance In 2021

Simple, Cars and Home insurance on Pinterest

Uninsured Property Damage Liability - STAETI

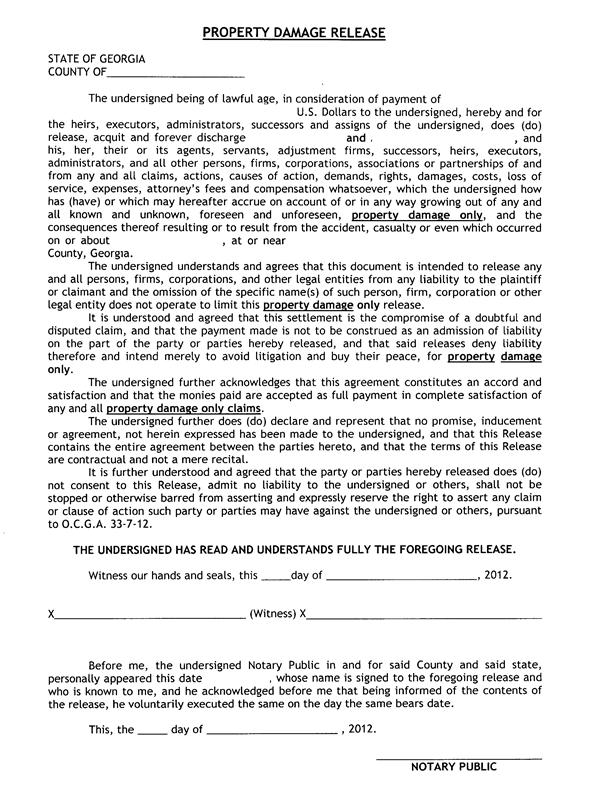

Release of Liability Property Damage– Diminished Value Georgia, Car