Minimum Requirements For Auto Insurance In Illinois

Minimum Requirements For Auto Insurance In Illinois

Overview

In the state of Illinois, auto insurance is mandatory for all drivers. The state sets minimum limits for liability coverage, and drivers must carry a policy that meets these limits. In addition, there are other types of coverage that are not required, but are highly recommended for protection. In this article, we will discuss the minimum requirements for auto insurance in Illinois, as well as the recommended types of coverage you should consider for your policy.

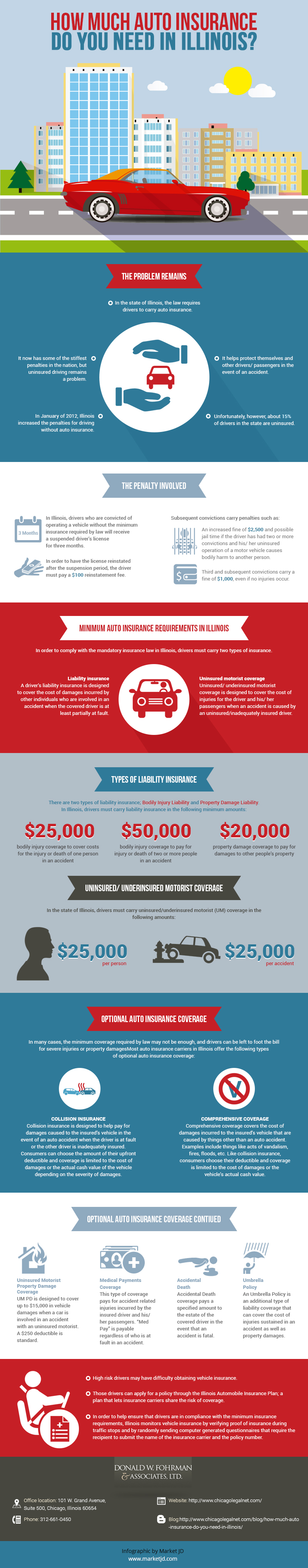

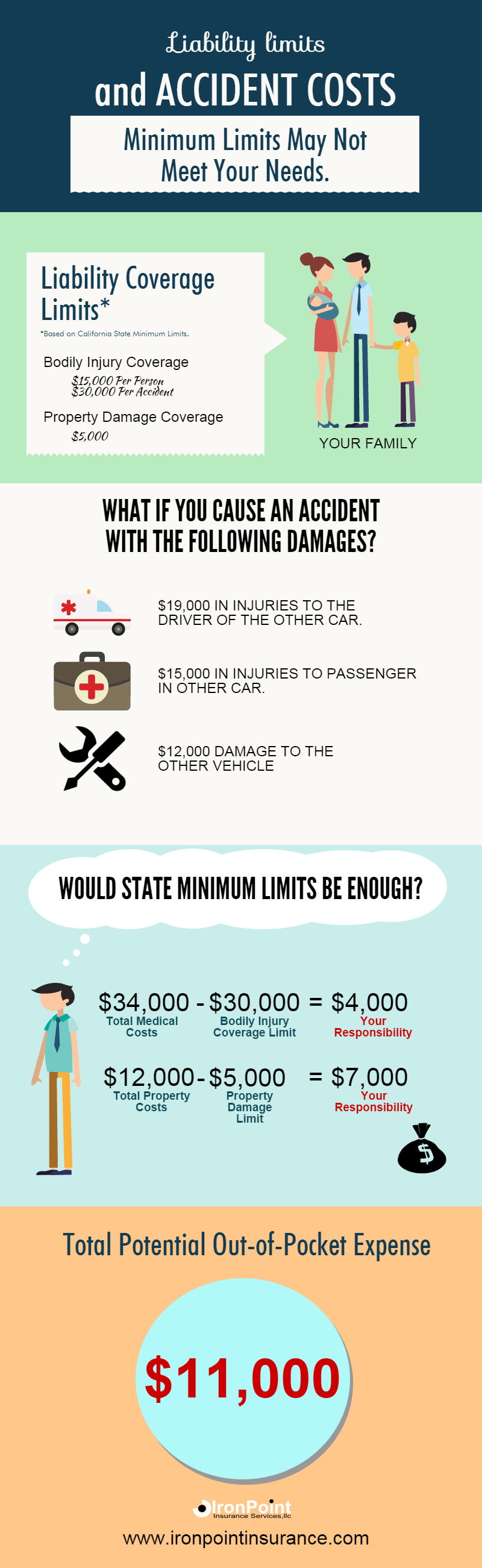

Liability Coverage

Liability coverage is the most important type of auto insurance coverage. It is the only type of coverage that is mandatory in Illinois. Liability coverage protects you from the financial costs of an accident, in the event that you are at fault. It pays for the medical bills and property damage of the other driver, up to the limits of your policy. In Illinois, the minimum required limits for liability coverage are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 per accident for property damage.

Uninsured Motorist Coverage

Uninsured motorist coverage is not required in Illinois, but it is highly recommended. This type of coverage protects you from the costs of an accident caused by an uninsured motorist. It pays for your medical bills and property damage, up to the limits of your policy. The minimum required limits for uninsured motorist coverage in Illinois are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 per accident for property damage.

Underinsured Motorist Coverage

Underinsured motorist coverage is also not required in Illinois, but it is highly recommended. This type of coverage protects you from the costs of an accident caused by an underinsured motorist. It pays for your medical bills and property damage, up to the limits of your policy. The minimum required limits for underinsured motorist coverage in Illinois are $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $20,000 per accident for property damage.

Collision Coverage

Collision coverage is not required in Illinois, but it is recommended. This type of coverage pays for the repair or replacement of your vehicle in the event that you are involved in an accident. It also pays for the medical bills of anyone injured in the accident, up to the limits of your policy. The minimum required limits for collision coverage in Illinois are $10,000 per accident for property damage.

Comprehensive Coverage

Comprehensive coverage is not required in Illinois, but it is highly recommended. This type of coverage pays for the repair or replacement of your vehicle in the event that it is damaged by something other than an accident, such as theft, vandalism, fire, or hail. It also pays for the medical bills of anyone injured in the incident, up to the limits of your policy. The minimum required limits for comprehensive coverage in Illinois are $5,000 per accident for property damage.

Auto Insurance Illinois | Personal Injury Lawyers

Illinois Car Insurance Requirements

Should I buy minimum liability limits auto insurance?

Minimum Car Insurance Requirements in Chicago, IL | Injury Lawyers

Car Insurance 101: Car Insurance for First-Time Drivers