How Many States Are No Fault Insurance

What is No Fault Insurance?

No fault insurance is a type of insurance policy that provides coverage for certain medical expenses, lost wages, and other damages, regardless of who is found to be at fault in a car accident. No fault insurance is also referred to as personal injury protection (PIP) insurance or medical payments coverage. It is designed to make sure that both drivers involved in a car accident receive compensation for their medical expenses, regardless of who is found to be at fault.

No fault insurance is a state-mandated insurance policy that is required in certain states. It is a type of insurance policy that is designed to reduce the cost of litigation associated with car accidents by providing coverage for medical expenses and lost wages regardless of who is found to be at fault. The coverage provided by no fault insurance varies by state and the type of policy that is purchased.

How Many States Are No Fault Insurance?

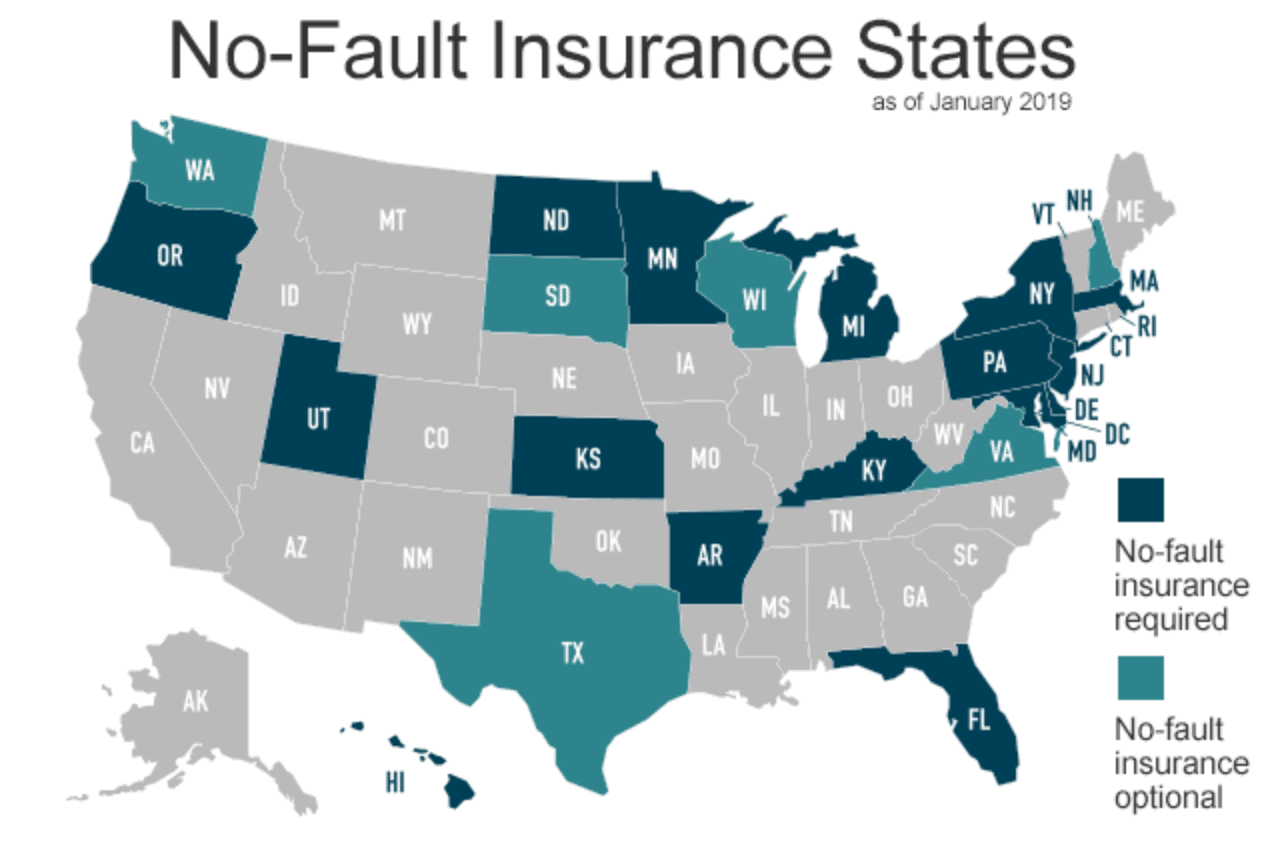

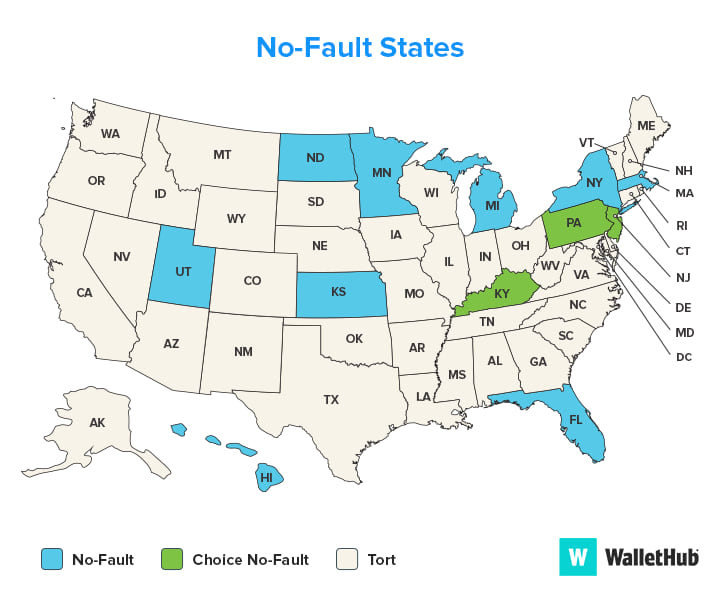

Currently, twelve states have some form of no fault insurance: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Each of these states has its own unique set of regulations and requirements for no fault insurance.

In no fault states, each driver's insurance company pays for the driver's own medical expenses, regardless of who is found to be at fault in the accident. This eliminates the need to prove who is at fault in the accident, thus reducing the cost of litigation and providing quicker access to medical care. Additionally, most no fault states require that drivers carry additional types of coverage, such as uninsured and underinsured motorist coverage, in order to provide additional protection.

Benefits of No Fault Insurance

No fault insurance provides several benefits for drivers. First, it eliminates the need for lengthy litigation in determining who is liable for an accident. This can lead to faster access to medical care, since the insurance company will pay for the driver's medical expenses regardless of fault. Additionally, no fault insurance helps reduce the cost of litigation, since the insurance company will pay for the driver's own medical expenses regardless of fault.

No fault insurance also provides additional protection for drivers in the event that they are injured in an accident. In some states, no fault insurance also provides coverage for lost wages, pain and suffering, and other damages, regardless of who is found to be at fault in the accident. This can provide drivers with additional peace of mind in the event of an accident.

Conclusion

No fault insurance is a type of insurance policy that is designed to reduce the cost of litigation associated with car accidents. It is currently required in twelve states, and provides coverage for medical expenses, lost wages, and other damages, regardless of who is found to be at fault in the accident. No fault insurance can provide drivers with additional peace of mind in the event of a car accident, and can help reduce the cost of litigation associated with car accidents.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

No-Fault Insurance: Guide for 2022

Can Someone Sue you for a Car Accident if you Have Insurance - Honest

How Do "No Fault" Laws Affect Your Personal Injury Case? | McKay Law